- United States

- /

- Life Sciences

- /

- NYSE:TMO

Thermo Fisher Scientific: Assessing Value After Diagnostics Acquisition and Recent Share Price Gains

Reviewed by Bailey Pemberton

- Wondering if Thermo Fisher Scientific is a standout value opportunity or if its price has already baked in all the upside? You are not alone. This is the perfect moment to dig into what the numbers say.

- The stock has seen an 11.4% gain over the last year and is up 9.6% year to date, though it has dipped 1.3% in the past week. This shows both growth potential and a dash of short-term volatility.

- Recent news includes expanded partnerships in life science research and a high-profile acquisition of a diagnostics firm. Both moves have captured Wall Street's attention in recent weeks. These developments have added new narrative layers to Thermo Fisher's long-term growth story and prompted investors to reassess the company's future upside.

- Thermo Fisher scores a 3 out of 6 on our valuation checks, so it sits right at the midpoint. It is not obviously cheap, nor wildly overpriced. Let's explore how different valuation frameworks stack up, and stick around to see why the most insightful perspective might just come at the end.

Approach 1: Thermo Fisher Scientific Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company’s intrinsic worth by projecting its future cash flows and discounting them back to today's value. This process delivers a present value based primarily on expected free cash flow generation over the next decade and a terminal value beyond that.

For Thermo Fisher Scientific, the most recent available Free Cash Flow (FCF) stands at $6.13 billion. Analysts have provided forecasts for these cash flows over the next five years, after which further projections are extrapolated. Based on these forecasts and extrapolations, Thermo Fisher's FCF is projected to grow to $11.27 billion by the end of 2029. This highlights robust expansion potential in its core operations.

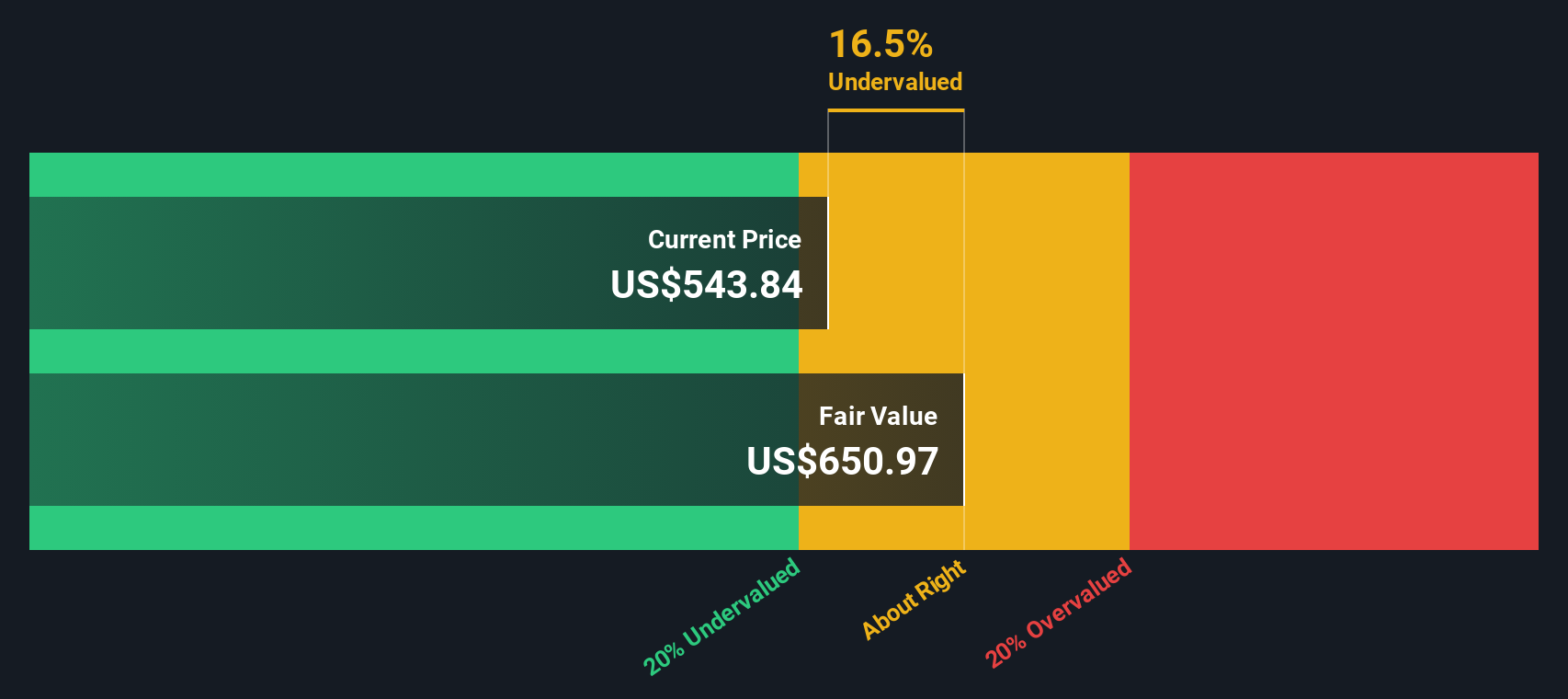

The DCF model employed here (2 Stage Free Cash Flow to Equity) arrives at an estimated intrinsic value of $606.72 per share. This reflects a 5.6% discount compared to the current market price, suggesting that the stock is valued almost in line with its projected fundamentals. Because this discount is under 10%, Thermo Fisher Scientific shares appear to be trading at a level that is ABOUT RIGHT according to this approach.

Result: ABOUT RIGHT

Thermo Fisher Scientific is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Thermo Fisher Scientific Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a classic valuation tool for profitable companies like Thermo Fisher Scientific, as it tells investors how much they are paying for each dollar of earnings. For established and steadily growing businesses, the PE ratio can reveal whether the stock is trading at a reasonable price relative to its bottom-line performance.

Expectations about a company’s future growth and the risks it faces are factored into what analysts and investors view as a “normal” or “fair” PE ratio. Faster growing or lower-risk companies typically command a higher PE, while slower growth or heightened risk can bring the multiple down.

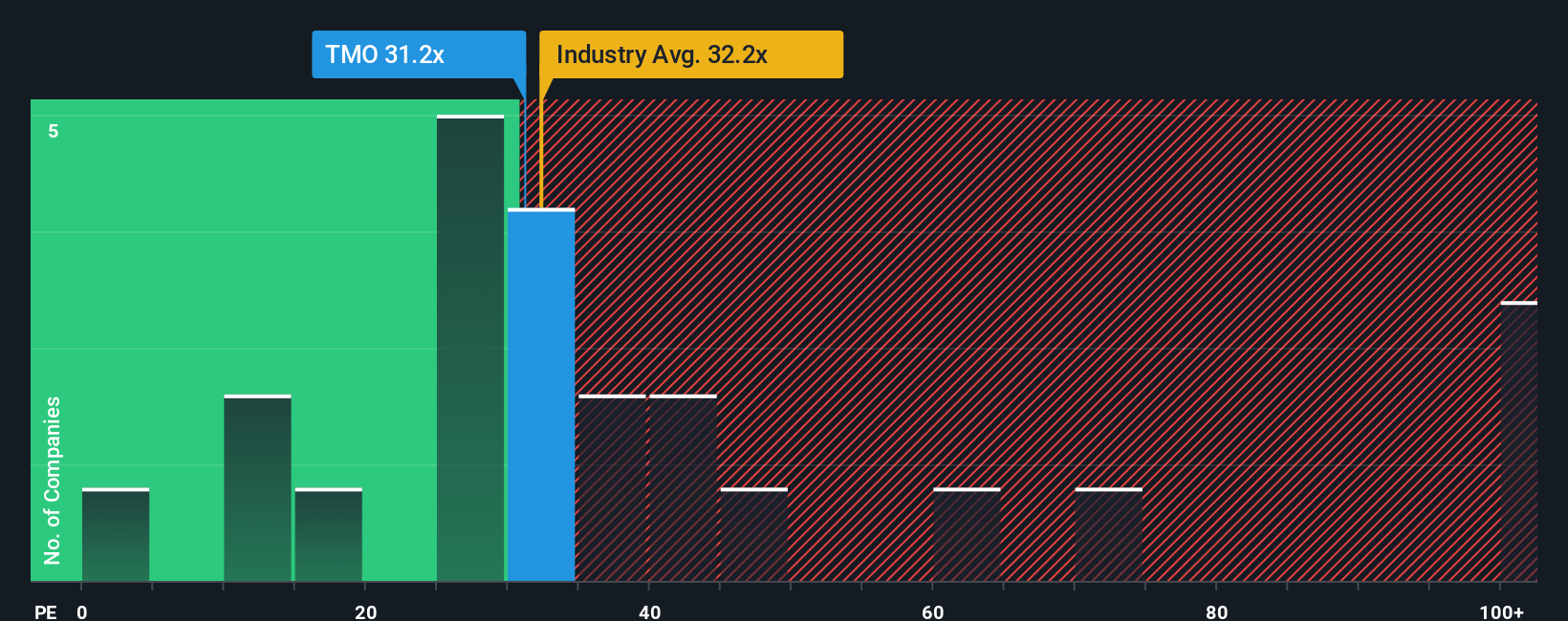

Thermo Fisher Scientific currently trades at a PE ratio of 32.8x, which is a bit lower than both the peer average of 35.4x and the Life Sciences industry average of 34.9x. However, simply comparing PE ratios side by side can miss the bigger picture.

That is where Simply Wall St’s proprietary “Fair Ratio” provides deeper context. The Fair Ratio for Thermo Fisher, at 29.8x, incorporates not just earnings growth but also factors in elements like profit margins, risk profile, market cap and industry dynamics. This custom benchmark is designed to be more tailored and informative than broad industry or peer averages.

With the stock’s current PE of 32.8x sitting just above its Fair Ratio but within a reasonable range, Thermo Fisher appears to be trading at a price that aligns closely with its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Thermo Fisher Scientific Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives make investing personal by giving you the chance to create and share the story you believe about a company, what you think its fair value is, and what future revenue, earnings, and margin trends are likely based on your research and outlook.

A Narrative connects a company’s real-world story to a specific financial forecast and then directly to a fair value, helping put the numbers in context. Narratives on Simply Wall St are accessible and easy to use on the Community page, where millions of investors post their views, forecasts, and logic for everyone to learn from.

Narratives make it crystal clear when you believe a stock is worth buying or selling, as you compare your Narrative Fair Value to the price today. Better still, they update automatically as fresh news or earnings are released, so your thesis stays current.

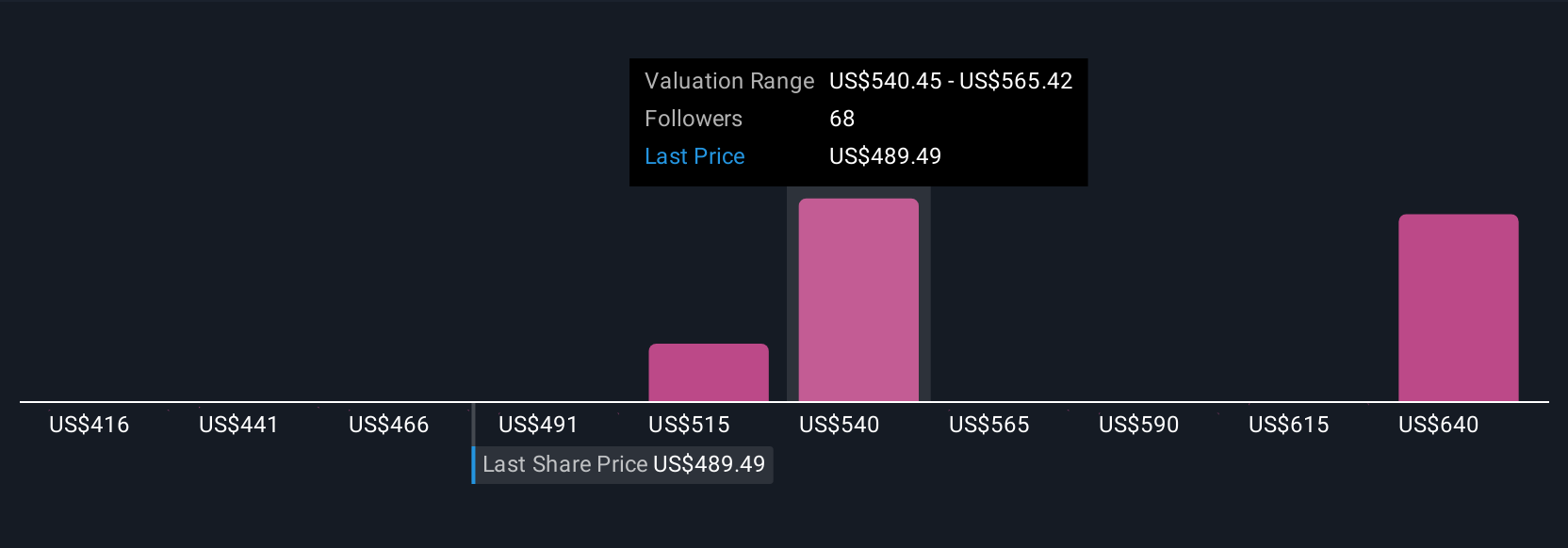

For example, some investors see Thermo Fisher Scientific as having significant upside, using bullish forecasts and future PE ratios near 30x to produce a fair value over $760 per share. Others take a more cautious view, with lower earnings and margin estimates, arriving at a fair value closer to $490. That is the power of Narratives: your investment, your perspective, all backed by data and dynamic insights.

For Thermo Fisher Scientific, we will make it really easy for you with previews of two leading Thermo Fisher Scientific Narratives:

🐂 Thermo Fisher Scientific Bull Case

Fair Value: $613.58

Current Price vs Fair Value: 6.7% undervalued

Projected Revenue Growth: 5.2%

- Pharmaceutical manufacturing expansion, innovative products, and tighter customer integration contribute to robust recurring revenue and strong competitive positioning.

- AI-driven process efficiency, strict cost discipline, and strategic acquisitions support margin growth and sustainable returns even as markets fluctuate.

- Major risks include funding uncertainty in academic and government sectors, China market headwinds, margin compression in select segments, and management transition concerns.

🐻 Thermo Fisher Scientific Bear Case

Fair Value: $540.27

Current Price vs Fair Value: 6.0% overvalued

Projected Revenue Growth: 7.0%

- Growth drivers include resilient demand from biotech and pharma, margin improvements from recent acquisitions, and a diverse, recurring revenue stream model.

- Industry tailwinds are balanced by headwinds such as waning COVID-related sales, macroeconomic sensitivity, regulatory and integration risks, and variability in R&D spending.

- Even with upside for patient investors, slower R&D growth, regulatory shifts, or M&A missteps could threaten profitability and lead to periods of overvaluation.

Do you think there's more to the story for Thermo Fisher Scientific? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives