- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (NYSE:ZTS) Declares $0.432 Dividend and Unveils Innovative Vetscan OptiCell for Market Growth

Reviewed by Simply Wall St

Zoetis (NYSE:ZTS) continues to demonstrate its commitment to innovation and shareholder value, as evidenced by the recent dividend affirmation of $0.432 per share for Q4 2024, alongside the upcoming launch of the AI-powered Vetscan OptiCell™ hematology analyzer. While facing challenges such as a slight dip in earnings growth and high debt levels, Zoetis's strategic focus on advanced diagnostics and market expansion positions it well for future growth, with a promising earnings forecast and potential undervaluation highlighting its strong market position. Readers should expect a detailed exploration of these developments, alongside an analysis of Zoetis's strategic initiatives and financial performance in the discussion that follows.

Click to explore a detailed breakdown of our findings on Zoetis.

Core Advantages Driving Sustained Success for Zoetis

Zoetis boasts high-quality earnings and a return on equity forecast of 46% over the next three years. The leadership team, with an average tenure of 2.5 years, has been instrumental in driving strategic goals, as evidenced by a consistent earnings growth rate of 10.3% annually over the past five years. The company's dividend strategy is well-supported, with a payout ratio of 31.5% and stable dividend payments for the past decade. Notably, Zoetis's shares are trading at $181.95, below the SWS fair ratio of $249.34, suggesting potential undervaluation in light of its strong market positioning and financial health.

To dive deeper into how Zoetis's valuation metrics are shaping its market position, check out our detailed analysis of Zoetis's Valuation.Challenges Constraining Zoetis's Potential

Zoetis faces challenges such as a recent earnings growth of 5.9%, which falls short of its five-year average. The net profit margin has also decreased to 26.3% from 26.9% last year, highlighting potential inefficiencies. Additionally, the company's high debt level, with a net debt to equity ratio of 101.2%, poses financial risks. These issues, coupled with operational inefficiencies and rising costs, as noted by Kristin Peck, CEO, suggest areas needing strategic focus.

To gain deeper insights into Zoetis's historical performance, explore our detailed analysis of past performance.Emerging Markets or Trends for Zoetis

Opportunities abound with forecasted earnings growth of 10.09% annually. Product-related announcements, such as the upcoming Vetscan OptiCell™, an AI-powered diagnostic tool, underscore Zoetis's commitment to innovation and market expansion. This product is expected to enhance clinic workflows and patient outcomes, reinforcing Zoetis's market position and capitalizing on emerging trends in veterinary medicine.

Market Volatility Affecting Zoetis's Position

External threats, including slower revenue and earnings growth compared to the US market averages, present challenges. Economic headwinds and regulatory hurdles, as mentioned by CFO Wetteny Joseph, could impact Zoetis's growth trajectory. Additionally, supply chain disruptions pose risks to meeting market demand, necessitating strategic management to mitigate these vulnerabilities.

See what the latest analyst reports say about Zoetis's future prospects and potential market movements. Explore the current health of Zoetis and how it reflects on its financial stability and growth potential.Conclusion

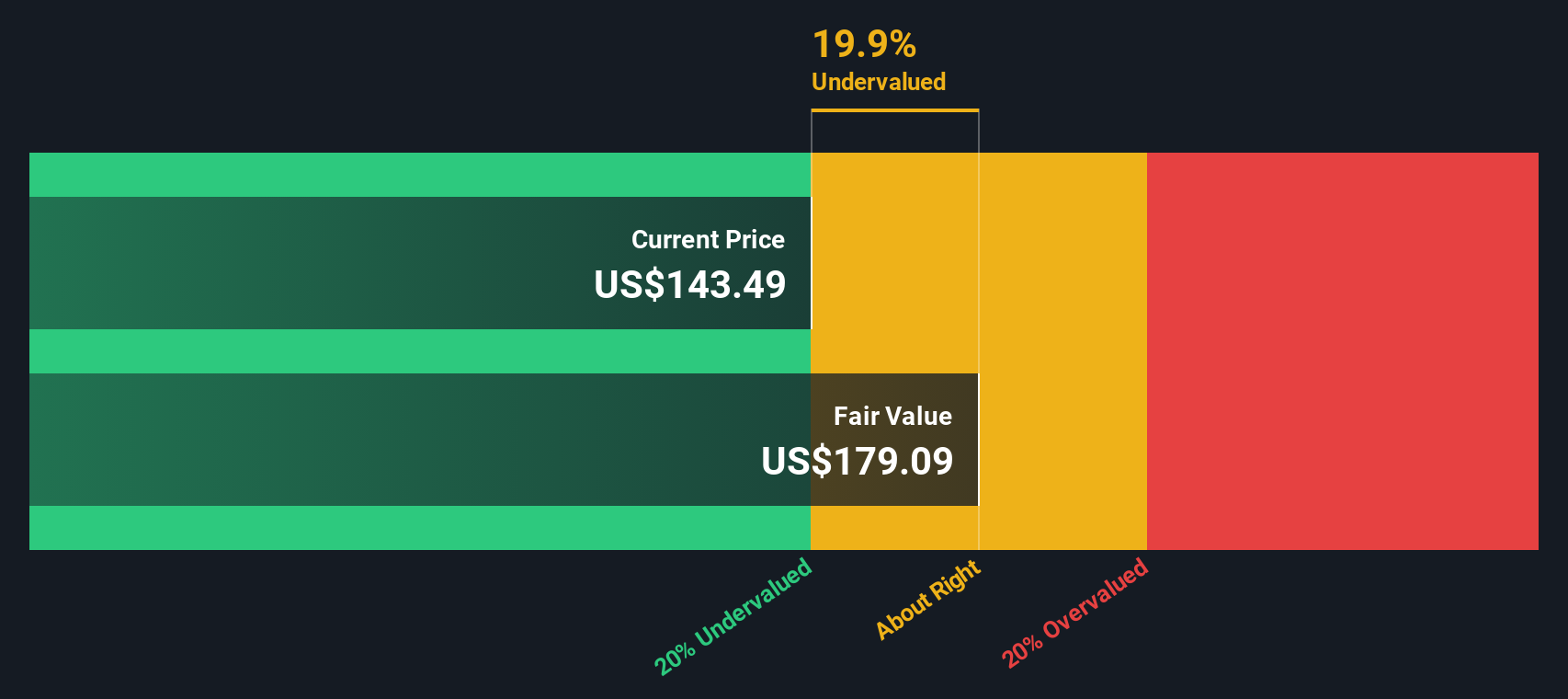

Zoetis demonstrates strong potential for sustained success, driven by high-quality earnings and a projected return on equity of 46% over the next three years. Recent challenges such as reduced earnings growth and high debt levels are present, but the company's strategic focus on innovation, exemplified by products like the Vetscan OptiCell™, positions it well to capitalize on emerging trends in veterinary medicine. The company's shares, currently trading at $181.95, are priced below their estimated fair value of $249.34, suggesting a favorable opportunity for investors considering Zoetis's strong market positioning and commitment to overcoming external threats like economic headwinds and supply chain disruptions. This potential undervaluation, coupled with a strategic focus on addressing inefficiencies, indicates a promising outlook for Zoetis's future performance.

Key Takeaways

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, and diagnostic products and services in the United States and internationally.

Adequate balance sheet average dividend payer.