- United States

- /

- Life Sciences

- /

- NYSE:WST

West Pharmaceutical Services (WST): Exploring Valuation After Q3 Earnings Beat and Upgraded Outlook

Reviewed by Simply Wall St

West Pharmaceutical Services (WST) topped Wall Street’s third quarter expectations for both revenue and profit, attributing this strength to surging demand for its components used in GLP-1 therapies and key upgrade projects.

Alongside the results, management raised full-year guidance for net sales and earnings. This signals increased confidence in the business outlook and draws positive attention from investors who track the company’s progress closely.

See our latest analysis for West Pharmaceutical Services.

West’s latest earnings beat and upbeat guidance have helped shake off some earlier market nerves, with the shares up nearly 18% over the past 90 days. While the stock is still working to recover from a year-to-date share price decline, its three-year total shareholder return of 32% hints at resilient longer-term growth and possible renewed momentum as new product launches such as the Synchrony™ Prefillable Syringe grab investor interest.

If the buzz around product innovation and renewed confidence at West has you looking further afield, it could be the ideal moment to discover See the full list for free.

With the stock rebounding in recent months and new product innovations gaining traction, the big question for investors is whether West is still undervalued, or if the market is already anticipating the company’s future growth.

Most Popular Narrative: 12% Undervalued

Compared to West Pharmaceutical Services’ last close at $282.07, the current narrative peers believe fair value sits at $321.45. This reflects a bullish outlook and expectations for further upside as growth catalysts develop. Here’s what’s driving attention and why so many investors are focused on this narrative.

The continued growth in GLP-1s, which made up about 7% of total revenues in the first quarter, and the company's ability to capitalize on significant opportunities in this market could drive revenue and earnings growth. The introduction of an automated line for HVP delivery devices later in 2025 to early 2026 is expected to improve margins by driving operational efficiencies and scale, enhancing net margins.

Want to know how West’s future margin expansion and automated breakthroughs feed into that valuation? The key feature of this narrative is an ambitious profit and sales growth runway, paired with a premium earnings multiple. Curious which financial levers led to that double-digit discount? Click through to discover the calculations and forecasts that fuel this fair value.

Result: Fair Value of $321.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued shifts in demand for high-value products and the impact of new tariffs could slow revenue growth and limit margin expansion.

Find out about the key risks to this West Pharmaceutical Services narrative.

Another View: What About Market Comparisons?

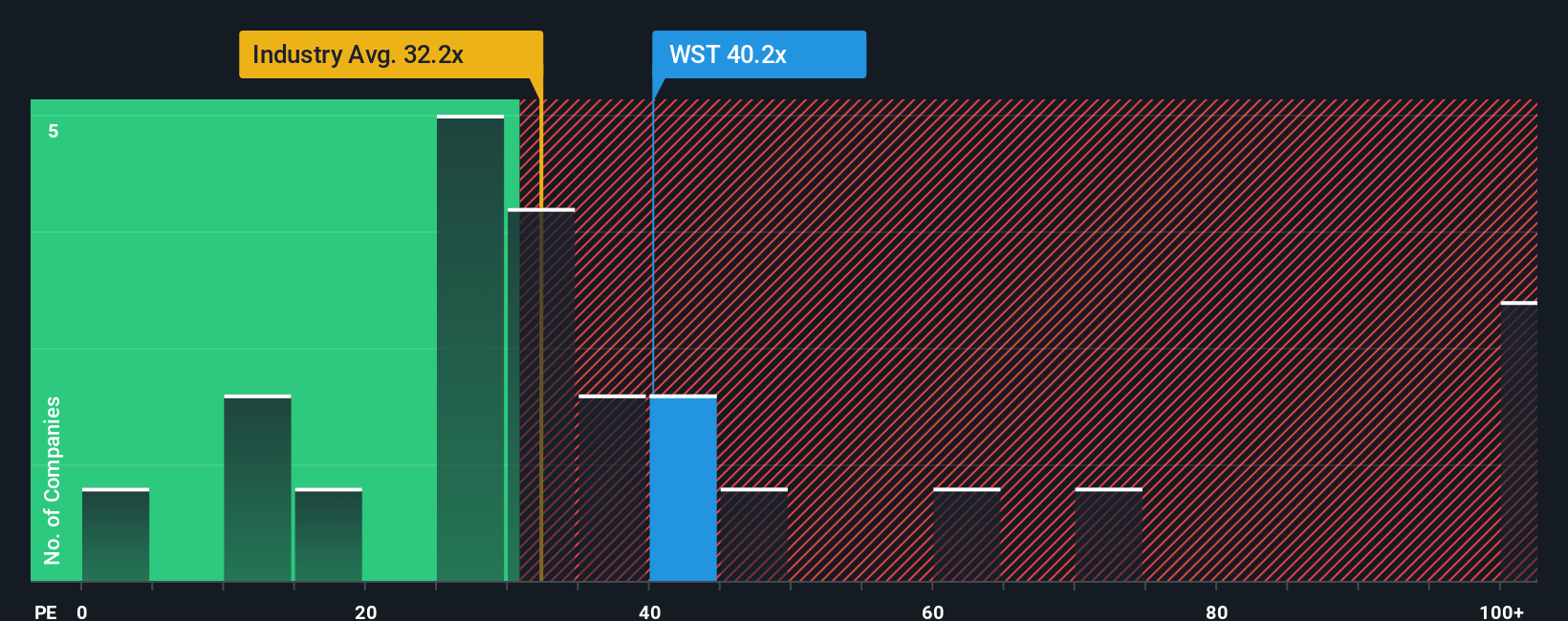

While some investors see upside based on fair value estimates above the share price, a quick look at valuation multiples offers a more cautious perspective. West’s price-to-earnings ratio sits at 41.3x, significantly higher than both the peer average of 28.9x, the broader US Life Sciences industry at 35.5x, and even the market-calculated fair ratio of 25x.

This premium valuation means investors are paying much more for each dollar of earnings than they would for similar companies. Does the business truly justify such optimism, or could expectations be getting ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own West Pharmaceutical Services Narrative

If you’re keen to analyze the numbers firsthand or take a different perspective, crafting your own narrative around West Pharmaceutical Services takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding West Pharmaceutical Services.

Looking for more investment ideas?

Fast-track your research with handpicked lists to spot tomorrow’s outliers and build an advantage before everyone else realizes the opportunity is here.

- Maximize potential returns by joining early with these 3583 penny stocks with strong financials, which are known for robust financials and breakout momentum.

- Tap into critical breakthroughs by reviewing these 28 quantum computing stocks, where transformative computing and new hardware are reshaping what’s possible.

- Strengthen your portfolio stability by considering these 22 dividend stocks with yields > 3%, featuring companies offering reliable yields above 3% to help you stay ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives