- United States

- /

- Life Sciences

- /

- NYSE:WST

How Strong Q3 Results and Raised Guidance At West Pharmaceutical Services (WST) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- West Pharmaceutical Services recently presented at the Stephens Annual Investment Conference, following the announcement of strong third-quarter results and an upward revision to its full-year guidance.

- Investor optimism was further buoyed by decreased short interest and analyst upgrades, signaling confidence in the company’s operational strength despite a year-to-date share price drop.

- We’ll explore how the positive third-quarter performance and raised guidance could influence West Pharmaceutical Services’ investment outlook going forward.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

West Pharmaceutical Services Investment Narrative Recap

To be a shareholder in West Pharmaceutical Services, you need to believe in the company's ability to capture growth in the drug delivery and biologics markets, while managing evolving customer demand and executing on product innovation. The recent jump in shares following strong third-quarter results and raised guidance may strengthen investor focus on operational execution as a key short-term catalyst, but demand constraints for HVP components remain the main risk to near-term revenue growth. These new financial benchmarks could help shape expectations, yet persistent variability in product demand still warrants careful attention.

Of the recent announcements, the upward revision in full-year financial guidance stands out as especially relevant. Following the better-than-expected third-quarter performance, management now anticipates net sales between US$3.060 billion and US$3.070 billion for 2025, reflecting higher expected organic growth and operational progress. This revision directly connects to investor sentiment after earnings and keeps attention on the trajectory of HVP component demand moving forward.

However, despite analyst upgrades and renewed optimism, investors should be mindful of one factor that could disrupt this momentum, especially if customer demand continues to shift between facilities and...

Read the full narrative on West Pharmaceutical Services (it's free!)

West Pharmaceutical Services is projected to achieve $3.6 billion in revenue and $675.2 million in earnings by 2028. This outlook assumes a 6.5% annual revenue growth rate and a $187.5 million increase in earnings from the current figure of $487.7 million.

Uncover how West Pharmaceutical Services' forecasts yield a $350.77 fair value, a 29% upside to its current price.

Exploring Other Perspectives

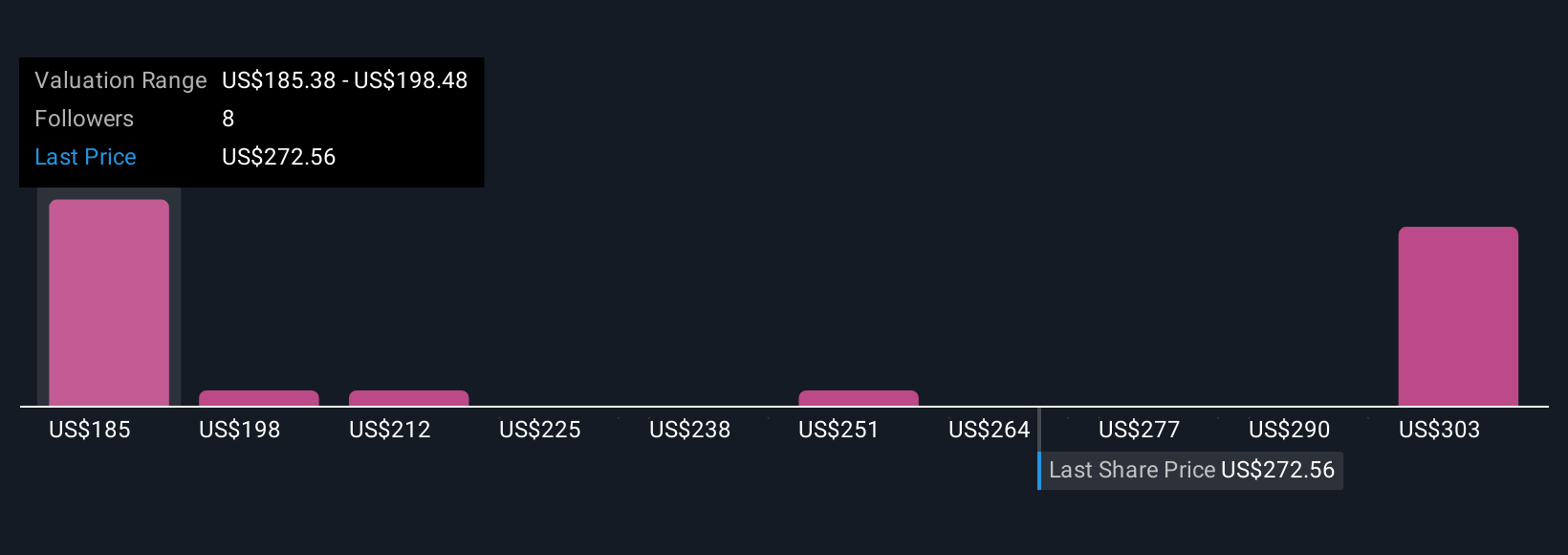

Simply Wall St Community members' fair value estimates span from US$162.75 to US$350.77 across 5 separate analyses, reflecting wide differences in opinion. Contrast this with analysts’ focus on HVP demand trends as a central factor that could affect future returns, and consider how your own outlook aligns with these perspectives.

Explore 5 other fair value estimates on West Pharmaceutical Services - why the stock might be worth 40% less than the current price!

Build Your Own West Pharmaceutical Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West Pharmaceutical Services research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free West Pharmaceutical Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West Pharmaceutical Services' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives