- United States

- /

- Life Sciences

- /

- NYSE:WST

West Pharmaceutical Services (WST): Valuation in Focus as Profitability Signals Raise New Investor Concerns

Reviewed by Kshitija Bhandaru

West Pharmaceutical Services (WST) has come under renewed scrutiny after recent commentary called attention to sluggish revenue growth, falling operating margins, and a marked slide in return on invested capital. These signals are sparking debate about the company’s ability to manage costs and sustain long-term profitability.

See our latest analysis for West Pharmaceutical Services.

After a year marked by headline risk and concerns around profitability, the share price has struggled to gain traction, with the latest close at $273.16. Over the last 12 months, the total shareholder return was essentially flat, which points to fading momentum as management grapples with rising costs and softer revenue growth.

If you’re keeping an eye out for other opportunities in the sector, now could be the perfect time to discover fast growing stocks with high insider ownership

With a flat share price and key financial metrics coming under pressure, the question now is whether West Pharmaceutical Services is attractively undervalued at current levels or if the market has already taken its future prospects into account.

Most Popular Narrative: 13.7% Undervalued

With analysts’ fair value of $316.36 standing notably above the current share price, the latest narrative suggests market expectations are lagging behind bullish future growth drivers for West Pharmaceutical Services.

The continued growth in GLP-1s, which made up about 7% of total revenues in the first quarter, along with the company's ability to capitalize on significant opportunities in this market, could drive revenue and earnings growth. The introduction of an automated line for HVP delivery devices later in 2025 to early 2026 is expected to improve margins by driving operational efficiencies and scale, resulting in enhanced net margins.

Want to know the secret sauce behind West Pharmaceutical Services’ valuation? The narrative is powered by aggressive growth bets in one category and bold future profit assumptions. Curious how these projections aim to set a new benchmark for the company’s earnings and margins? Dive in to see what makes this forecast so daring.

Result: Fair Value of $316.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand constraints for HVP components and uncertainty from tariff increases could quickly challenge the company’s projected growth and margin improvements.

Find out about the key risks to this West Pharmaceutical Services narrative.

Another View: Multiples Raise Fresh Questions

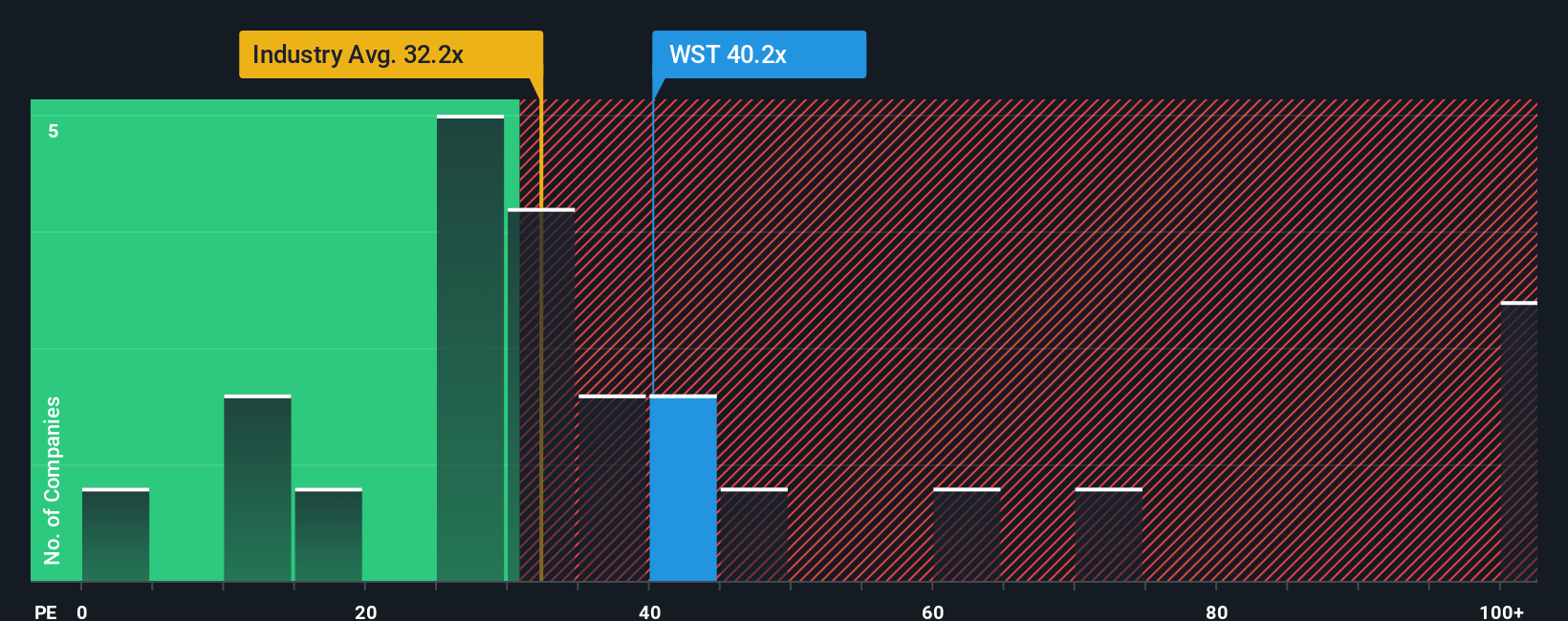

Switching from analyst projections to a market-based lens, West Pharmaceutical Services trades at a price-to-earnings ratio of 40.3x, sharply above both the US Life Sciences industry average of 32.2x and a peer average of 23.1x. Notably, the fair ratio estimate sits even lower at 25.4x. This considerable premium suggests the market is pricing in aggressive future growth. However, is the optimism justified, or has risk crept in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own West Pharmaceutical Services Narrative

If this viewpoint doesn’t quite match your own, or you’d rather dive into the numbers firsthand, you can put together your own analysis in under three minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding West Pharmaceutical Services.

Looking for more investment ideas?

Smart investors stay ahead by targeting timely opportunities beyond the obvious. Supercharge your watchlist with these handpicked strategies before markets move and leave you trailing.

- Uncover growth stories by tapping into these 24 AI penny stocks and see how intelligent automation is transforming entire industries.

- Generate steady income streams and peace of mind by checking out these 19 dividend stocks with yields > 3%, featuring companies with yields above 3%.

- Ride the crest of breakthrough innovation as you explore these 26 quantum computing stocks and discover bold advances in quantum technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives