- United States

- /

- Life Sciences

- /

- NYSE:QGEN

Will Qiagen’s (QGEN) New Automation Platform Strengthen Its Competitive Edge in Precision Oncology?

Reviewed by Sasha Jovanovic

- At the 2025 AMP annual meeting in Boston earlier this month, QIAGEN N.V. unveiled QIAsymphony Connect, the next-generation iteration of its automated nucleic acid purification platform, offering enhanced speed, digital integration, and liquid biopsy support, with broader release planned for 2026 and early access already rolling out.

- This debut underscores QIAGEN's continued innovation in laboratory automation, highlighting collaborative advancements in genomic profiling and digital connectivity aimed at expanding precision oncology and workflow efficiency.

- We'll review how QIAsymphony Connect's emphasis on digital integration and operational efficiency could influence Qiagen's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Qiagen Investment Narrative Recap

To believe in Qiagen as a shareholder, you would need confidence in the company’s ability to drive recurring revenue through automation and digital lab tools that meet rising demand for molecular diagnostics and genomics. The recent debut of QIAsymphony Connect reinforces Qiagen’s commitment to laboratory innovation and workflow efficiency, but is unlikely to meaningfully shift near-term catalysts or alter the central risk of intense market competition in automation and digital PCR.

One directly relevant recent announcement is the launch of QIAstat-Dx Rise, which complements QIAsymphony Connect by targeting automated syndromic testing with enhanced throughput. Both represent Qiagen’s push to position itself at the forefront of lab workflow automation, supporting its growth thesis even as the company faces competitive and integration risks ahead.

However, investors should be aware that, in contrast, headwinds from rapid technological change and rival offerings could quickly affect Qiagen's ability to...

Read the full narrative on Qiagen (it's free!)

Qiagen’s outlook anticipates $2.5 billion in revenue and $554.3 million in earnings by 2028. This is based on an expected 6.9% annual revenue growth rate and a $180.9 million increase in earnings from current earnings of $373.4 million.

Uncover how Qiagen's forecasts yield a $50.79 fair value, a 8% upside to its current price.

Exploring Other Perspectives

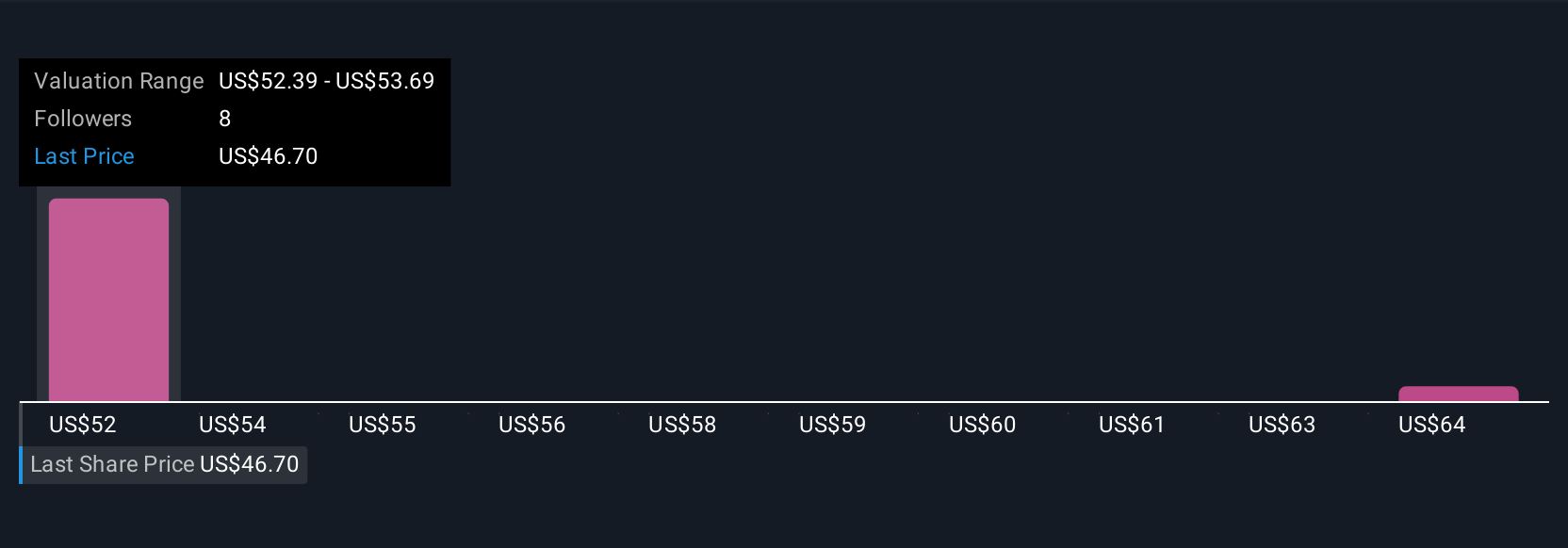

Community fair value estimates for Qiagen range from US$50.79 to US$59.84, generated by two perspectives within the Simply Wall St Community. While optimism around automation adoption is rising, intensifying competition in digital PCR may pressure market share and long-term profitability, so be sure to consider multiple viewpoints.

Explore 2 other fair value estimates on Qiagen - why the stock might be worth as much as 28% more than the current price!

Build Your Own Qiagen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qiagen research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qiagen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qiagen's overall financial health at a glance.

No Opportunity In Qiagen?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qiagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives