- United States

- /

- Pharma

- /

- NYSE:PRGO

Why Perrigo (PRGO) Is Down 8.3% After Class Action Over Alleged Formula Business Misstatements

Reviewed by Sasha Jovanovic

- On November 18, 2025, Glancy Prongay & Murray LLP announced that it had filed a class action lawsuit against Perrigo Company plc in the U.S. District Court for the Southern District of New York, alleging materially misleading statements and disclosure failures related to Perrigo's infant formula business acquired from Nestlé.

- This lawsuit raises significant concerns about historical underinvestment, manufacturing deficiencies, and the accuracy of prior financial reporting by Perrigo, which may impact investor confidence in management transparency.

- We will examine how allegations of undisclosed operational risks in the infant formula business reshape the company's investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Perrigo Investment Narrative Recap

Being a Perrigo shareholder rests on believing in the company’s capacity to rebound through self-care innovation, private label growth, and operational efficiency, even amid industry challenges. The recent class action lawsuit concerning alleged past disclosure failures in the infant formula business directly intensifies the spotlight on management transparency, the current key risk potentially impacting near-term trust and the ongoing strategic review’s impact on recovery efforts.

Of all recent developments, Perrigo’s November 6 announcement of a strategic review of its infant formula business is especially relevant here. This move aligns with immediate pressure on the company to address operational deficiencies and clarify the business’s future, directly intersecting with investor concerns triggered by the lawsuit.

Yet, against the potential for turnaround, investors should also consider the impact of increased supply chain and product quality risks lurking beneath the surface…

Read the full narrative on Perrigo (it's free!)

Perrigo's narrative projects $4.6 billion revenue and $183.6 million earnings by 2028. This requires 1.7% yearly revenue growth and a $243.1 million increase in earnings from -$59.5 million currently.

Uncover how Perrigo's forecasts yield a $21.50 fair value, a 70% upside to its current price.

Exploring Other Perspectives

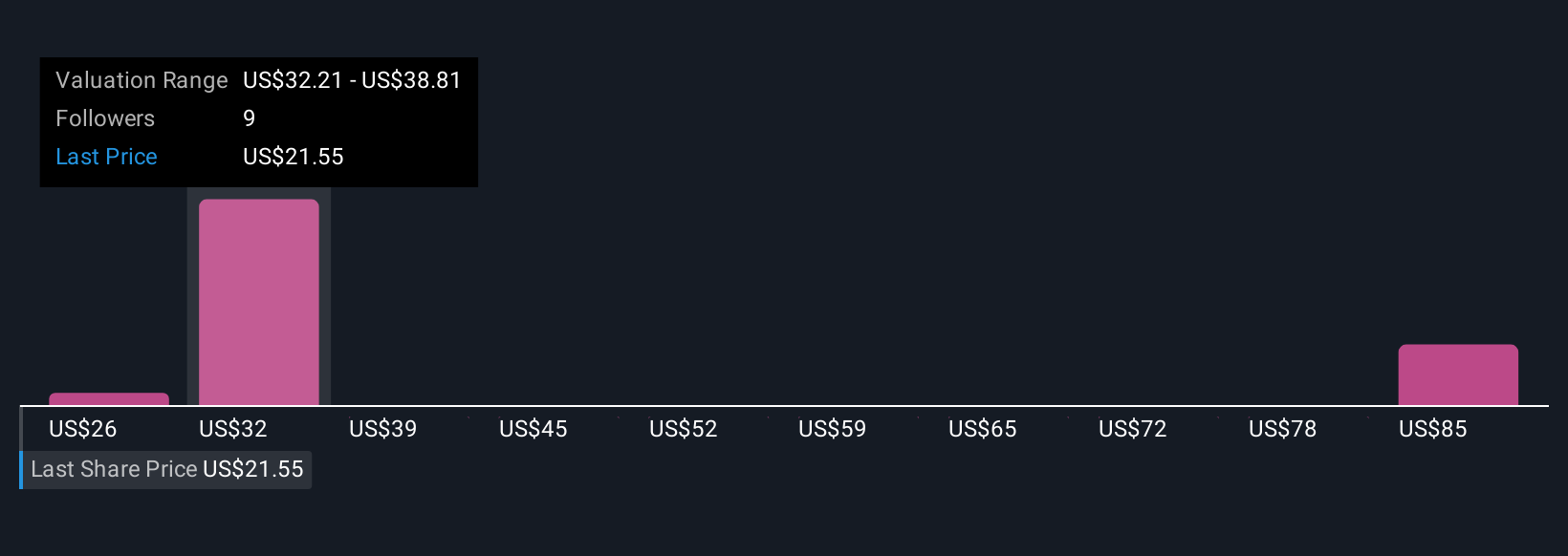

Four estimates from the Simply Wall St Community place Perrigo's fair value between US$21.50 and US$55.05 per share. Despite optimism for longer term profit growth, the recent lawsuit raises pointed questions around earnings quality and transparency, underscoring the importance of weighing every viewpoint.

Explore 4 other fair value estimates on Perrigo - why the stock might be worth just $21.50!

Build Your Own Perrigo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perrigo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Perrigo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perrigo's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRGO

Perrigo

Provides over-the-counter health and wellness solutions in the United States, Europe, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives