Stock Analysis

- United States

- /

- Biotech

- /

- NYSEAM:LCTX

If You Had Bought Lineage Cell Therapeutics (NYSEMKT:LCTX) Stock A Year Ago, You Could Pocket A 129% Gain Today

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the Lineage Cell Therapeutics, Inc. (NYSEMKT:LCTX) share price has soared 129% in the last year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 88% gain in the last three months. On the other hand, longer term shareholders have had a tougher run, with the stock falling 18% in three years.

See our latest analysis for Lineage Cell Therapeutics

Lineage Cell Therapeutics recorded just US$2,712,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Lineage Cell Therapeutics has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Lineage Cell Therapeutics investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

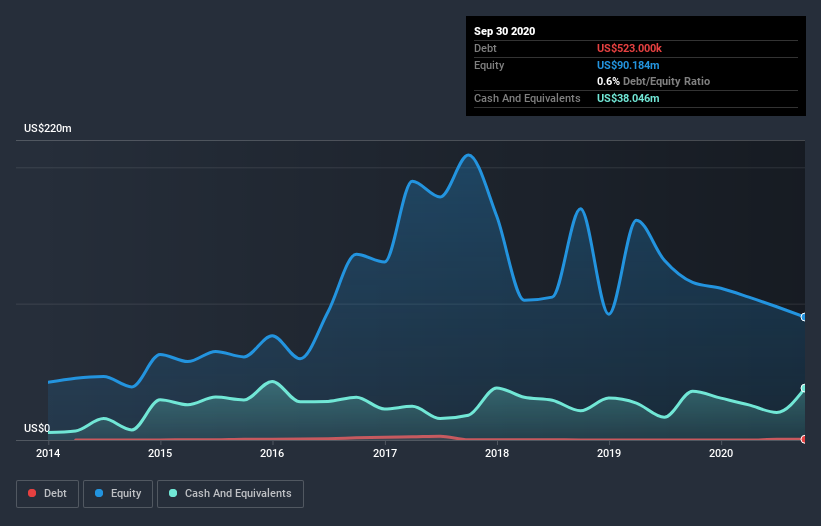

Lineage Cell Therapeutics had cash in excess of all liabilities of US$25m when it last reported (September 2020). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. With the share price up 90% in the last year , the market is seems hopeful about the potential, despite the cash burn. You can see in the image below, how Lineage Cell Therapeutics' cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. It's often positive if so, assuming the buying is sustained and meaningful. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

We're pleased to report that Lineage Cell Therapeutics shareholders have received a total shareholder return of 129% over one year. There's no doubt those recent returns are much better than the TSR loss of 8% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Lineage Cell Therapeutics better, we need to consider many other factors. Even so, be aware that Lineage Cell Therapeutics is showing 3 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Lineage Cell Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Lineage Cell Therapeutics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:LCTX

Lineage Cell Therapeutics

A clinical-stage biotechnology company, develops novel cell therapies for unmet medical needs in the United States and internationally.

Flawless balance sheet and slightly overvalued.