- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (ZTS): Reassessing Valuation as Market Optimism Follows Fed Rate Cut Comments

Reviewed by Simply Wall St

Zoetis (ZTS) popped 5% after a Federal Reserve official hinted that interest rate cuts could be on the table. This sparked optimism throughout the broader market and lifted shares despite limited direct business news for the company.

See our latest analysis for Zoetis.

Despite a wave of optimism from Fed comments, Zoetis’s 1-day share price return of 4.09% and 7-day rally have not reversed its broader downtrend. The company has a year-to-date share price return of -21.35% and a 1-year total shareholder return of -26.68%. Momentum is starting to recover, but long-term investors are still weighing earlier growth concerns, mixed quarterly results, and revised guidance against the company’s fundamentals.

If you're curious about other healthcare names gaining traction, check out the latest promising opportunities in our See the full list for free..

With Zoetis trading well below analyst targets and despite recent rallies, the question now is whether investors are looking at an undervalued opportunity or if the market has already factored in the company’s prospects for recovery.

Most Popular Narrative: 25% Undervalued

With Zoetis closing at $127.89 and the most popular narrative assigning a fair value above $170, the current stock price appears out of sync with future expectations. Explore how analysts arrive at that higher valuation and see what is driving it in their own words.

Ongoing innovation and accelerated R&D output, with expectations for a major new product approval in a key market every year over the next few years, positions Zoetis to expand addressable markets, launch higher-margin products, and protect market share, positively impacting organic revenue growth and net margins.

What is the secret sauce behind such a bold stock target? Analysts are betting on an ambitious mix of rapid product launches, margin expansion, and relentless R&D momentum. Want to see the exact projections and the number everyone is watching? The full narrative breaks it all down.

Result: Fair Value of $170.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and slower adoption of key products could challenge Zoetis’s recovery story if execution falters in the coming quarters.

Find out about the key risks to this Zoetis narrative.

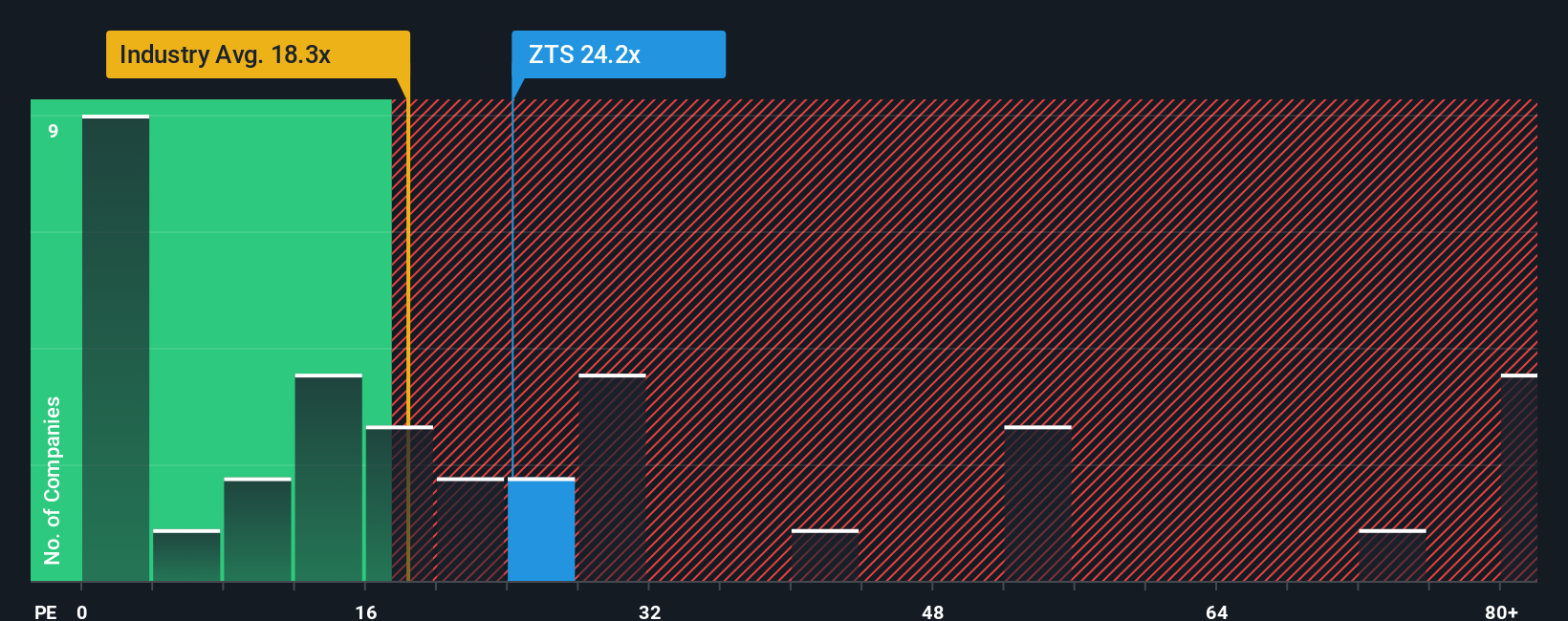

Another View: Gauging Value Through Multiples

While the SWS models suggest Zoetis trades below its fair value, a look at its price-to-earnings ratio raises a flag. Zoetis is priced at 21.3x earnings, higher than the wider US Pharmaceuticals industry average of 20.5x, but a bit lower than peers at 23.2x. The "fair ratio" for Zoetis is estimated at 23.2x, hinting there may be room for further market adjustment. Will investors see this as a value entry or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zoetis Narrative

If these perspectives don’t quite match your own, why not dig into the data and build your own story in just a few minutes? Do it your way

A great starting point for your Zoetis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Snap up your next great idea before others get there. Check out these hand-picked investment strategies that could help you unlock untapped growth potential:

- Capture strong cash flow opportunities by targeting these 924 undervalued stocks based on cash flows, built on solid fundamentals and future earnings momentum.

- Boost your portfolio’s income potential today by tapping into these 14 dividend stocks with yields > 3%, offering reliable yields and financial stability.

- Ride the future of medicine by following these 30 healthcare AI stocks, making breakthroughs with artificial intelligence in healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success