- United States

- /

- Life Sciences

- /

- NYSE:QGEN

Will Qiagen's (QGEN) Automation Push Redefine Its Edge in Forensic Lab Innovation?

Reviewed by Sasha Jovanovic

- QIAGEN recently launched the EZ2 DNA Investigator Sep&Prep Kit, an automated solution for forensic laboratories, and marked the placement of its 4,000th QIAcube Connect instrument, underscoring progress in automation and product innovation across life science and diagnostic labs.

- The expanded automation portfolio and forensics DNA technology highlight QIAGEN’s efforts to address pressing workflow challenges while advancing sample-processing efficiency for a diverse range of lab environments.

- We'll explore how QIAGEN's forensics-focused product launch strengthens its investment narrative by meeting critical needs in automated DNA analysis.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Qiagen Investment Narrative Recap

To believe in Qiagen as a shareholder, you need to back the story of automation transforming lab efficiency, with product innovation addressing the industry’s need for scalable, reliable workflows. While the new EZ2 DNA Investigator Sep&Prep Kit launch and the 4,000th QIAcube Connect placement reinforce Qiagen’s automation push, these developments may not materially change the near-term catalyst of strong QIAstat-Dx adoption, nor do they offset current risks from health science funding pressures and intensified competition. Of the recent developments, the 4,000th placement of QIAcube Connect stands out as most relevant, aligning with Qiagen’s accelerated rollout of automated sample processing systems. This push toward automation is central to driving higher recurring sales and operational scale, offering resilience against short-cycle demand swings in traditional research markets. However, investors should not overlook that, despite automation progress, industry-wide macro volatility and funding constraints remain important factors to monitor ...

Read the full narrative on Qiagen (it's free!)

Qiagen's outlook anticipates $2.5 billion in revenue and $554.3 million in earnings by 2028. This implies a 6.9% annual revenue growth rate and a $180.9 million increase in earnings from the current $373.4 million.

Uncover how Qiagen's forecasts yield a $51.64 fair value, a 10% upside to its current price.

Exploring Other Perspectives

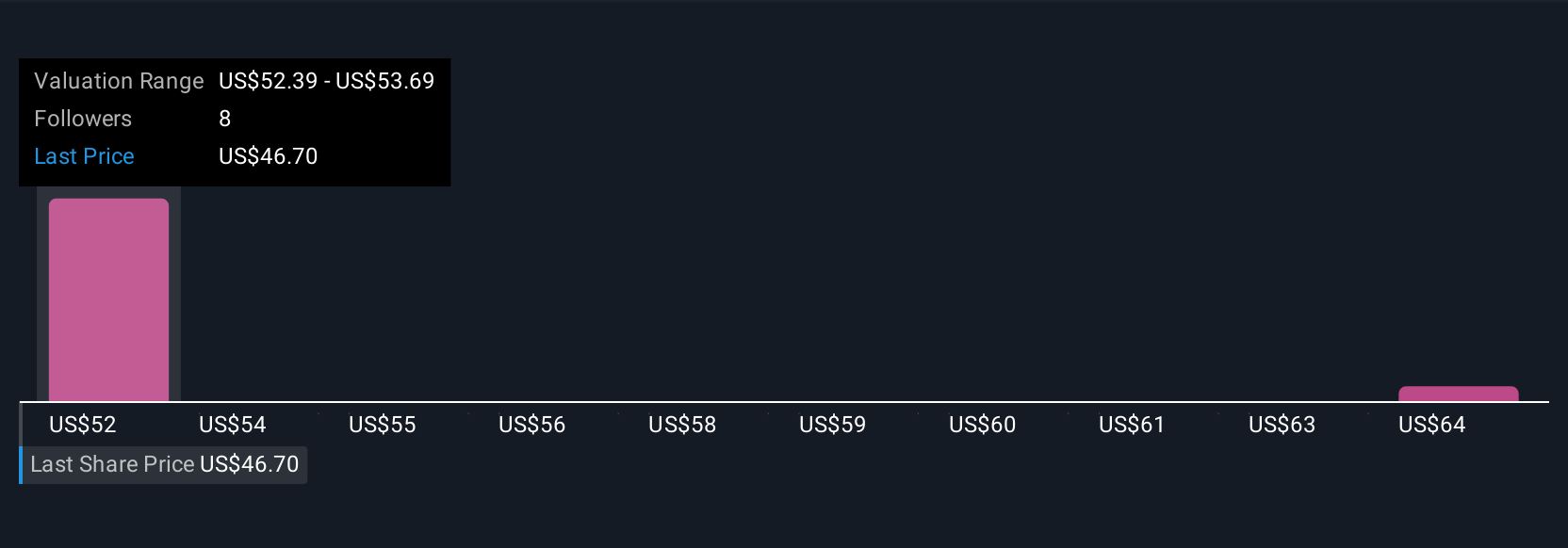

Two Simply Wall St Community members value Qiagen between US$51.64 and US$62.47, suggesting wide opinion on its fair worth. While automation advances are promising, persistent competition and research budget cuts could shape Qiagen’s trajectory, consider these different viewpoints as you assess the company’s outlook.

Explore 2 other fair value estimates on Qiagen - why the stock might be worth just $51.64!

Build Your Own Qiagen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qiagen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Qiagen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qiagen's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qiagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives