- United States

- /

- Life Sciences

- /

- NYSE:TMO

What Thermo Fisher Scientific (TMO)'s FDA Clearance for EXENT System Means for Shareholders

Reviewed by Sasha Jovanovic

- Thermo Fisher Scientific has received FDA 510(k) clearance for its EXENT System, an automated platform designed to enhance the diagnosis of multiple myeloma and related blood disorders by improving result accuracy and clinical workflow efficiency for laboratories in the U.S. and several international markets.

- This regulatory milestone expands Thermo Fisher’s commercial reach in the diagnostics sector, reflecting how innovation in laboratory automation can influence patient care and clinical decision-making on a broad scale.

- We’ll explore how this new regulatory clearance for the EXENT System could shape Thermo Fisher’s investment narrative and diagnostic leadership.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Thermo Fisher Scientific Investment Narrative Recap

To be a shareholder of Thermo Fisher Scientific, you have to believe in the company’s ability to drive sustained innovation in laboratory products, diagnostics, and services, leveraging growth in global biopharma, research, and precision medicine. The recent FDA 510(k) clearance of the EXENT System strengthens its competitive edge and near-term growth prospects by broadening its portfolio in high-value diagnostics, though short-term risk remains in muted demand from academic and government sectors, which could weigh on top-line momentum.

Among recent announcements, the new share repurchase program standing at up to US$5,000 million underlines management's confidence in Thermo Fisher’s future cash flows, a relevant backdrop as momentum from product innovation like the EXENT System potentially boosts near-term catalysts for the stock. With these developments and continued product launches, focus remains on the balance between margin resilience and international revenue uncertainty.

However, investors should also be aware that despite these advancements, continued revenue softness in certain end-markets could still present a cautionary sign for...

Read the full narrative on Thermo Fisher Scientific (it's free!)

Thermo Fisher Scientific's narrative projects $50.0 billion in revenue and $9.0 billion in earnings by 2028. This requires 5.0% yearly revenue growth and a $2.4 billion earnings increase from current earnings of $6.6 billion.

Uncover how Thermo Fisher Scientific's forecasts yield a $613.58 fair value, a 7% upside to its current price.

Exploring Other Perspectives

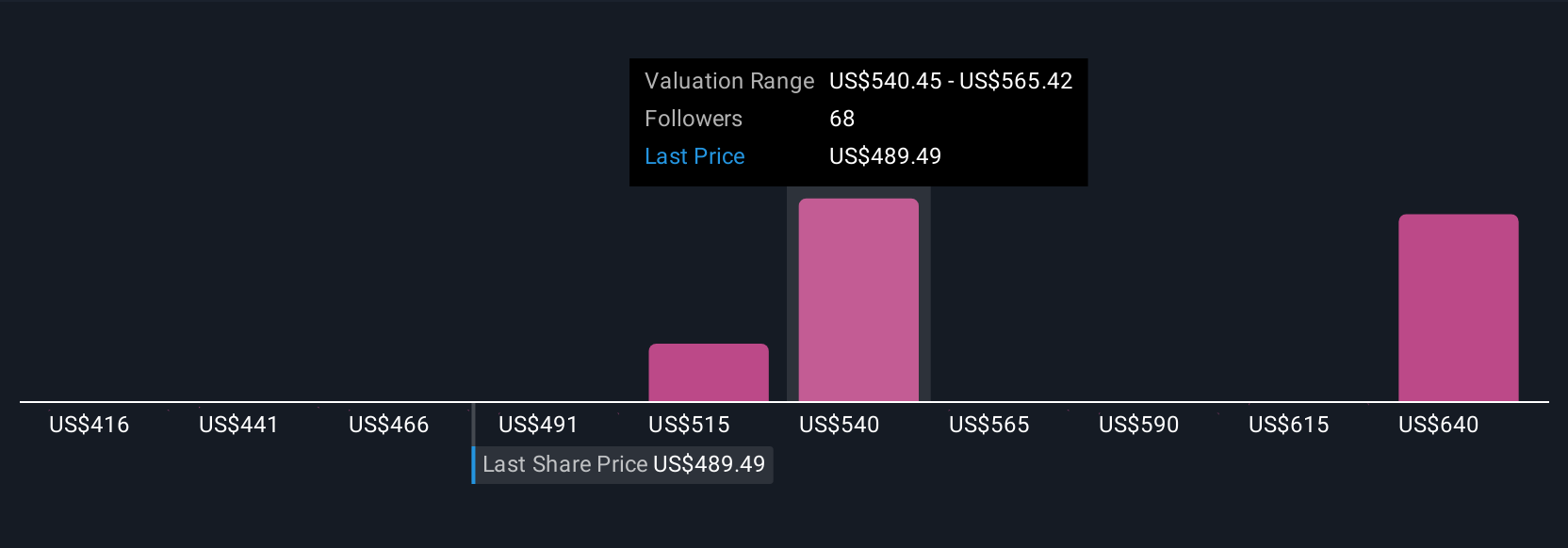

Thirteen individual fair value estimates from the Simply Wall St Community span from US$450 to US$662, reflecting a wide spectrum of opinions. Amid this diversity, the risk of persistent revenue declines in academic and government markets may shape how you interpret these views on Thermo Fisher's future performance.

Explore 13 other fair value estimates on Thermo Fisher Scientific - why the stock might be worth as much as 15% more than the current price!

Build Your Own Thermo Fisher Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thermo Fisher Scientific research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Thermo Fisher Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thermo Fisher Scientific's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives