- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (ZTS): Is the Current Valuation a Buying Opportunity After Recent Share Price Decline?

Reviewed by Simply Wall St

See our latest analysis for Zoetis.

Looking beyond the past quarter's dip, Zoetis has faced a challenging stretch, with its share price down 11.4% year-to-date and the total shareholder return over the past year falling nearly 20%. Although the long-term track record includes positive three-year gains, recent momentum has clearly faded as investors weigh growth potential against valuation concerns.

If Zoetis’ recent moves have you rethinking your watchlist, it might be the perfect moment to explore See the full list for free.

With shares trading at a significant discount to analyst price targets despite steady growth in revenue and profit, the key question is whether Zoetis now offers a compelling buying opportunity or if the market has already accounted for its future potential.

Most Popular Narrative: 23.2% Undervalued

Zoetis is trading substantially below what the most widely followed narrative considers its fair value, with the latest close offering a notable discount for investors who buy into the growth story projected by the consensus. This sets up a compelling debate about whether robust recurring revenues and international upside are enough to justify the higher target price, and what it requires from Zoetis in the next few years.

Ongoing innovation and accelerated R&D output, with expectations for a major new product approval in a key market every year over the next few years, positions Zoetis to expand addressable markets, launch higher-margin products, and protect market share, positively impacting organic revenue growth and net margins.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $187.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competitive pressures or slower than expected adoption of key new products could quickly undermine consensus growth forecasts for Zoetis.

Find out about the key risks to this Zoetis narrative.

Another View: Market Multiples Tell a Cautious Story

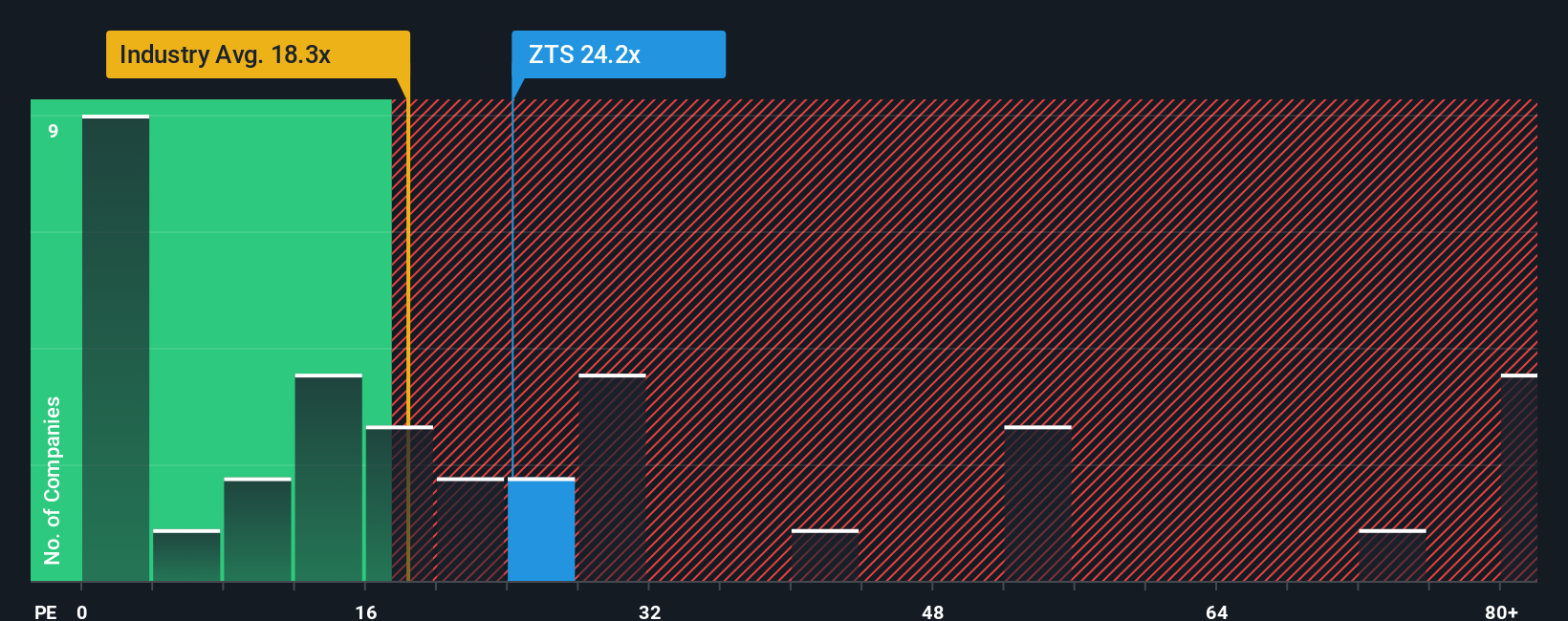

While fair value estimates suggest Zoetis is trading at a discount, its price-to-earnings ratio of 24.4 times stands notably above the US Pharmaceuticals industry average of 18.1, peers at 13.9, and even our calculated fair ratio of 23. This premium signals investors are paying up for quality. Still, could it limit future upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zoetis Narrative

If you’d rather dig into the numbers yourself or challenge the most popular perspectives, it only takes a few minutes to craft your own assessment. Do it your way

A great starting point for your Zoetis research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never rely on a single stock. Give yourself an edge by targeting opportunities in high-potential areas our research team spotlights daily.

- Capitalize on emerging trends by investigating these 26 AI penny stocks that are driving transformative change with advancements in automation and machine learning across industries.

- Benefit from steady income streams as you review these 22 dividend stocks with yields > 3% offering yields over 3 percent and supporting your portfolio with reliable payouts.

- Position yourself early in the future of computing by evaluating these 28 quantum computing stocks to discover innovators in quantum breakthroughs and next-generation technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives