- United States

- /

- Pharma

- /

- NYSE:PFE

Is There Now an Opportunity in Pfizer After Mixed Pipeline Expansion News?

Reviewed by Bailey Pemberton

If you were holding Pfizer stock a year ago, you probably felt the sting of watching the share price drift lower. But does that mean it’s time to give up, or could we be looking at an opportunity in disguise? Over the past year, Pfizer’s share price is down about 7.9%, with a bumpy three-year journey leaving the stock off nearly 40%. Still, in the last month, the stock nudged up 3.1%, hinting that market sentiment could be shifting as headlines start to cloud and clarify the company’s future simultaneously.

Recent news around Pfizer paints a mixed but intriguing picture. The company has taken bold steps to expand its drug pipeline, moving deeper into areas like oncology and partnering with biotech innovators. Meanwhile, investors have watched management shed non-core assets and invest in a next wave of treatments poised to replace pandemic-era revenues, adding fresh context to the valuation conversation. All this happens as the broader market is weighing both the risks and the renewed growth potential inherent in Pfizer’s next chapter.

When we step back and look at the numbers, Pfizer actually scores a 5 out of 6 on the commonly used undervaluation checks. This is a strong signal that value seekers should be paying attention. Of course, no single metric tells the whole story, and if you’re wondering which valuation approach really cuts through the noise, you’re not alone. Let’s break down each method and consider whether there’s an even more insightful way to judge the company’s worth.

Why Pfizer is lagging behind its peers

Approach 1: Pfizer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a staple valuation tool for investors, as it projects a company’s future cash flows and discounts them back to today’s value. This provides a data-driven estimate of what the business could be worth. By using corporate earnings and analyst estimates, the model helps to distill the potential value shareholders might unlock over time.

For Pfizer, the current Free Cash Flow stands at $12.0 Billion. Looking ahead, analysts project the company’s Free Cash Flow could reach around $16.7 Billion by 2029, with annual projections from several analyst sources supporting these upward trends. Further projections, extending out ten years, indicate steady growth is expected, though estimates are extrapolated beyond the five-year horizon. All free cash flow figures are considered in dollars, matching reporting conventions.

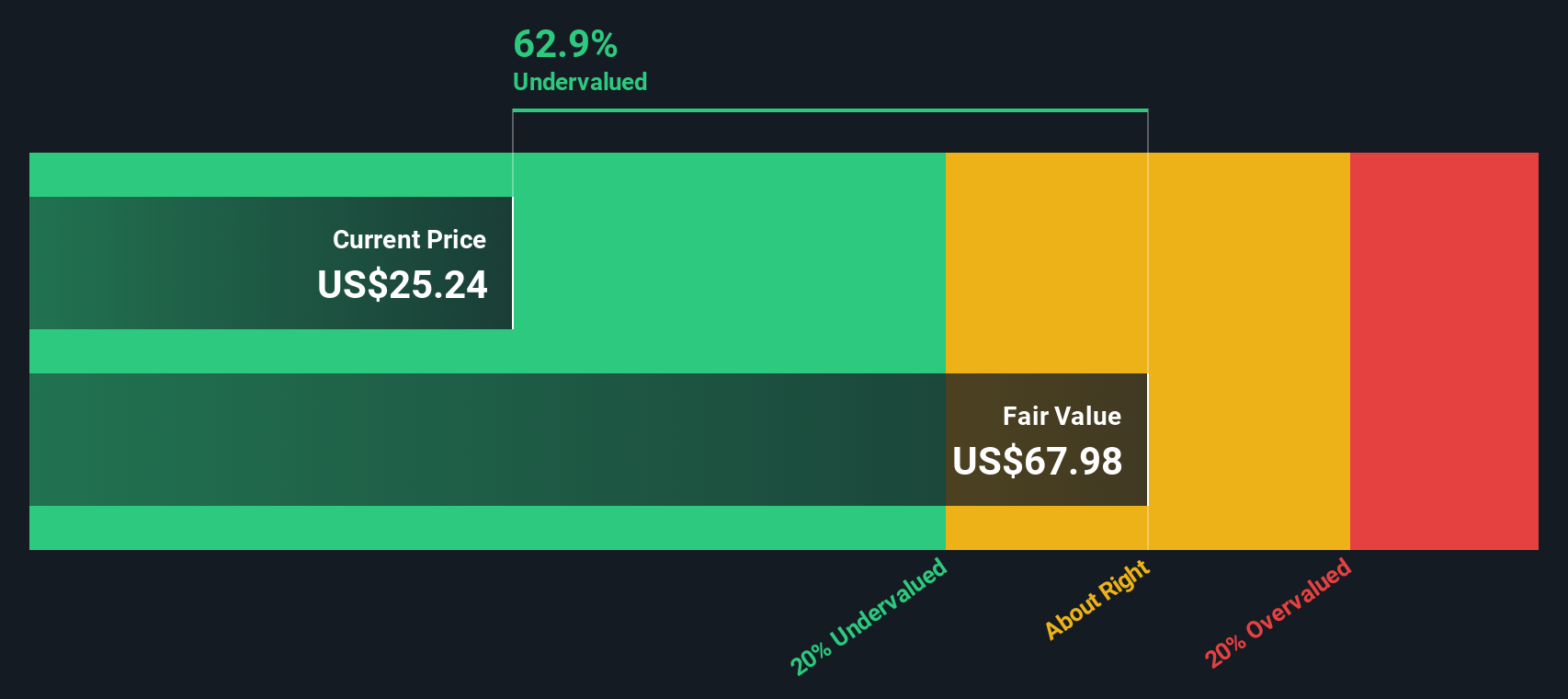

Based on this cash flow outlook, the DCF analysis suggests Pfizer’s intrinsic value is $67.65 per share. This represents a 63.8% discount compared to its current price, indicating the market may be underestimating Pfizer’s ability to generate long-term value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pfizer is undervalued by 63.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Pfizer Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like Pfizer because it directly relates a company's share price to its earnings per share. Investors often use the PE ratio to get a sense of how much they are paying for a dollar of the company's earnings. This makes the metric especially relevant for established businesses generating consistent profits.

A "normal" or "fair" PE ratio is not set in stone, as it depends on expectations for the company’s growth and the risks it faces. A higher growth outlook or lower risk profile can justify a higher PE ratio. On the other hand, slower growth or higher risks tend to bring that multiple down.

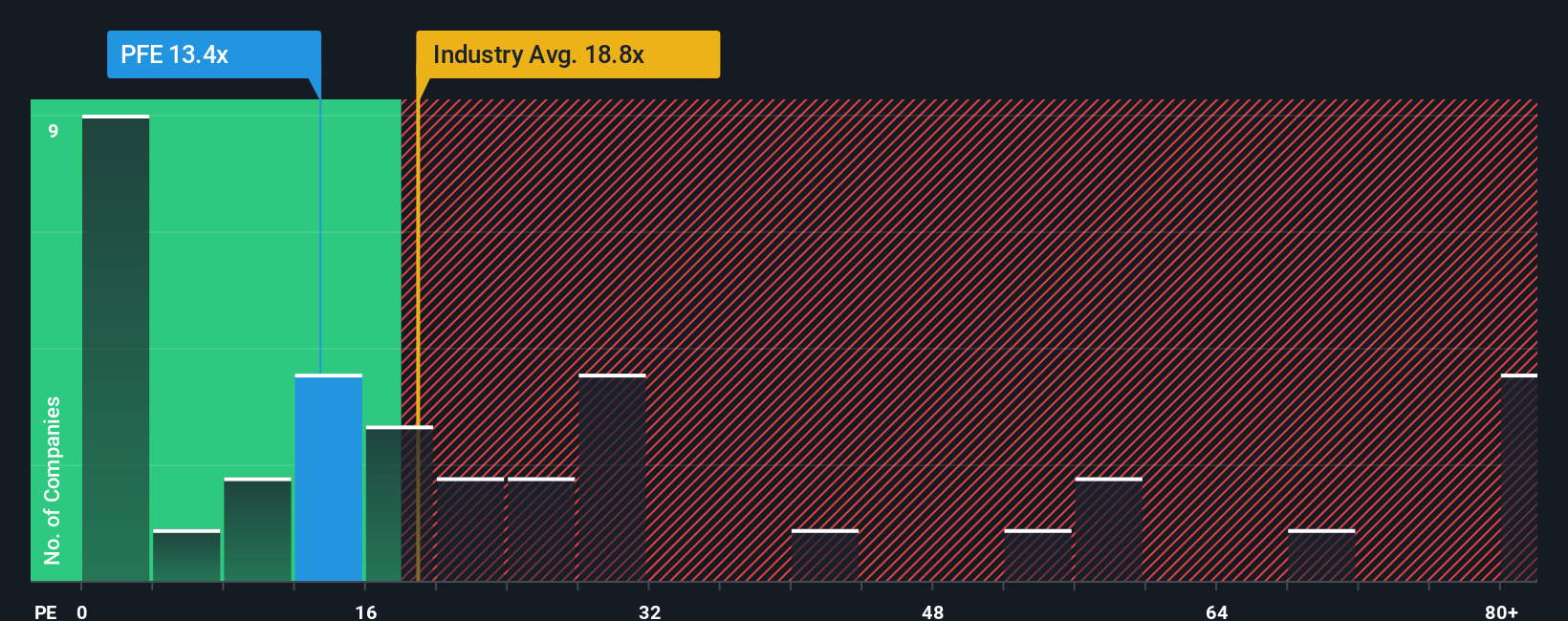

Pfizer currently trades at a PE ratio of 13.0x. For perspective, the pharmaceuticals industry average is around 17.3x and the average for Pfizer’s peers is 18.3x. This means Pfizer's stock is notably cheaper than both benchmarks.

Taking the analysis a step further, Simply Wall St’s proprietary “Fair Ratio” for Pfizer calculates what the PE ratio should be by factoring in the company’s earnings growth, industry, profit margins, market cap, and risks. Unlike simple peer or sector comparisons, the Fair Ratio provides a more personalized target based on Pfizer’s own unique fundamentals. For Pfizer, this Fair Ratio is 22.3x, which is well above its current multiple.

Because Pfizer’s actual PE is significantly below both the Fair Ratio and broader industry averages, this suggests the stock may be undervalued based on its earnings potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pfizer Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you build your own view of a company's future, connecting your story about Pfizer, such as beliefs about drug launches, profit margins, and industry trends, to concrete financial forecasts and a personal estimate of fair value.

With Narratives on Simply Wall St’s Community page, you can easily capture your unique perspective on Pfizer’s next steps, set your own expectations for revenue and earnings, and instantly see what you believe the stock is worth. It is a dynamic, accessible approach used by millions of investors, helping you decide whether to buy or sell by comparing your Fair Value to the current Price. As company news, earnings, or analyst updates roll in, Narratives update automatically, keeping your investment thesis current and relevant.

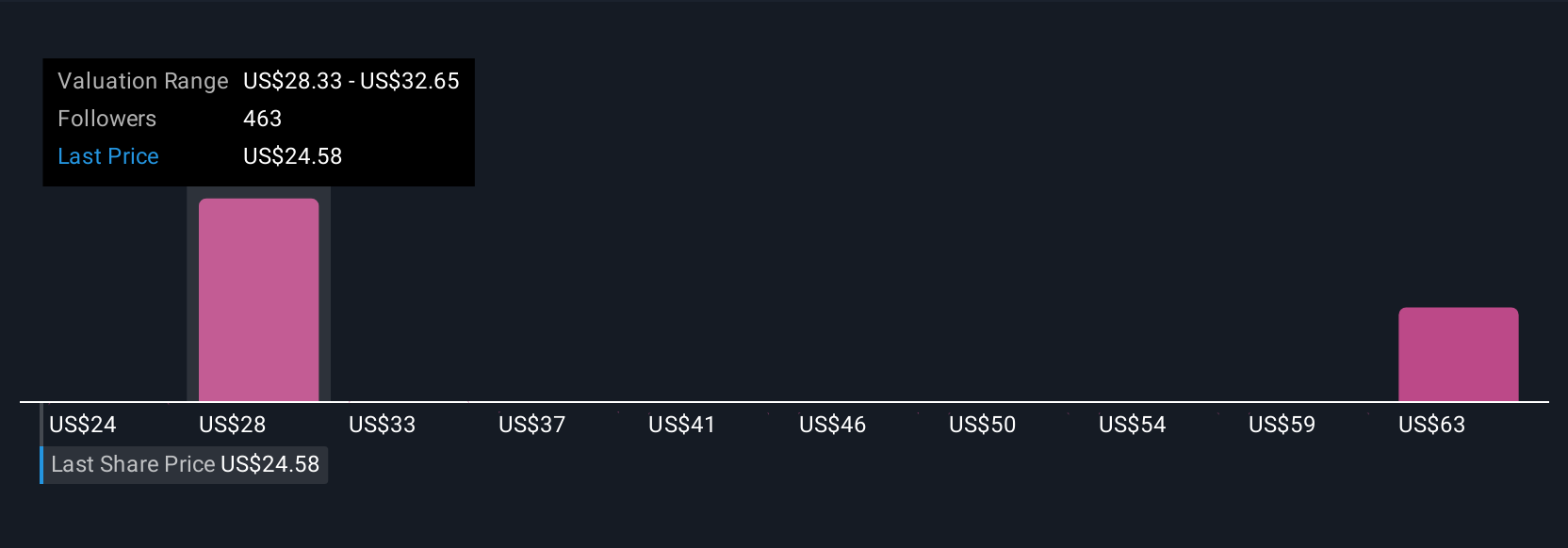

For example, right now, the highest Pfizer Narrative values the company at $36 per share by betting on oncology growth and global expansion, while the lowest is more cautious at $24, reflecting price pressures and slower drug sales. Every investor can see how their outlook compares at a glance.

For Pfizer, we will make it really easy for you with previews of two leading Pfizer Narratives:

Fair Value: $28.86

Undervalued by 15.1%

Revenue Growth Rate: -2.25%

- Expansion in innovative therapies, especially oncology and rare diseases, along with growth in emerging markets and digital initiatives, could drive long-term revenue and resilience.

- Rising profit margins are expected as digitalization and operational efficiency lead to cost improvements, even as near-term revenues dip.

- Main risks include regulatory pressures, rising competition, and patent expirations potentially undermining profit and market share.

Fair Value: $24.00

Overvalued by 2.1%

Revenue Growth Rate: -4.21%

- Regulatory reforms, patent expirations, and global pricing pressures could drag on revenue and squeeze margins, limiting upside.

- There are risks that new pipeline products may not offset legacy drug losses, with innovation and acquisitions possibly falling short of replacing declining blockbusters.

- Strong demographic and market trends toward generics and biosimilars threaten Pfizer’s pricing power and long-term earnings, despite cost-saving efforts.

Do you think there's more to the story for Pfizer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives