- United States

- /

- Life Sciences

- /

- NYSE:WST

A Look at West Pharmaceutical Services (WST) Valuation Following Robust Q3 Earnings and Upgraded Guidance

Reviewed by Simply Wall St

West Pharmaceutical Services (WST) saw its stock surge after delivering third-quarter earnings that topped expectations, with management lifting the company’s full-year financial guidance. The strong results reflected ongoing organic growth and operational momentum.

See our latest analysis for West Pharmaceutical Services.

West Pharmaceutical Services’ momentum has picked up steam after its recent earnings beat and upgraded guidance, with the shares jumping 5.2% in the latest session and clawing back some of this year’s losses. While year-to-date share price return is still off by 17.5% and total shareholder return over the past year remains negative, the company’s solid operational execution has encouraged investors and dampened short interest. This hints at renewed optimism for the long term.

If you’re looking for new growth stories beyond West Pharma’s rebound, broaden your search and discover fast growing stocks with high insider ownership.

With shares still trading well below their analyst price targets, and after a strong quarter, investors now face a key question: does the current price reflect all future growth, or is there room for a breakout buying opportunity?

Most Popular Narrative: 22.7% Undervalued

West Pharmaceutical Services is trading at $271.07, while the narrative-supported fair value is significantly higher. This creates a sizeable gap that investors are watching closely.

The continued growth in GLP-1s, which made up about 7% of total revenues in the first quarter, and the company's ability to capitalize on significant opportunities in this market could drive revenue and earnings growth. The introduction of an automated line for HVP delivery devices later in 2025 to early 2026 is expected to improve margins by driving operational efficiencies and scale, which may enhance net margins.

A massive future profit multiple is fueling the bulls. The key factors are compounding high-value mix, optimistic revenue projections, and higher margins. Want to uncover the financial leap underlying this bold target? The details might just surprise you.

Result: Fair Value of $350.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in customer demand and increased tariffs could put pressure on West Pharmaceutical Services' profit margins and near-term growth potential.

Find out about the key risks to this West Pharmaceutical Services narrative.

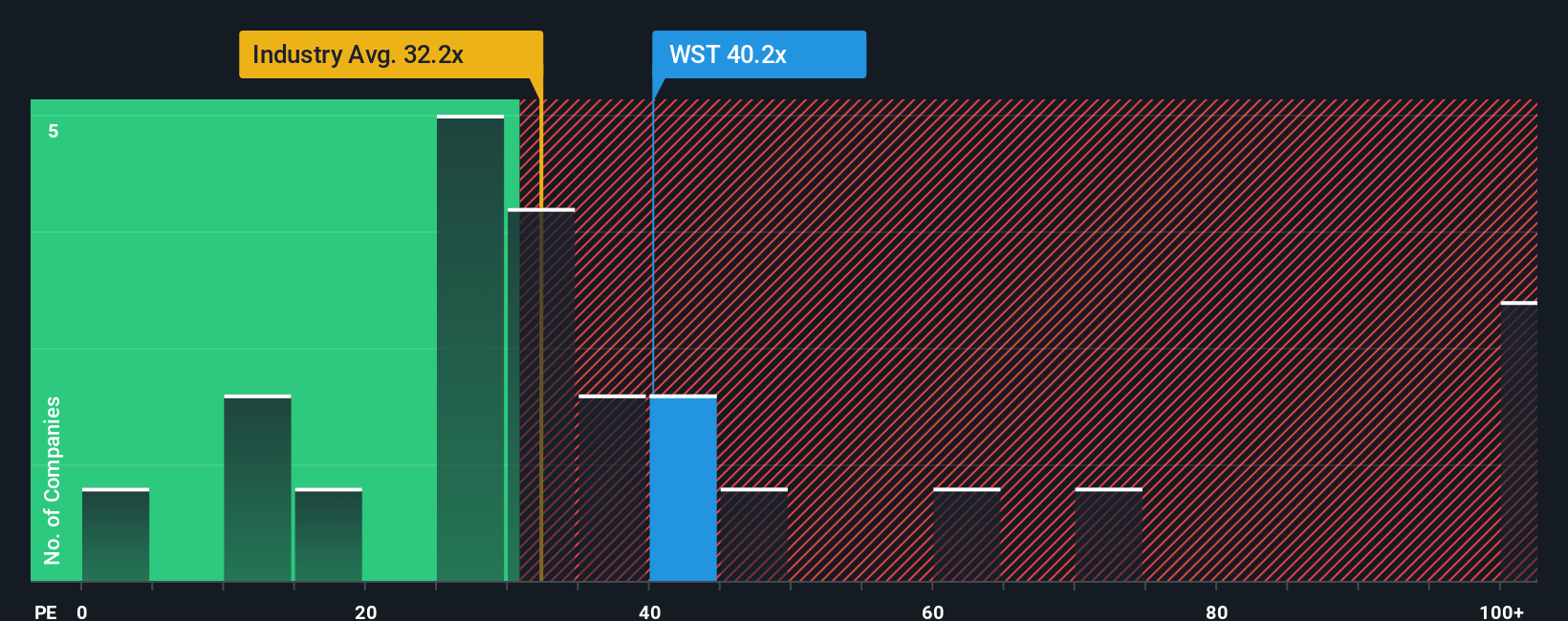

Another View: Multiples Tell a Different Story

Looking at valuation through the standard price-to-earnings ratio, West Pharmaceutical Services trades at 39.7x earnings. This is higher than the Life Sciences industry average of 35.1x and the fair ratio of 26.7x. Such a premium could mean investors are paying up for future growth, but it also raises questions about potential downside if company performance slows. Does this premium offer enough reward for the extra risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own West Pharmaceutical Services Narrative

Feel free to dive into the numbers and test your own ideas using the platform’s tools. Building a personal investment story takes just a couple of minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding West Pharmaceutical Services.

Looking for more investment ideas?

Broaden your investing edge by tapping into stock picks tailored to powerful market trends. Don’t let your next opportunity slip away. Take action now.

- Fuel your portfolio with companies trading below their intrinsic worth by starting with these 926 undervalued stocks based on cash flows.

- Maximize your potential returns by capturing strong income streams through these 16 dividend stocks with yields > 3%.

- Propel your strategy forward with innovators pushing boundaries in AI by exploring these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives