- United States

- /

- Pharma

- /

- NYSE:OGN

Has the 54% YTD Slide Created Opportunity for Organon?

Reviewed by Bailey Pemberton

- Curious whether Organon stock is an attractive opportunity or a value trap? Let’s take a look beneath the surface to help you decide if this is a hidden gem or something best left alone.

- After a sharp drop of 33.8% over the past month and a year-to-date slide of 54.7%, it is clear that investor sentiment and market risk perceptions for Organon have shifted dramatically.

- News of ongoing legal actions around women’s health products, as well as recent reports on the company's efforts to manage its substantial debt load, have dominated headlines, adding extra uncertainty for shareholders. These updates help explain the price swings and highlight the factors currently shaping market reactions.

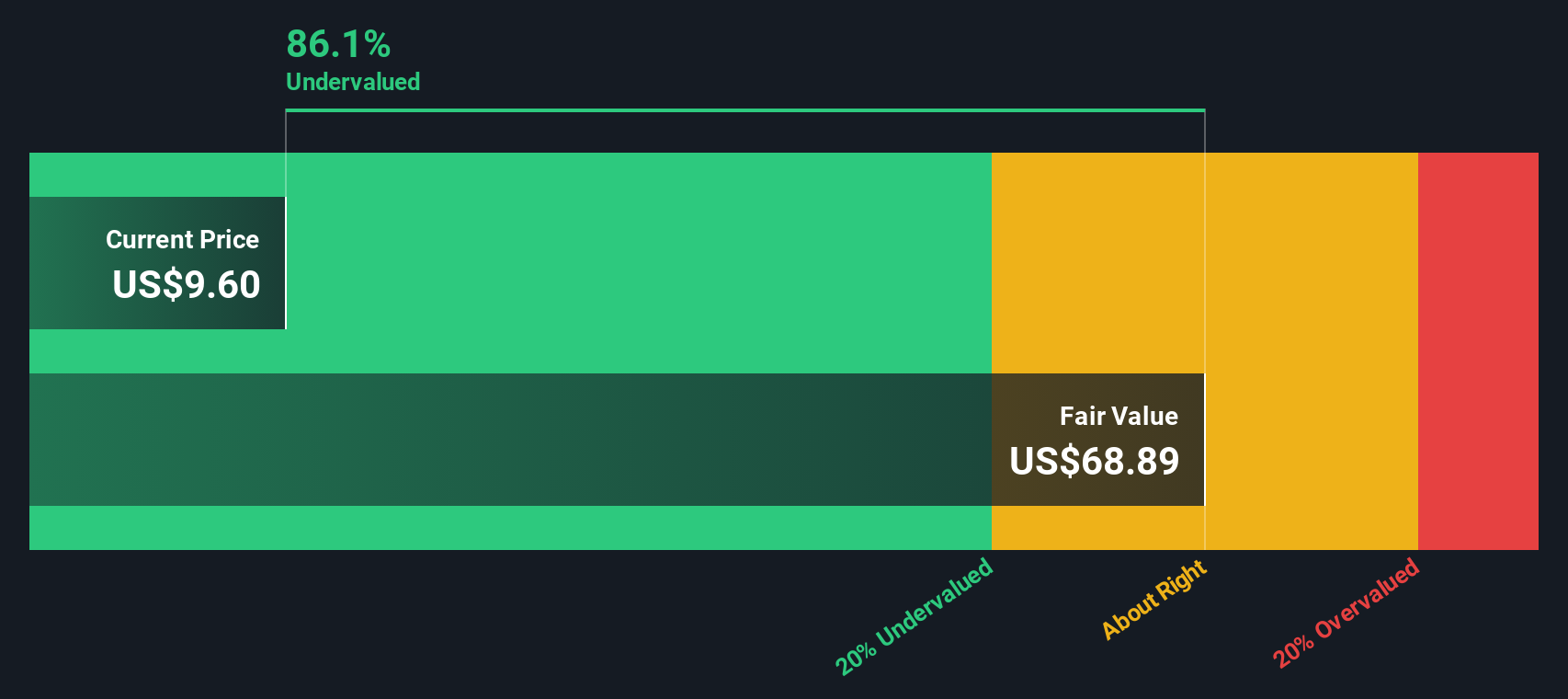

- Despite those challenges, Organon scores a 5 out of 6 on our undervaluation checks, suggesting that there may be significant value hiding in plain sight. First, we’ll break down how this score is calculated and compare different valuation measures. Stick around, as there is a more nuanced approach to assessing fair value that we will reveal by the end of this article.

Find out why Organon's -56.0% return over the last year is lagging behind its peers.

Approach 1: Organon Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to their present value. For Organon, this approach starts with the company's latest trailing twelve months Free Cash Flow of $482.5 Million and then extrapolates growth based on both analyst estimates and longer-term forecasts.

Analysts project that Organon's Free Cash Flow will rise significantly and reach $1.27 Billion by 2029. Simply Wall St then extrapolates future values beyond analyst coverage and suggests a continued growth trend. All calculations are in US dollars and reflect Organon's reporting and listing currencies.

The model calculates an intrinsic fair value of $60.67 per share, which implies the stock is trading at an 88.8% discount to its estimated worth. This suggests investors may be underestimating Organon's long-term potential based on its projected cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Organon is undervalued by 88.8%. Track this in your watchlist or portfolio, or discover 869 more undervalued stocks based on cash flows.

Approach 2: Organon Price vs Earnings

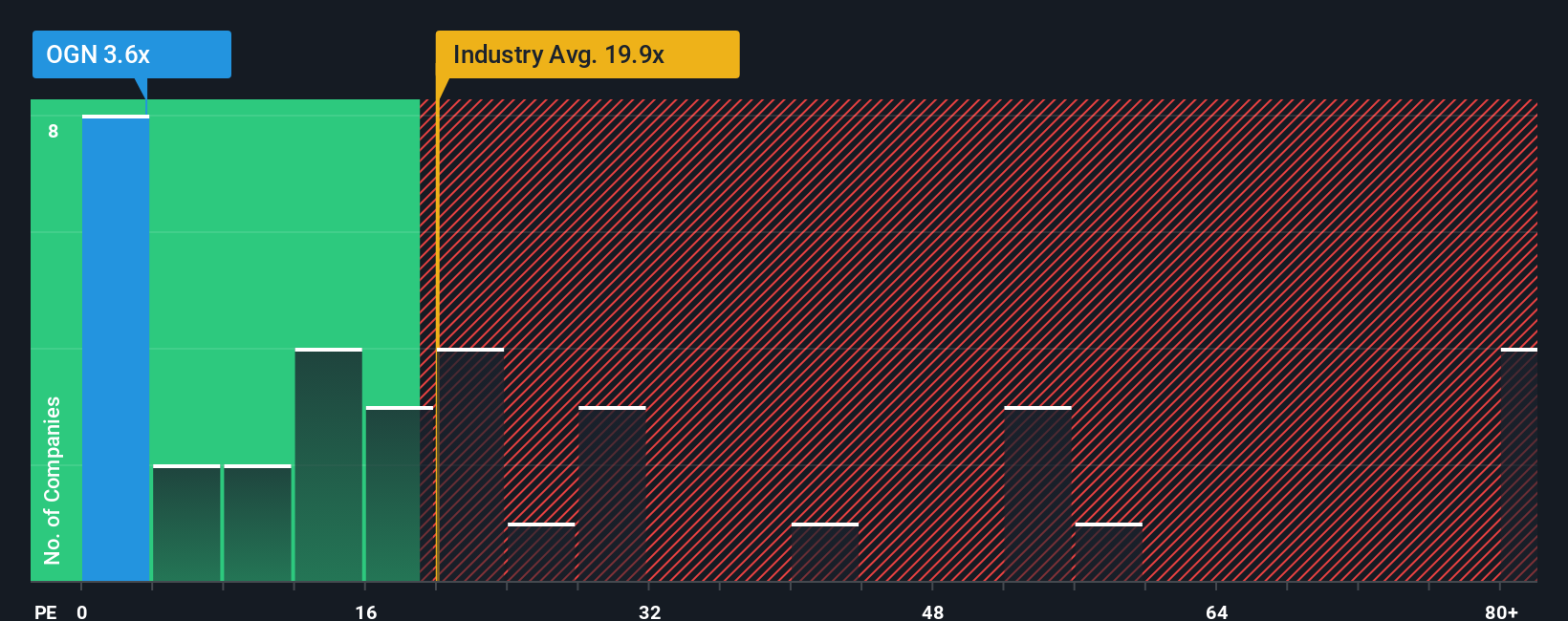

For profitable companies like Organon, the Price-to-Earnings (PE) ratio is a classic and insightful way to gauge valuation. The PE ratio reflects what investors are willing to pay today for a dollar of current earnings. Growth prospects play a large role in setting a fair PE, since companies expected to grow faster typically deserve a higher multiple, while those facing greater risks or slowdowns may see a reduced ratio.

Right now, Organon is trading at just 2.5x earnings. For context, the Pharmaceuticals industry average stands at 17.9x, and the average for Organon's listed peers is 14.9x. Such a steep discount often grabs attention, but not all low PE ratios signal a bargain. Risk factors and unique company specifics definitely matter.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. Rather than just benchmarking against peers or the broader industry, the Fair Ratio integrates Organon’s earnings growth outlook, profit margins, market capitalization, and risk profile. This provides a tailored multiple that better matches the company’s reality. Currently, Organon's Fair Ratio is 20.8x, significantly higher than its actual multiple.

With Organon’s PE of 2.5x well below both the Fair Ratio of 20.8x and industry benchmarks, the analysis points to the stock being meaningfully undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Organon Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a powerful, yet approachable way to connect your personal view of a company’s future with the financial numbers. Simply put, it lets you link a story (your perspective on Organon's growth, risks, and turning points) to specific forecasts for revenue, earnings, and profit margins, arriving at your own fair value.

With Simply Wall St’s Narratives, available right within the Community page and used by millions, you don’t need to be a financial expert. Any investor can express their outlook, quickly turning a story about business momentum or risks into a set of numbers that automatically updates as new information (like earnings, executive changes, or regulatory news) emerges.

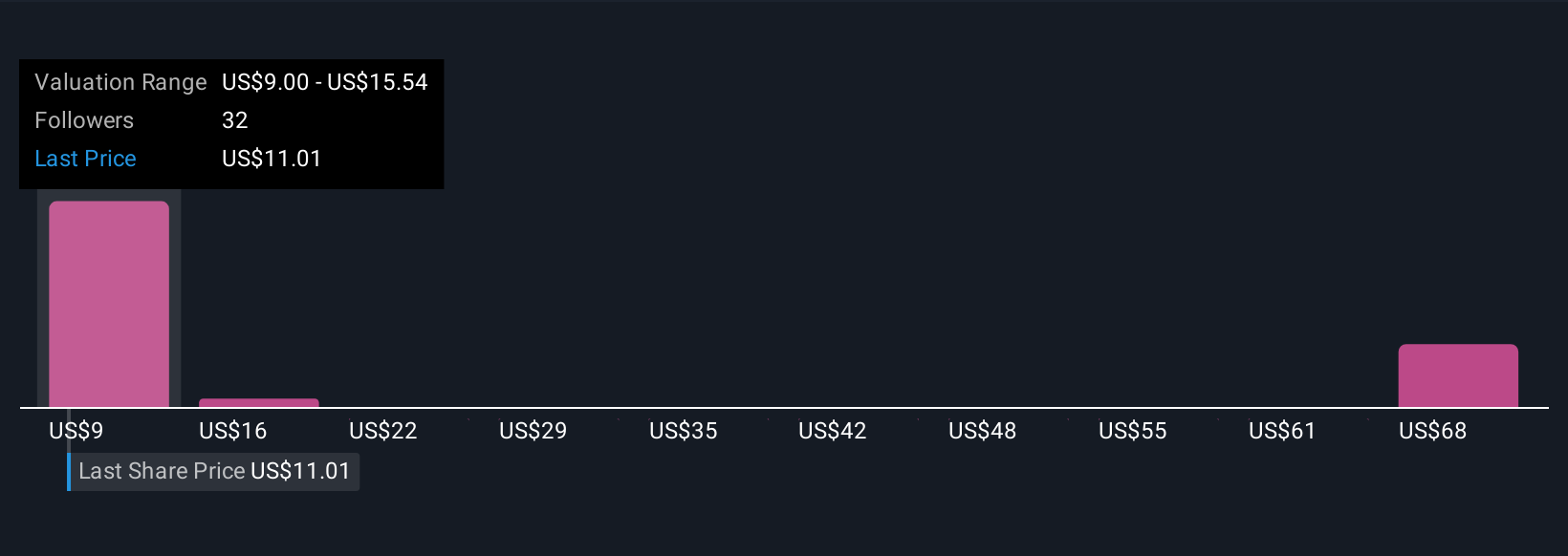

By comparing your Narrative’s fair value with the current market price, you have a clear, personalized guide to help decide when to buy, hold, or sell. For example, some investors currently see Organon’s fair value as low as $9 per share, citing ongoing executive changes and governance challenges, while others see it as high as $18, confident that a pipeline of biosimilars and margin expansion will drive a rebound. Narratives let you transparently match these convictions with actual numbers, so you can make decisions adapted to your perspective and adjust quickly as the facts change.

Do you think there's more to the story for Organon? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGN

Organon

Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives