- United States

- /

- Life Sciences

- /

- NYSE:WST

How Strong Q3 Results and a New Biologics Platform at West (WST) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- West Pharmaceutical Services recently reported third quarter results that exceeded expectations, driven by strong sales growth in High Value Product components like elastomers for GLP-1 therapies, and raised its full-year guidance for both revenue and earnings.

- This update was accompanied by the launch announcement of the West Synchrony Prefillable Syringe System, a fully verified platform targeting biologics and vaccines, designed to streamline regulatory submissions and enhance supply chain flexibility.

- We'll explore how West Pharmaceutical Services' raised full-year guidance and product innovation could impact its investment outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

West Pharmaceutical Services Investment Narrative Recap

To own shares of West Pharmaceutical Services, you need confidence in the company's ability to sustain demand for its high-value product (HVP) components and drive ongoing innovation in drug delivery solutions. The recent earnings and product launch announcements highlight operational momentum, but they do not fully resolve short-term revenue risks from potential customer demand shifts or margin pressures, which remain the most important catalyst and risk factors for the stock right now.

The new West Synchrony Prefillable Syringe System is particularly relevant, as it expands the company’s offering for biologics and vaccines, a market segment closely tied to its future growth drivers. This product’s commercial availability in early 2026 has the potential to support higher-value contract wins and serve customers seeking reliability and regulatory clarity, in line with management's strategy to focus on higher-margin HVP opportunities.

However, investors should not overlook the possibility that ongoing shifts in customer demand across facilities could still limit revenue growth in the months ahead, especially if...

Read the full narrative on West Pharmaceutical Services (it's free!)

West Pharmaceutical Services is expected to reach $3.6 billion in revenue and $675.2 million in earnings by 2028. This outlook assumes a 6.5% annual revenue growth rate and a $187.5 million increase in earnings from the current level of $487.7 million.

Uncover how West Pharmaceutical Services' forecasts yield a $321.45 fair value, a 15% upside to its current price.

Exploring Other Perspectives

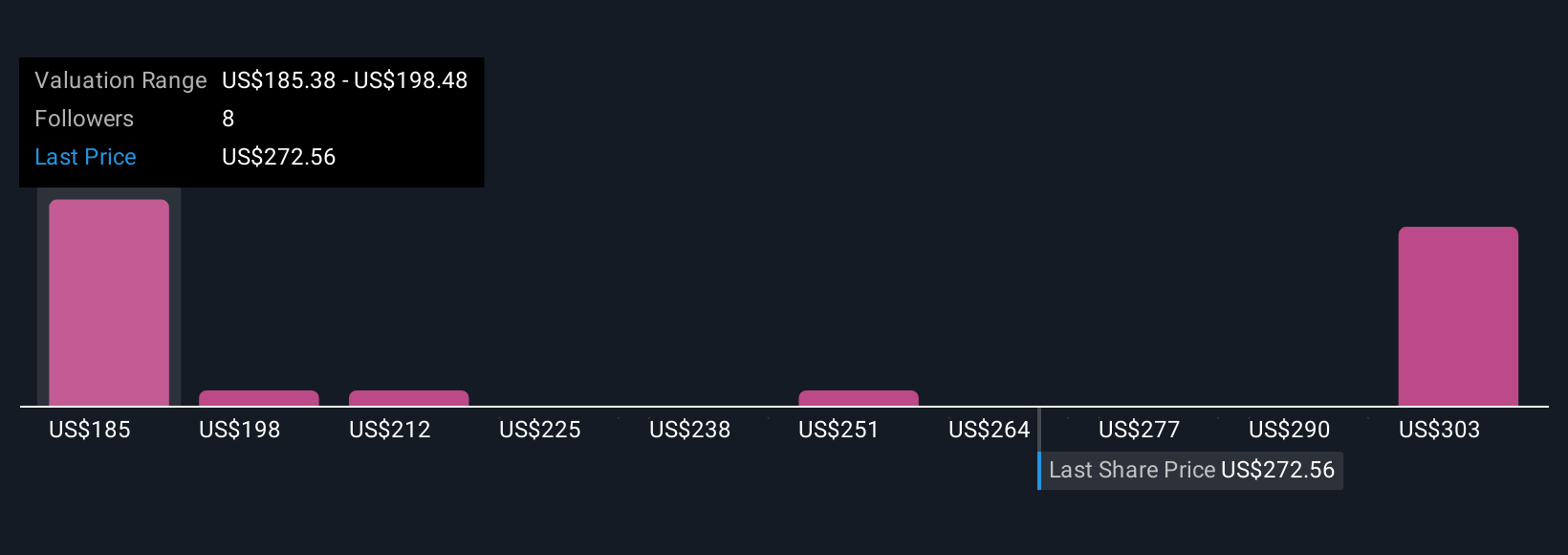

Five private investors in the Simply Wall St Community placed fair value estimates for West Pharmaceutical Services between US$179 and US$321. Despite the recent full-year guidance upgrade, short-term revenue risks from shifting customer demand remain an important theme, challenging consensus on the company's near-term performance. Consider how these varied viewpoints could broaden your understanding before making any decisions.

Explore 5 other fair value estimates on West Pharmaceutical Services - why the stock might be worth 36% less than the current price!

Build Your Own West Pharmaceutical Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West Pharmaceutical Services research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free West Pharmaceutical Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West Pharmaceutical Services' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives