- United States

- /

- Pharma

- /

- NYSE:TEVA

Teva Pharmaceutical Industries (NYSE:TEVA): Evaluating Valuation After European Approval for Key Biosimilars

Reviewed by Simply Wall St

Teva Pharmaceutical Industries (NYSE:TEVA) has received European Commission approval for its biosimilars PONLIMSI and DEGEVMA. This development strengthens its position in the biosimilars space and aligns with its ongoing Pivot to Growth strategy.

See our latest analysis for Teva Pharmaceutical Industries.

It has been a big year for Teva. Recent launches like the new open innovation platform, Teva Rise, and regulatory approvals in Europe have driven fresh attention and confidence among investors, fueling a 34% 1-month share price return and lifting the 1-year total shareholder return to an impressive 59%. The company’s momentum is building, reflecting both renewed growth prospects and changing risk perceptions as it pivots successfully into biosimilars and innovation.

If Teva's transformation has you thinking about other opportunities, now's the perfect time to discover See the full list for free.

With the stock up nearly 60% over the past year and positive news driving momentum, is Teva still trading below its true value, or are investors already anticipating higher future growth in the share price?

Most Popular Narrative: 5.7% Undervalued

With Teva shares closing at $26.32, the most closely followed narrative places fair value at $27.90. This sets expectations for modest upside if the company delivers on its core growth thesis.

Operational efficiencies, modernization, and a resilient generics platform are strengthening Teva's financial foundation, supporting income growth, free cash flow, and debt reduction. Heavy dependency on select branded drugs, ongoing debt constraints, and heightened regulatory and competitive risks threaten sustainable growth and margin improvement.

What keeps analysts betting on Teva’s future? One bold assumption about sustainable profit margins and premium multiples is baked in. Want a peek at which ambitious forecasts are shaping these valuation models? The details behind this high-conviction price target may surprise you. Dive deeper to see what could spark the next rally.

Result: Fair Value of $27.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on key branded drugs and ongoing debt pressures could quickly shift Teva’s growth outlook if margins or cash flow do not meet expectations.

Find out about the key risks to this Teva Pharmaceutical Industries narrative.

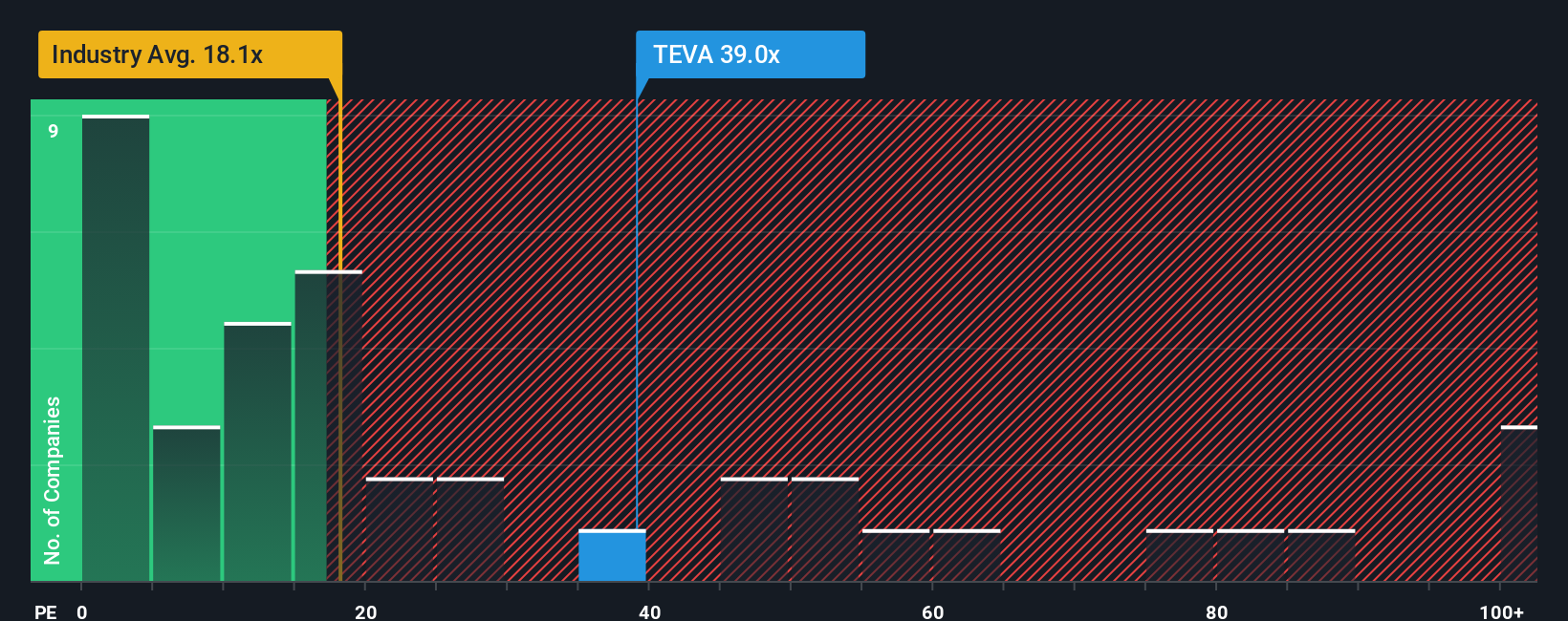

Another View: Market Ratios Point to Overvaluation

Looking at the company’s price-to-earnings ratio, Teva trades at 42.4x, which is well above both the US Pharmaceuticals industry average of 20.5x and the peer average of 35.1x. This also exceeds its fair ratio of 29.6x, suggesting the market might be pricing in a lot of optimism. Does this premium highlight investor confidence, or could it signal a risk if earnings growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teva Pharmaceutical Industries Narrative

If you have your own take or want to dig deeper into Teva’s story, why not test the data for yourself and shape your own perspective in minutes. Do it your way

A great starting point for your Teva Pharmaceutical Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. The smartest investors scan beyond today’s headlines. Use the Simply Wall Street Screener to spot overlooked gems and future leaders before the crowd catches on.

- Boost your portfolio’s yield potential and tap into consistent returns by exploring these 15 dividend stocks with yields > 3% with robust payouts and stable growth histories.

- Ride the surge in artificial intelligence by tracking these 25 AI penny stocks poised to transform everything from healthcare to logistics with groundbreaking innovations.

- Seize the chance for deep value by uncovering these 928 undervalued stocks based on cash flows that the market is missing but savvy investors won’t overlook for long.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teva Pharmaceutical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEVA

Teva Pharmaceutical Industries

Develops, manufactures, markets, and distributes generic and other medicines, and biopharmaceutical products in the United States, Europe, Israel, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success