- United States

- /

- Life Sciences

- /

- NYSE:QGEN

Qiagen (NYSE:QGEN) Margin Recovery Challenges Bearish Narratives After 413.6% Earnings Growth

Reviewed by Simply Wall St

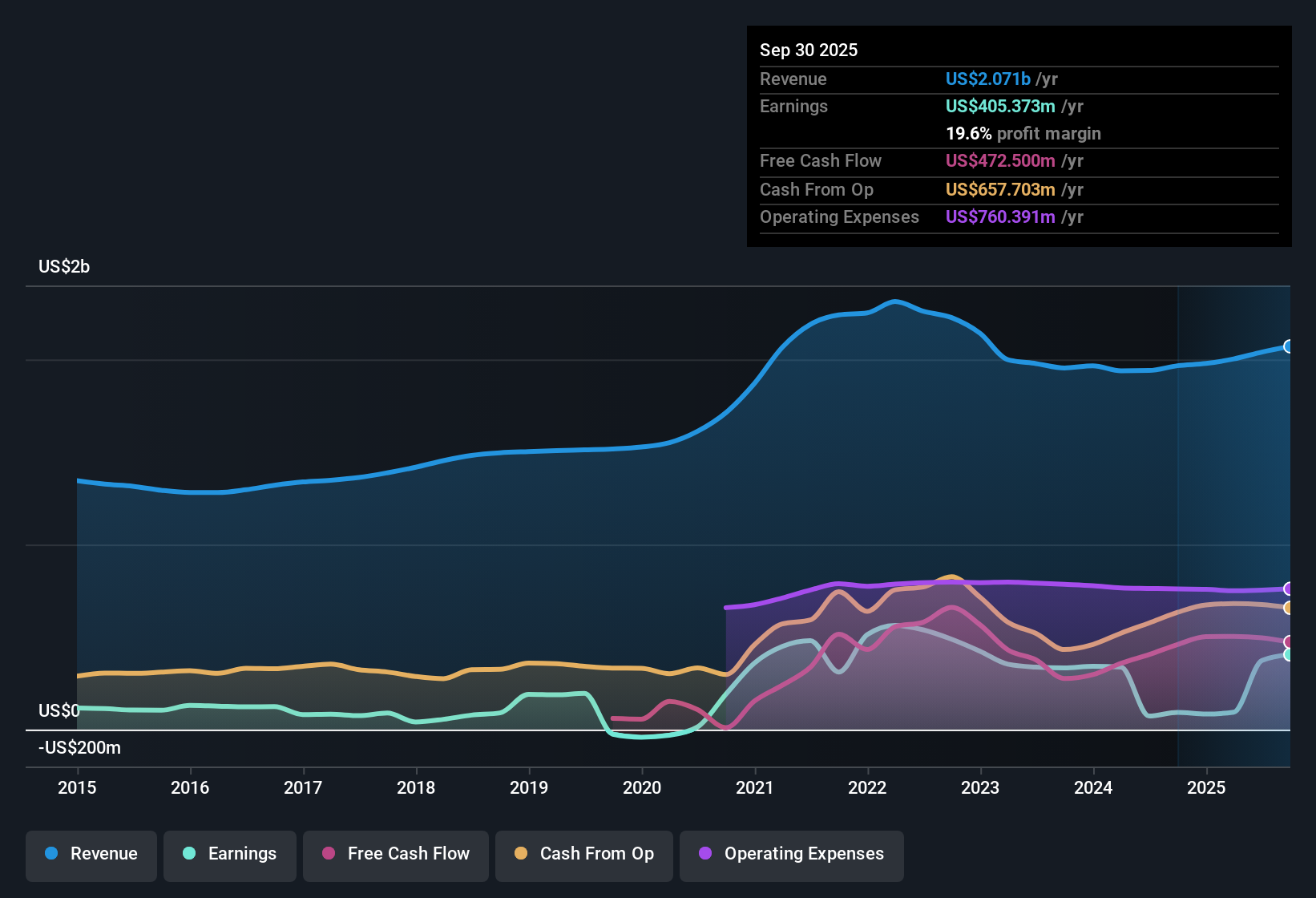

Qiagen (NYSE:QGEN) reported a sharp turnaround in profitability this quarter, with net profit margins rising to 18.3% from just 3.7% a year ago. Earnings growth surged by 413.6% over the past twelve months. Despite a negative five-year trend, earnings are now forecast to increase at 11.5% per year. This forecast is below the broader US market’s expected pace. Investors will note that Qiagen shares are trading at $44.05, representing a discount to the estimated fair value and pricing in steady, if moderate, future growth amid improved margins.

See our full analysis for Qiagen.Next, we will see how these headline earnings line up against the dominant market narratives and what this means for Qiagen’s outlook.

See what the community is saying about Qiagen

Margin Expansion Outpaces Industry Peers

- Qiagen’s net profit margin has reached 18.3%, well above last year’s 3.7% and exceeding the North American Life Sciences sector average. This signals stronger cost control and pricing power than most competitors.

- According to analysts' consensus view, the margin improvement is driven by growth in syndromic diagnostics and automation, as well as success from new product launches and efficiency initiatives.

- These trends have produced a 300 basis point gain in operating margin since 2023. This has enabled the company to boost long-term profitability even as broader industry funding remains weak.

- The consensus also points to recurring revenue from new automated platforms and partnerships as supportive factors for maintaining margins in the future. However, margin headwinds from macro factors such as tariffs and currency are noted.

- For a balanced view on how these factors shape Qiagen’s margin outlook, check how analysts are weighing sustainability and risk in the full consensus narrative. 📊 Read the full Qiagen Consensus Narrative.

Valuation Discount Versus Sector Averages

- Qiagen’s price-to-earnings ratio of 25.6x is substantially below the peer group average of 59.3x and the industry average of 36.3x. Its $44.05 share price trades at a 24% discount to the DCF fair value of $58.22.

- Analysts' consensus view highlights that the current valuation reflects a belief in steady growth, but not all upside is being priced in.

- The consensus price target of $51.64 is about 17% higher than the share price. This implies confidence that long-term earnings targets can be reached, even though the growth forecast trails the wider US market.

- This pricing gap challenges investors to decide whether the risk from previously reported one-off losses ($356 million) and exposure to macro volatility is adequately reflected in today’s discount, or if there is a margin of safety relative to sector headwinds.

Growth Forecasts Lag Broader Market

- Qiagen’s projected annual earnings growth rate of 11.5% and revenue growth of 7.7% both fall below the overall US market averages of 16% (earnings) and 10.5% (revenue), suggesting more moderate upside compared to high-growth peers.

- In the analysts' consensus narrative, there is optimism that automation and syndromic diagnostics expansion will help accelerate future growth. However, persistent headwinds from weak life sciences funding and limited China market recovery underline why consensus expectations are restrained.

- Projected increases in profit margin, from 18.3% today to 22.2% in three years, are meant to offset slower top-line expansion and support gradual earnings per share improvements.

- However, industry-wide macro risks such as currency fluctuations and intensifying competition remain barriers that could keep Qiagen’s growth below sector averages for longer.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Qiagen on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? It only takes a few minutes to build your unique perspective and share your analysis. Do it your way

A great starting point for your Qiagen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Qiagen’s below-market growth forecast and exposure to macro headwinds could limit future upside compared to sector leaders that are growing at a faster pace.

If you want more consistent expansion and fewer setbacks, consider stable growth stocks screener (2078 results) to discover companies delivering steady, reliable growth no matter the market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qiagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives