- United States

- /

- Life Sciences

- /

- NYSE:WST

Is West Pharma’s Share Price Justified After Recent Healthcare Market Volatility?

Reviewed by Bailey Pemberton

Are you considering what to do next with West Pharmaceutical Services stock? If so, you are definitely not alone. Plenty of investors are scratching their heads about whether it is time to double down, hold tight, or trim their positions as market sentiment around the company zigzags. The stock has bumped up 1.4% over the past week and gained a healthy 6.1% in the past month, but it is still down 19.0% year-to-date and off by 6.9% over the last year. Even when zooming out to three and five years, the performance looks mixed, with an 11.9% gain since 2021 but a 10.1% drop over the past five years. So, what is really driving this rollercoaster ride?

Recently, West Pharmaceutical Services has caught some investor attention as healthcare and pharma-related market themes have evolved, especially with ongoing shifts in demand for products linked to large-scale health initiatives. While no single headline has been responsible for the latest moves, there is a sense that risk perception is shifting, possibly tied to broader sector rotation and uncertainty in related industries. Against this backdrop, investors are turning a critical eye to valuation.

Curious about how the company’s value stacks up right now? Based on a widely-used set of valuation checks, West Pharmaceutical Services currently scores a 0 out of 6, meaning it is not considered undervalued by these measures. But is that the full story? In the next section, we will break down the popular valuation approaches and see how they apply here. Plus, stick around for an even sharper way to think about valuation later in the article.

West Pharmaceutical Services scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: West Pharmaceutical Services Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future free cash flows and discounting them back to the present value. This approach is designed to look past short-term market swings and focus on the company’s ability to generate cash in the years ahead.

For West Pharmaceutical Services, the current Free Cash Flow stands at $323.6 million. Looking ahead, analysts provide specific cash flow projections up to five years, with forecasts further into the future extrapolated based on expected growth trends. According to these projections, the company’s Free Cash Flow could rise to $757.8 million by 2035, reflecting a steady climb over the next decade.

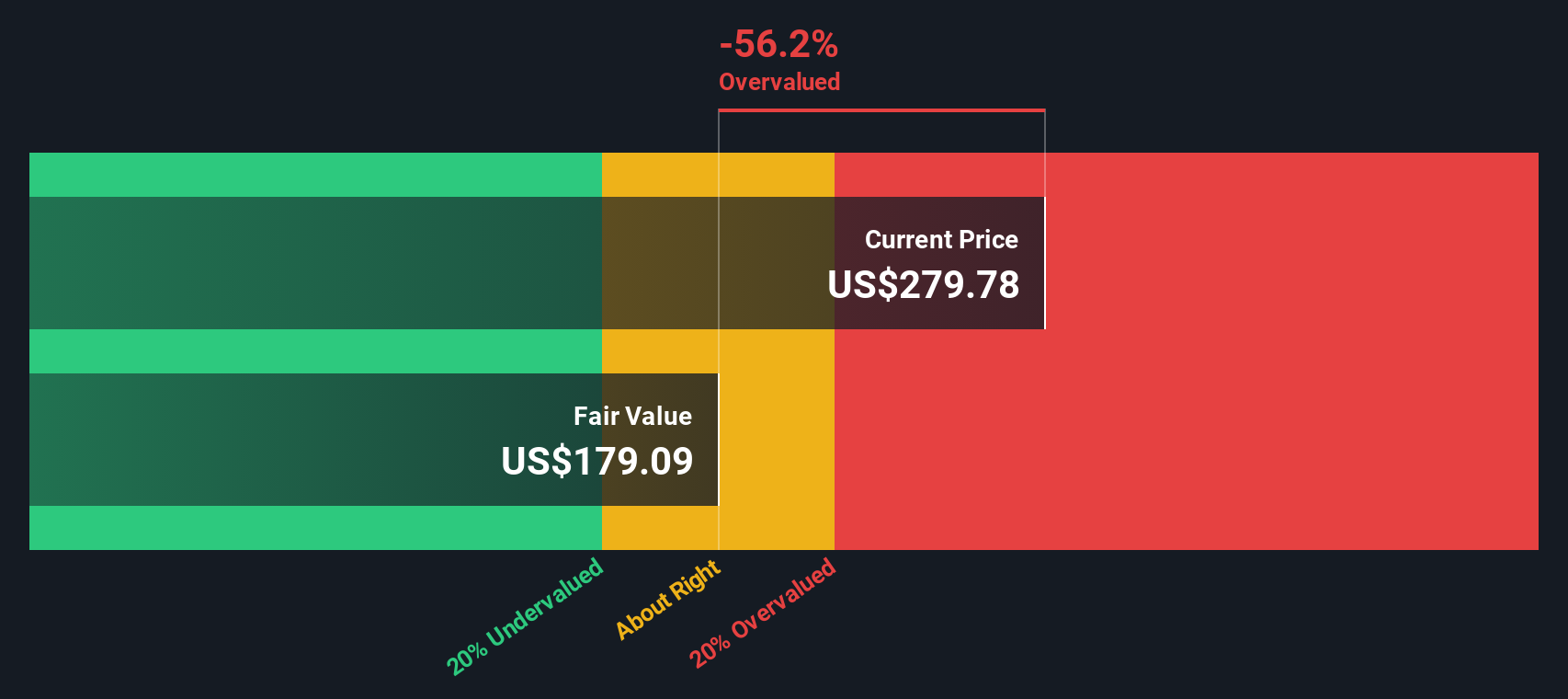

When this series of future cash flows is discounted back to today using appropriate rates, the model calculates an intrinsic fair value of $185.28 per share. Compared to the current share price, this implies the stock is trading at a 43.5% premium to its calculated value. In other words, the market price is significantly higher than the DCF’s estimate.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests West Pharmaceutical Services may be overvalued by 43.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: West Pharmaceutical Services Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored valuation method when analyzing profitable companies like West Pharmaceutical Services, as it links a company’s market price to its actual earnings. This multiple makes it easier for investors to quickly judge whether a stock’s price is justified given the business’s ability to generate profits right now.

What constitutes a “normal” or fair PE ratio often comes down to prospects for earnings growth and the risk profile of the company. Fast-growing, stable companies typically command higher PE ratios than peers with slower growth or more risk, as investors are willing to pay a premium for those future profits.

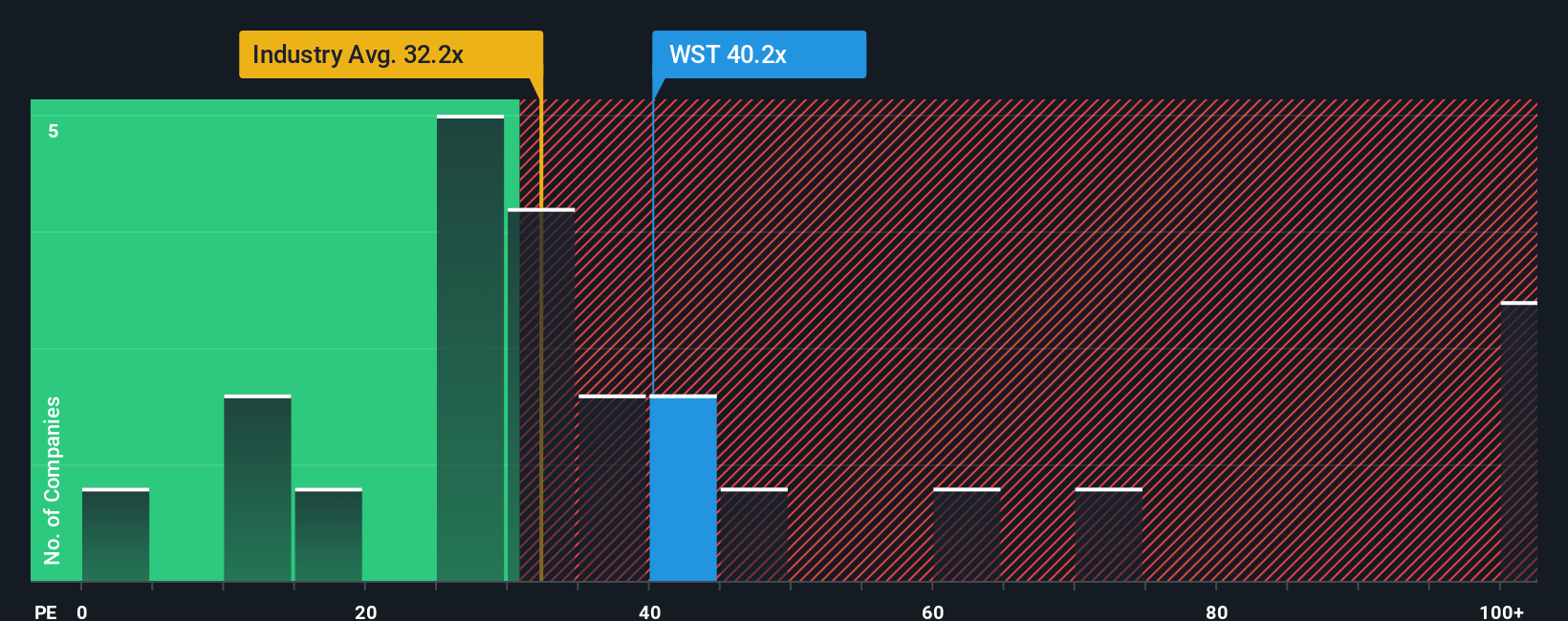

As of today, West Pharmaceutical Services trades at a PE ratio of 39.2x. That is well above the industry average of 32.2x and also surpasses the average of its closest peers, which sits at 22.8x. Simply Wall St’s proprietary Fair Ratio, calculated based on factors like West’s expected earnings growth, industry dynamics, profit margins, company size, and risk, is currently 25.3x.

The Fair Ratio approach is a significant step up from just comparing to the industry or peer averages. It blends both sector and company-specific factors, resulting in a tailored benchmark that reflects the unique realities that West Pharmaceutical faces in the market. This approach does not rely solely on broad averages or outlier peer valuations.

With the current PE ratio noticeably higher than the Fair Ratio, West Pharmaceutical Services appears to be valued above what its fundamentals suggest is reasonable.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your West Pharmaceutical Services Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a dynamic method for making investment decisions that goes beyond just the numbers. A Narrative is a story or thesis, shaped by your outlook on the company’s future, that connects your expectations for revenue, earnings, and margins to a financial forecast and an estimated fair value. Narratives make investing more intuitive by allowing you to see how your perspective links directly to fair value, helping you decide when a stock is genuinely undervalued or overvalued.

This approach is both easy and accessible, and is available to millions of investors on Simply Wall St’s Community page. Each Narrative adjusts automatically to new news or company developments as they happen. Narratives empower you to act swiftly when your assumptions or market conditions change, so you always know whether to buy, sell, or hold by comparing your fair value to the latest share price.

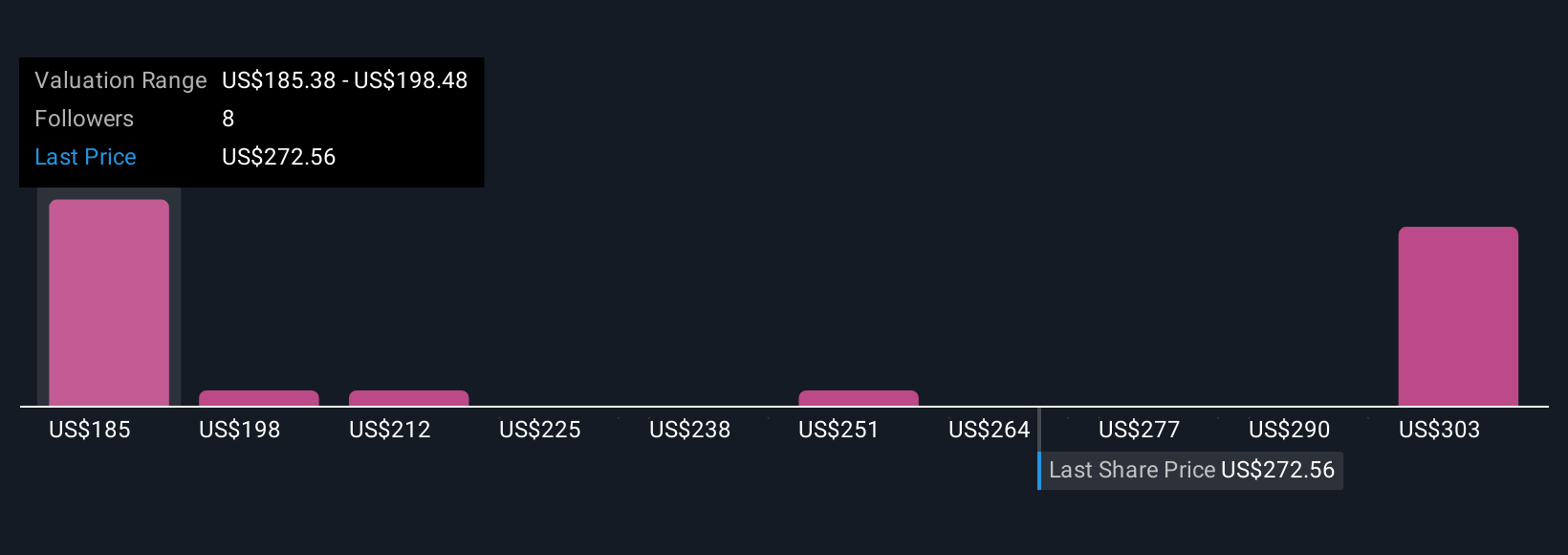

For example, some West Pharmaceutical Services Narratives project a future powered by automation and growing GLP-1 demand, leading to a high fair value of $350. Others foresee risks from industry headwinds and suggest a much lower fair value of just $260.

Do you think there's more to the story for West Pharmaceutical Services? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives