- United States

- /

- Pharma

- /

- NYSE:PRGO

Is Perrigo Now a Bargain After 20.6% Share Price Drop in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Perrigo's share price is starting to look like a bargain, or if you might be catching a falling knife? Let's take a closer look at the forces shaping its value and what they could mean for investors hunting for opportunities.

- Despite a recent dip of 4% this week and being down 20.6% year-to-date, Perrigo has a history of volatility, highlighting shifting market sentiment and changing expectations for the company’s future.

- News around Perrigo has focused on regulatory updates and product approvals, sparking both optimism and caution among investors. Ongoing developments in the company's generic medicines and consumer healthcare lines have added further intrigue to the stock’s recent price swings.

- Perrigo currently scores a 5 out of 6 on our valuation checks, signaling that the market might be missing some hidden value. Let’s break down what these checks mean, and stick around for a smarter way to judge Perrigo’s real worth beyond the usual methods.

Find out why Perrigo's -15.9% return over the last year is lagging behind its peers.

Approach 1: Perrigo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic worth by projecting its future cash flows and then discounting those back to their value today. This approach helps investors understand what Perrigo could genuinely be worth, regardless of market mood swings.

Perrigo’s current Free Cash Flow is $272.8 million. Projections, based on a combination of analyst estimates and calculated extrapolations, see this number steadily climbing and reaching $592.5 million by the end of 2029. In the coming decade, annual Free Cash Flow is forecasted to continue expanding, as reflected in the ten-year outlook, even as analyst consensus only extends for the next five years. These estimates are all denominated in USD, matching the share’s listed currency.

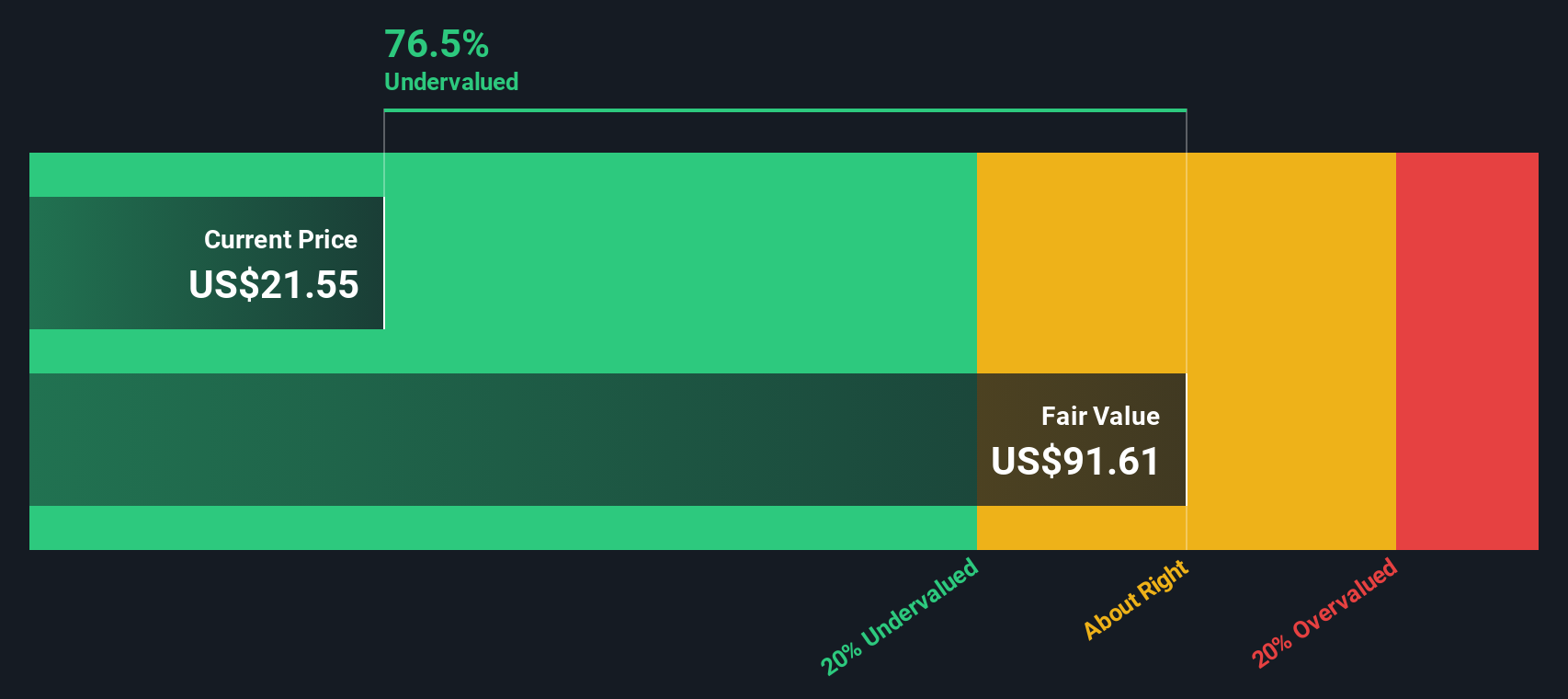

Based on the DCF model, Perrigo’s intrinsic fair value is calculated at $90.35 per share, implying a compelling 77.2% discount versus the current market price. That suggests the stock might be trading at a significant bargain compared to what the underlying business is really worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Perrigo is undervalued by 77.2%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Perrigo Price vs Sales

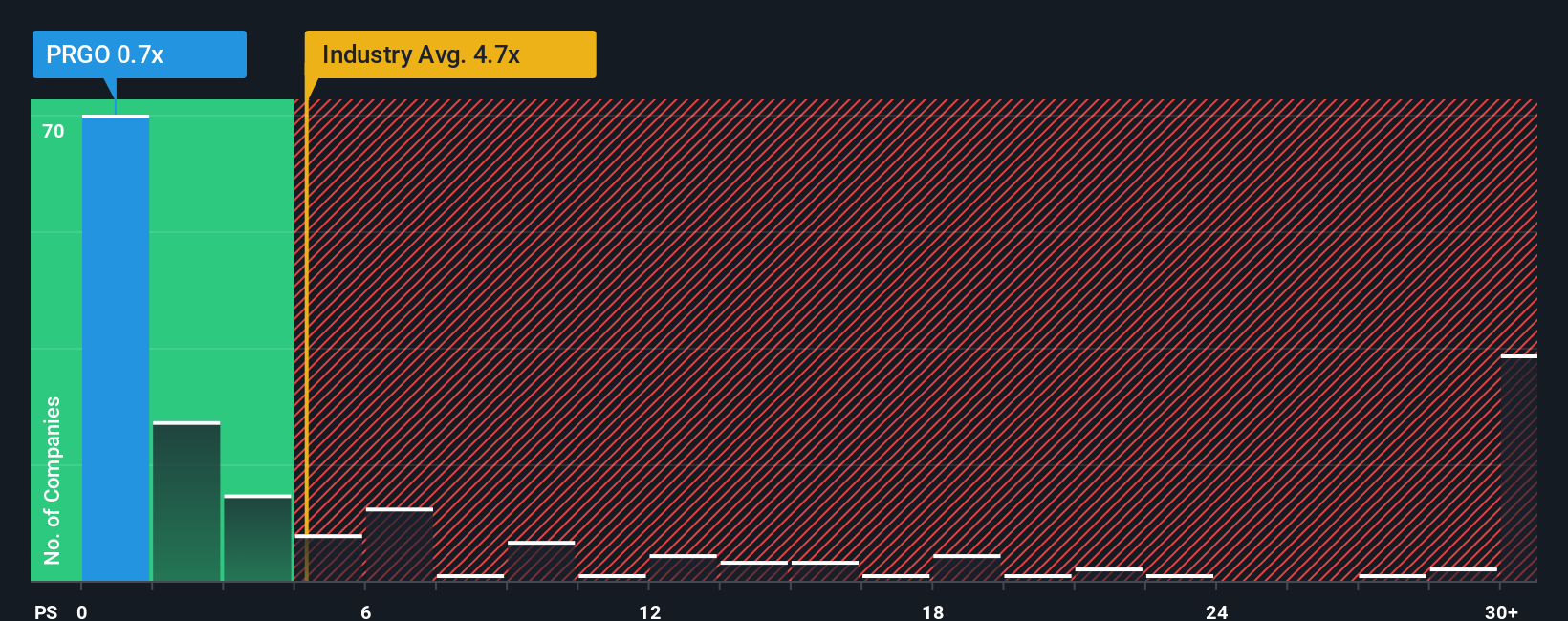

For companies in industries like pharmaceuticals, the Price-to-Sales (P/S) ratio is a useful way to gauge valuation, especially when profits are volatile or impacted by accounting adjustments. The P/S ratio highlights how much investors are willing to pay for each dollar of a company's revenue. This makes it particularly suitable for assessing Perrigo’s value and comparing it against peers during periods when earnings might not tell the whole story.

Normally, higher growth prospects and lower perceived risk justify a richer P/S multiple. In contrast, slower growth or greater uncertainty usually bring it down. In other words, the “right” P/S ratio depends on both a company’s future outlook and how safe or risky investors think its business is relative to others in the sector.

Perrigo’s current P/S multiple stands at just 0.66x, far lower than both the Pharmaceuticals industry average of 4.28x and the peer average of 6.81x. However, instead of simply comparing to these benchmarks, Simply Wall St’s proprietary “Fair Ratio” considers Perrigo’s growth rate, profit margins, risk factors, size, and industry nuances to compute a fair value multiple just for this company. Unlike generic comparisons, this tailored metric offers a deeper and more accurate perspective on what Perrigo’s valuation should be.

For Perrigo, the Fair Ratio is 2.19x, significantly above the company’s current P/S of 0.66x. This substantial discount suggests that the stock is undervalued at current prices based on its underlying fundamentals and outlook.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Perrigo Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. This feature lets you combine your perspective on Perrigo’s business with your own forecasts for future revenue, earnings, and margins, effectively creating your own story behind the numbers.

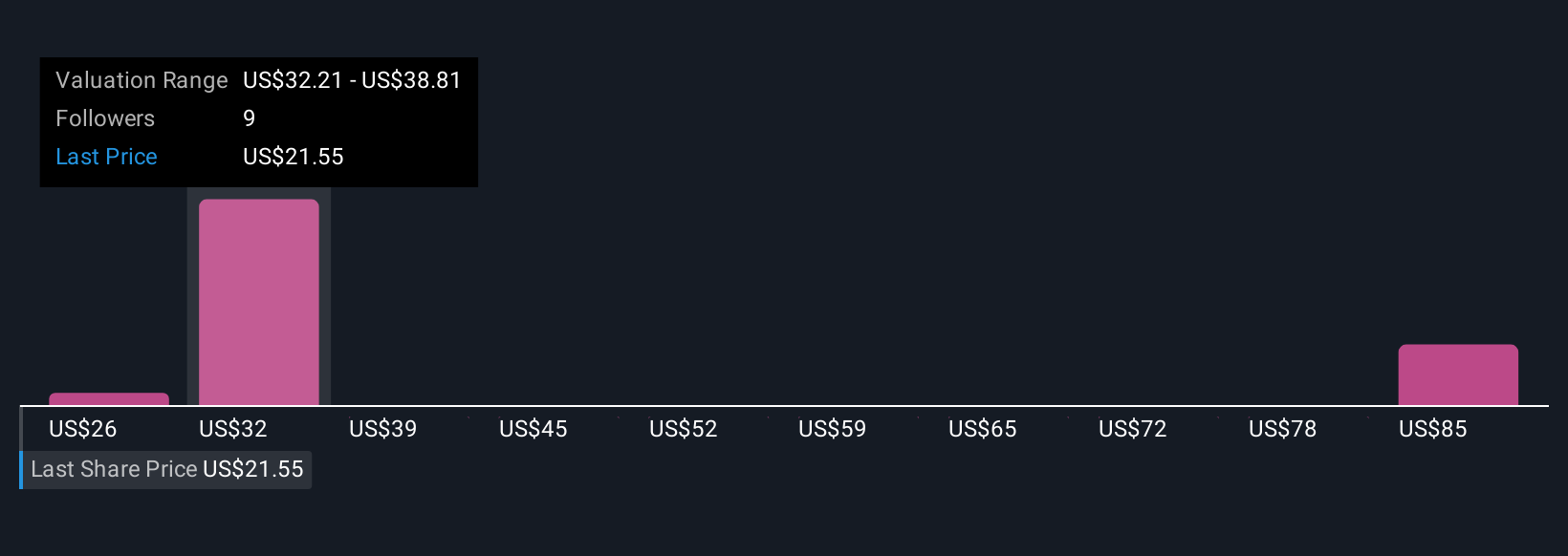

A Narrative is simply the reasoned story you believe about Perrigo's future, linked transparently to the financial assumptions you make and the resulting fair value for its shares. With Narratives, you can move beyond traditional ratios or fixed analyst targets and bring your personal expectations and insights into the investment decision process in an accessible, structured way.

On Simply Wall St’s Community page, millions of investors create and share Narratives to anchor their investment theses, compare their predictions with others, and decide whether now looks like a buy, hold, or sell opportunity by seeing how their own fair value stacks up against the current market price. As news or company results emerge, Narratives update in real-time so you’re always working with the latest outlooks and data.

For example, one investor might craft a bullish Narrative for Perrigo, focusing on strong store-brand growth and productivity gains, arriving at a $40 fair value. Another, more cautious view considers competition and margin risks and concludes $27 is justified. Narratives help you choose the story, confidence, and valuation that fit your beliefs and act decisively.

Do you think there's more to the story for Perrigo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRGO

Perrigo

Provides over-the-counter health and wellness solutions in the United States, Europe, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives