- United States

- /

- Life Sciences

- /

- NYSE:STVN

Did Stevanato Group's (STVN) German Manufacturing Expansion Just Shift Its Advanced Drug Delivery Investment Narrative?

Reviewed by Sasha Jovanovic

- Stevanato Group S.p.A. recently announced a significant expansion of its drug delivery system manufacturing capacity by adding over 2,500 square meters of advanced production space, including a new ISO 8 cleanroom, to its Bad Oeynhausen, Germany facility.

- This move is set to enhance European supply-chain integration and support major autoinjector and pen injector platforms, positioning Stevanato as an increasingly valuable partner for global pharmaceutical and biotech customers.

- We'll examine how this expanded manufacturing capacity influences Stevanato's investment narrative amid rising European demand for advanced drug delivery solutions.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Stevanato Group Investment Narrative Recap

Stevanato Group’s investment narrative centers on its ability to capture accelerating demand for advanced drug delivery and containment solutions, driven by industry trends toward biologics and self-administration. The recent Bad Oeynhausen expansion directly supports this by boosting European capacity for auto-injector and pen injector production; however, while it strengthens Stevanato’s position with global pharma clients, the near-term effect on margins depends on successful scaling and cost control, as high ongoing capital investments remain the most immediate risk to watch.

Among recent announcements, the July €200 million debt financing stands out, providing the financial flexibility needed for major facility expansions like Bad Oeynhausen. This additional liquidity helps fund capacity growth, but also adds focus to concerns about margin pressure and return on invested capital as these new projects ramp up over the coming quarters.

Yet, while expanded production unlocks growth opportunities, investors should be aware that persistent negative free cash flow could…

Read the full narrative on Stevanato Group (it's free!)

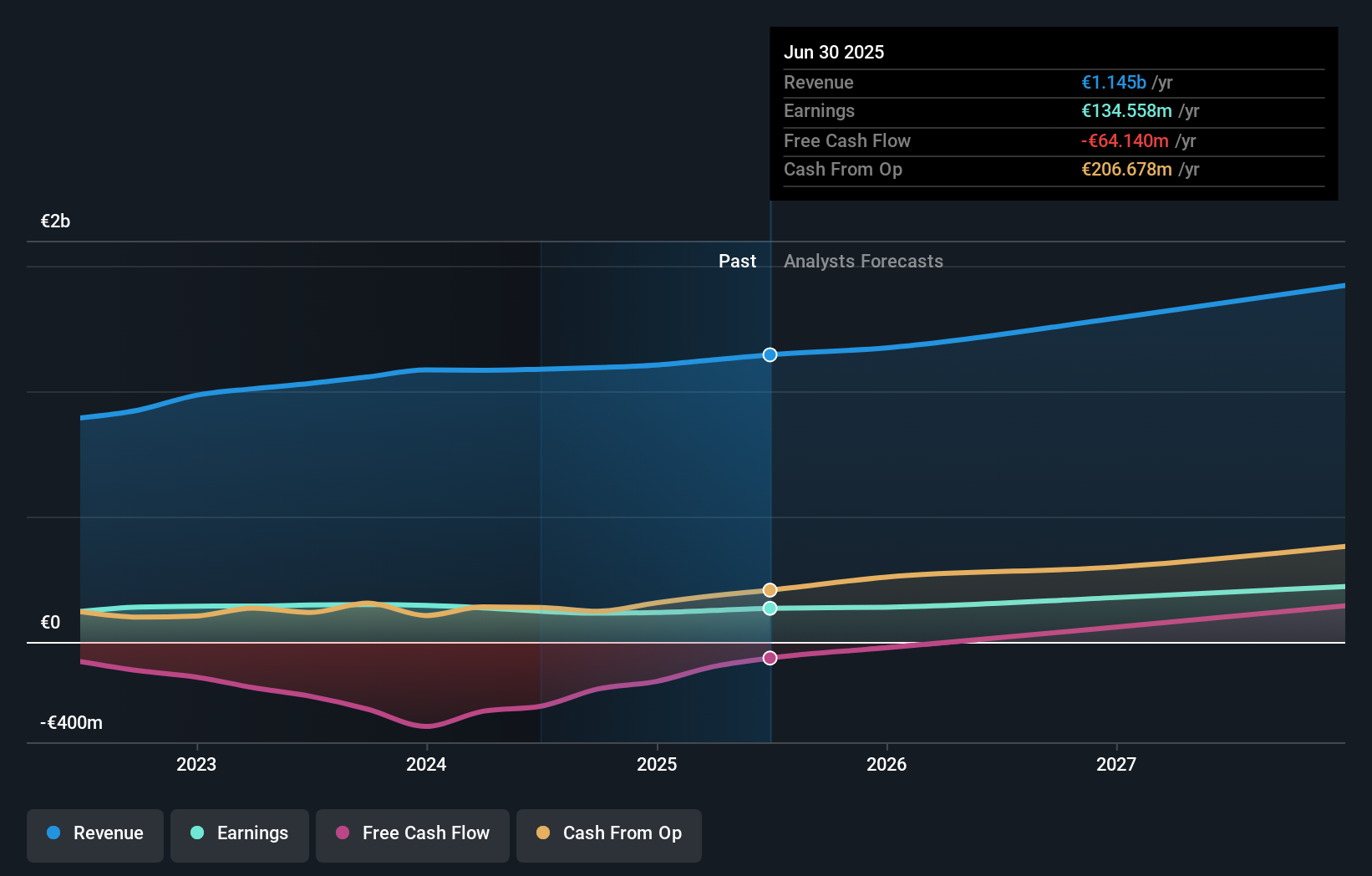

Stevanato Group's narrative projects €1.5 billion revenue and €242.0 million earnings by 2028. This requires 9.2% yearly revenue growth and a €107.4 million earnings increase from €134.6 million today.

Uncover how Stevanato Group's forecasts yield a $28.62 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates ranging narrowly from €28.59 to €28.62, reflecting closely aligned independent analysis. With heightened capital investment risk still present, it’s important to consider several viewpoints on Stevanato’s performance prospects.

Explore 2 other fair value estimates on Stevanato Group - why the stock might be worth as much as 13% more than the current price!

Build Your Own Stevanato Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stevanato Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Stevanato Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stevanato Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STVN

Stevanato Group

Engages in the design, production, and distribution of products and processes to provide solutions for biopharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives