- United States

- /

- Life Sciences

- /

- NYSE:WAT

How Investors May Respond To Waters (WAT) Launching Empower-Integrated CAD for Regulated Lab Workflows

Reviewed by Sasha Jovanovic

- Waters Corporation has announced the launch of its Charged Aerosol Detector (CAD), specifically designed for integration with the widely adopted Empower Software, offering improved sensitivity, consistency, and reproducibility for chromatography applications across pharmaceuticals, food, and environmental testing.

- This new CAD product directly addresses frequent workflow challenges in multi-vendor laboratory setups, reinforcing Waters’ established leadership in regulatory submissions and comprehensive molecular characterization.

- We’ll examine how the Empower-integrated CAD launch impacts Waters’ investment narrative and future opportunities in regulated lab workflows.

Find companies with promising cash flow potential yet trading below their fair value.

Waters Investment Narrative Recap

To be a Waters shareholder today, you need to believe in the company’s ability to maintain leadership in regulated lab environments, particularly by deepening integration of its chromatography hardware and software offerings. The Empower-integrated Charged Aerosol Detector (CAD) launch demonstrates this commitment, but in the near term, successful execution of the BD’s Biosciences and Diagnostic Solutions integration remains the primary catalyst, while persistent academic and pharma sector headwinds are still the most pressing risk. This new product does not materially change the balance of these factors for now. One recent announcement that stands out is Waters’ raised earnings guidance for 2025, anticipating constant currency sales growth of 6.7% to 7.3% and improved visibility into its pharma and recurring revenue segments. This is especially relevant as stronger recurring revenues and new product launches like the CAD could enhance earnings stability, but much depends on how the company manages integration risks with BD’s assets in the months ahead. However, investors should be aware that, despite new product launches, persistent weakness in academic and drug discovery spending could quickly test management’s...

Read the full narrative on Waters (it's free!)

Waters' outlook anticipates $3.7 billion in revenue and $946.3 million in earnings by 2028. This reflects a required annual revenue growth rate of 6.4% and an earnings increase of $284.9 million from the current earnings of $661.4 million.

Uncover how Waters' forecasts yield a $382.87 fair value, a 3% downside to its current price.

Exploring Other Perspectives

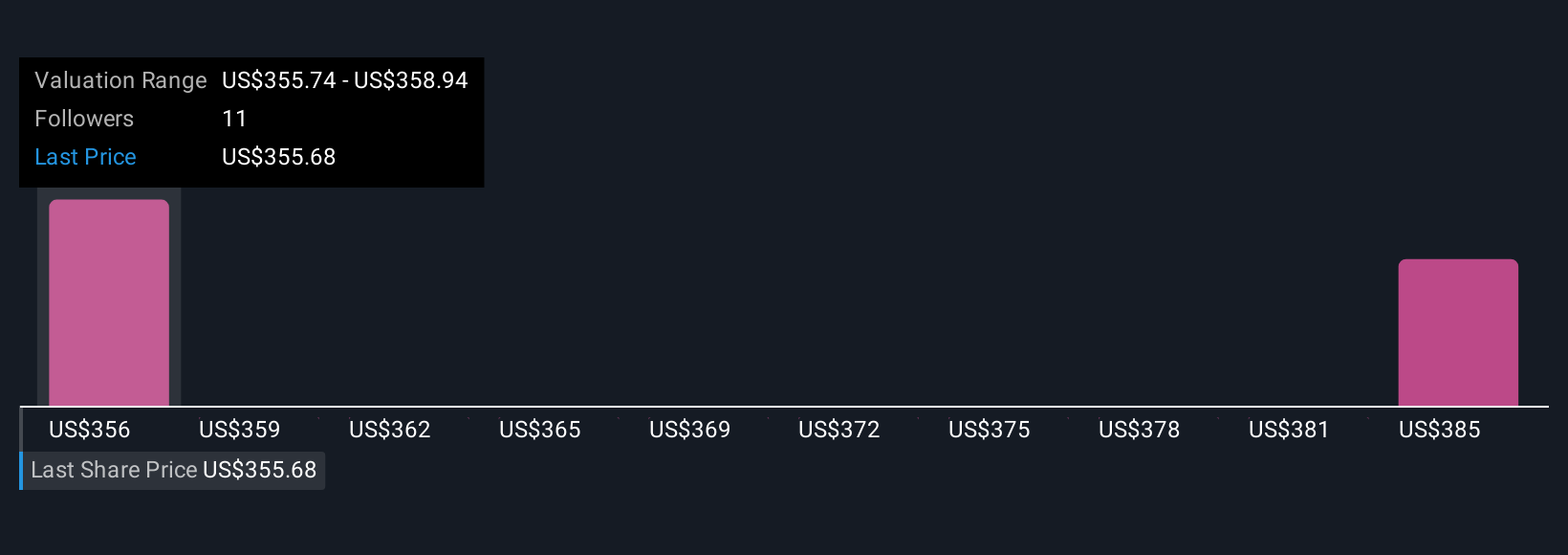

Simply Wall St Community members provided two fair value estimates for Waters, ranging from US$362.29 to US$382.87 per share. While many expect improved recurring revenues, caution remains around ongoing funding uncertainty in key customer segments.

Explore 2 other fair value estimates on Waters - why the stock might be worth as much as $382.87!

Build Your Own Waters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Waters research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Waters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Waters' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAT

Waters

Provides analytical workflow solutions in Asia, the Americas, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives