- United States

- /

- Pharma

- /

- NYSE:TEVA

Teva (TEVA) Discounted Valuation Reinforces Bull Case Despite Unprofitability and Slow Revenue Growth

Reviewed by Simply Wall St

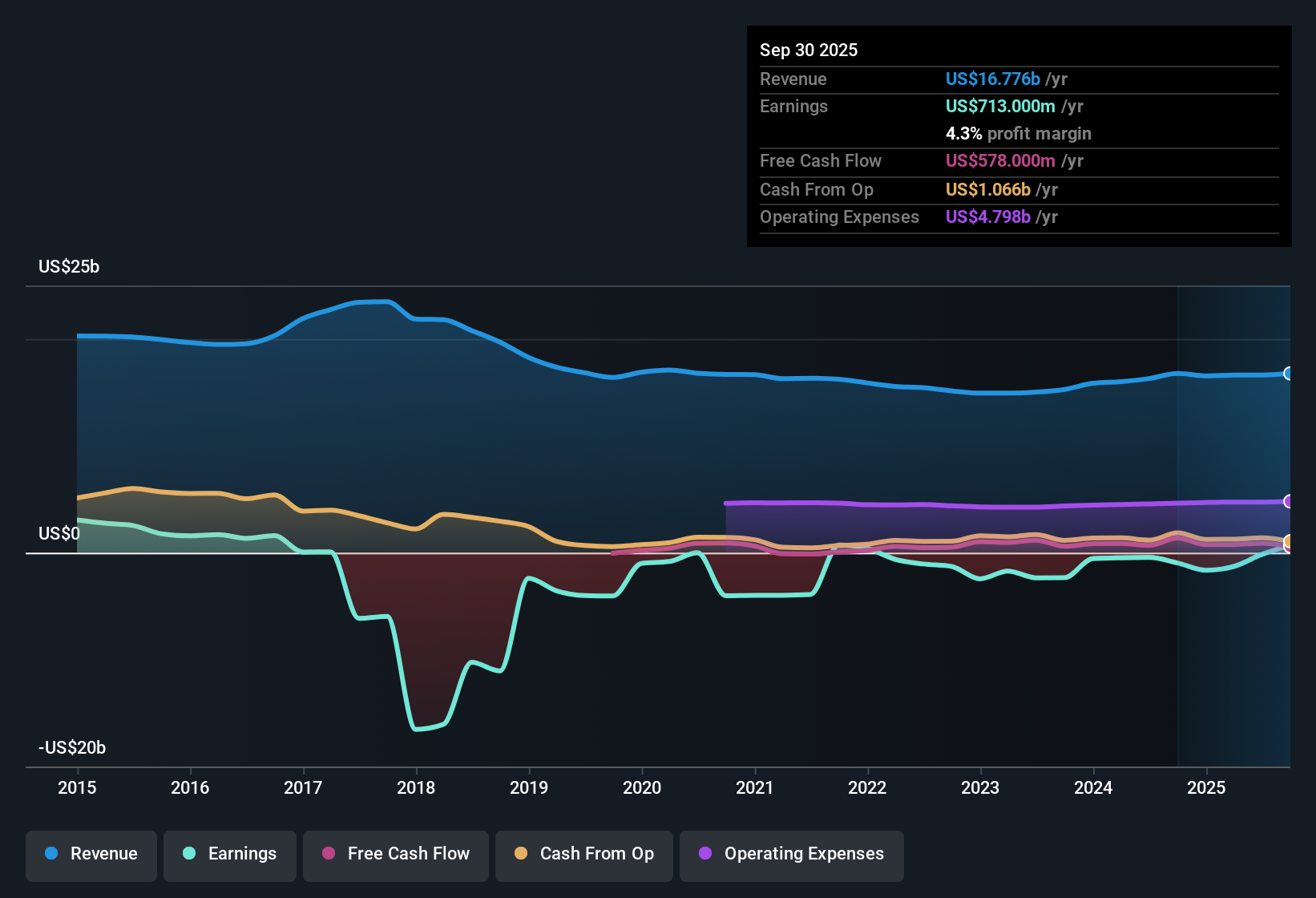

Teva Pharmaceutical Industries (TEVA) is currently unprofitable, but the company has managed to trim its losses by 28.6% per year over the past five years. Revenue is forecast to grow at 2.8% per year, which is well below the US pharmaceutical market average of 10.5%. Earnings are expected to jump 19.73% annually, with the company projected to become profitable within three years. With shares trading at a significant discount compared to fair value and peers, the improving earnings outlook and loss reduction set up an interesting narrative for investors seeking value opportunities, even as slow revenue growth and unprofitability remain important factors to watch.

See our full analysis for Teva Pharmaceutical Industries.The numbers alone only tell part of the story. Next, we’ll see how these results compare to the prevailing narratives in the market and within the Simply Wall St community.

See what the community is saying about Teva Pharmaceutical Industries

Margins and Pipeline Support Profit Turnaround

- Profit margin is projected to expand dramatically from -0.9% currently to 8.2% in three years, suggesting the company could cross solidly into profitability as its branded and biosimilar launches gain traction.

- Analysts' consensus view highlights Teva’s ability to drive margin expansion as a key upside:

- The positive narrative around operational efficiencies and $700 million in savings is supported by expectations of stronger free cash flow and earnings, even with only 2.3% annual revenue growth projected through 2027.

- However, dependency on select branded therapies like AUSTEDO, especially considering forthcoming government price negotiations, keeps margin uncertainties connected to product concentration risks.

- The consensus narrative emphasizes Teva’s defensive moves in cost reduction and branded pipeline expansions, pinpointing margin growth as central to the near-term turnaround.

- A notable factor is how much of this anticipated margin improvement depends on executing complex launches and containing expenses, even as the generic segment experiences flat growth.

- Consensus suggests that if execution remains on track, these initiatives could shift the bottom line closer to peers, though key execution risks persist.

The consensus narrative highlights the cost-saving drive and product focus as engines for the margin story, but underscores the need for successful branded launches to deliver on that margin promise. 📊 Read the full Teva Pharmaceutical Industries Consensus Narrative.

Debt Load and Execution Risks Remain

- Teva’s net debt position stands at over $15 billion, with net debt/EBITDA just above 3x, placing balance sheet pressure at the forefront of the risk narrative.

- Consensus narrative flags several bear concerns:

- The large debt load may constrain Teva’s ability to continue investing in product R&D and business development, potentially slowing future catalysts.

- Significant exposure to a few branded drugs means upcoming regulatory changes, such as the Inflation Reduction Act’s impact on AUSTEDO, could affect cash flow and margins more than sector averages.

Discount Valuation Signals Recovery Potential

- Teva’s price-to-sales ratio is 1.7x, well below the US pharmaceuticals industry’s 4.2x, and the stock trades at $24.60 compared to a DCF fair value of $58.33, making it one of the most discounted names among its peers.

- Analysts' consensus narrative frames this valuation gap as a reflection of both opportunity and skepticism:

- Teva’s discounted multiple points to concerns about execution and debt risks, but also offers potential for upside should margins and pipeline launches meet analyst expectations.

- The current share price’s gap to the fair value suggests that even modest improvements in profitability or new product traction could drive larger reratings compared to higher-multiple peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Teva Pharmaceutical Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a different interpretation of the results? Add your point of view and build your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Teva Pharmaceutical Industries.

Explore Alternatives

Despite margin improvement potential, Teva’s high debt burden and concentrated revenue present substantial balance sheet and execution risks for investors.

If you want to focus on companies with stronger financial health and less debt pressure, discover options with solid balance sheet and fundamentals stocks screener (1979 results) that are built for stability even in challenging markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teva Pharmaceutical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEVA

Teva Pharmaceutical Industries

Develops, manufactures, markets, and distributes generic and other medicines, and biopharmaceutical products in the United States, Europe, Israel, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives