- United States

- /

- Building

- /

- NYSE:ZWS

Zurn Elkay Water Solutions (NYSE:ZWS) Reports Strong Q3 Earnings and Announces Dividend Increase

Reviewed by Simply Wall St

Zurn Elkay Water Solutions (NYSE:ZWS) has recently reported its third-quarter earnings, showcasing a steady increase in sales and net income compared to the previous year, alongside an optimistic earnings guidance for the fourth quarter. The company has also announced a 12.5% increase in its quarterly dividend, reflecting confidence in its financial health and strategic direction. Readers can expect an analysis of the company's competitive advantages, operational challenges, and growth opportunities, as well as the impact of market volatility on its performance.

Unlock comprehensive insights into our analysis of Zurn Elkay Water Solutions stock here.

Competitive Advantages That Elevate Zurn Elkay Water Solutions

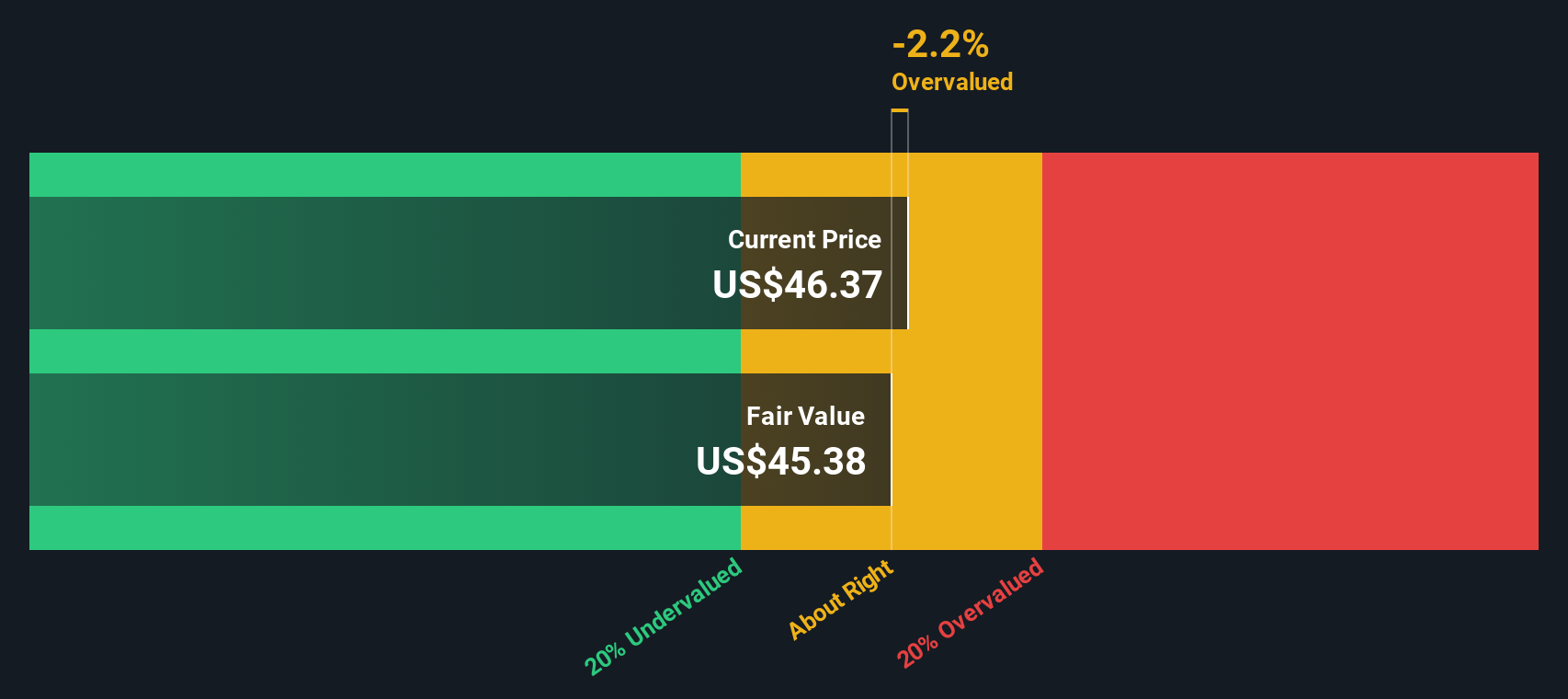

With earnings growing by 35% over the past year and a forecasted growth rate of 15.4% annually, Zurn Elkay Water Solutions demonstrates strong financial health. The company's net profit margins have improved from 6.7% to 8.8%, reflecting efficient cost management. Strategic acquisitions, such as that of Elkay, have expanded market presence and enhanced product offerings, strengthening competitive positioning. The board's average tenure of 7.1 years ensures seasoned oversight, contributing to strategic stability and reliability. Additionally, the company's trading below its estimated fair value suggests potential undervaluation, despite a high SWS Price-To-Earnings ratio, indicating strong market positioning.

To gain deeper insights into Zurn Elkay Water Solutions's historical performance, explore our detailed analysis of past performance.Critical Issues Affecting the Performance of Zurn Elkay Water Solutions and Areas for Growth

Operational challenges persist, as indicated by CEO Todd Adams, which may hinder efficiency and profitability. The management team's average tenure of 1.8 years suggests a need for more experienced leadership. Earnings have shown a 3.7% decrease annually over five years, highlighting longer-term performance issues. Return on equity at 8.6% is below industry standards, and dividend payments have been inconsistent, potentially affecting investor confidence. The high Price-To-Earnings ratio raises concerns about overvaluation, despite the company's fair market value.

To dive deeper into how Zurn Elkay Water Solutions's valuation metrics are shaping its market position, check out our detailed analysis of Zurn Elkay Water Solutions's Valuation.Growth Avenues Awaiting Zurn Elkay Water Solutions

Significant profit growth opportunities exist if the company maintains its earnings trajectory. Revenue growth, currently forecasted at 4.6% annually, could align more closely with the market's 8.8% rate through strategic initiatives. Product innovation and strong customer relationships, as emphasized by Todd Adams, position the company to capitalize on emerging market opportunities and enhance customer loyalty.

Market Volatility Affecting Zurn Elkay Water Solutions's Position

Economic fluctuations pose risks, potentially impacting product demand. Regulatory changes could increase costs or disrupt operations, as noted by Todd Adams. Supply chain issues remain a concern, with potential delays and cost increases affecting business performance. These external factors, coupled with competitive pressures, threaten growth and market share.

See what the latest analyst reports say about Zurn Elkay Water Solutions's future prospects and potential market movements. Explore the current health of Zurn Elkay Water Solutions and how it reflects on its financial stability and growth potential.Conclusion

Zurn Elkay Water Solutions stands at a critical juncture with significant growth potential, as evidenced by its 35% earnings increase over the past year and a forecasted 15.4% annual growth rate. The company's strategic acquisitions and improved profit margins highlight its strong market positioning, yet operational challenges and a management team with limited experience could impede this trajectory. Despite trading below its estimated fair value, the high Price-To-Earnings ratio suggests that investor expectations are elevated, reflecting confidence in future performance but also signaling potential risks if growth targets are not met. To capitalize on emerging opportunities and mitigate market volatility, Zurn Elkay must focus on enhancing leadership stability, improving return on equity, and addressing supply chain vulnerabilities to sustain investor confidence and achieve long-term success.

Key Takeaways

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Excellent balance sheet with proven track record.