- United States

- /

- Pharma

- /

- NYSE:NVO

Does Novo Nordisk’s 44% Stock Slide Signal a New Opportunity in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Novo Nordisk is still a bargain or if the market has already priced in its strengths? Here is a breakdown of what has been happening and what the numbers really say.

- After some impressive long-term gains, Novo Nordisk’s stock jumped more than 50% over the past five years but has pulled back sharply, falling 18.8% in the past month and down over 44% year-to-date.

- The latest headlines have shifted focus to Novo Nordisk’s expanding diabetes and obesity pipeline. Global partnerships and regulatory milestones are making waves, sparking both optimism and uncertainty among investors. Analysts are split on whether recent product developments can offset competitive and pricing pressures in the sector.

- Novo Nordisk scores a 5 out of 6 on our valuation checks, which is a strong showing but may not tell the entire story. We will examine the details using established methods and, by the end, introduce a more holistic way to assess value that goes beyond just the basics.

Find out why Novo Nordisk's -53.1% return over the last year is lagging behind its peers.

Approach 1: Novo Nordisk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates a company’s true worth by projecting its future cash flows and discounting them to their present value. This method gives investors a way to cut through market noise and focus on the actual cash generated by the business.

Novo Nordisk’s latest reported Free Cash Flow stands at 68.36 billion DKK. Looking ahead, analysts anticipate that annual Free Cash Flows could grow significantly, reaching an estimated 135.28 billion DKK in 2029. Long-term projections show continued increases even past 2030. Notably, analyst forecasts inform the first five years, while future estimates beyond that are extrapolated for a fuller picture.

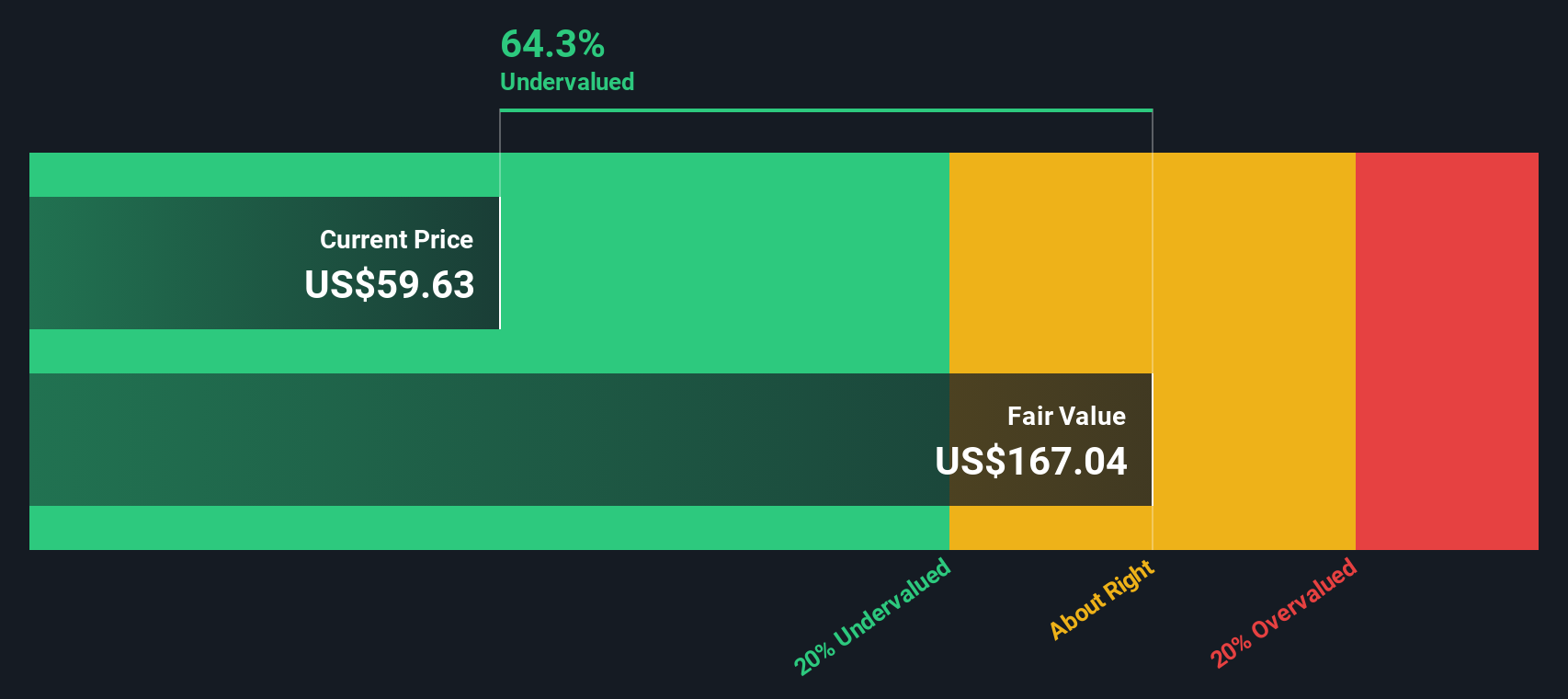

After applying the DCF valuation, the estimated fair value per share for Novo Nordisk is $169.45 (value calculated in DKK, but presented in equity listing currency). This implies the stock is trading at a 71.4% discount to its intrinsic value based on these inputs, making it appear substantially undervalued relative to where the market currently prices it.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novo Nordisk is undervalued by 71.4%. Track this in your watchlist or portfolio, or discover 838 more undervalued stocks based on cash flows.

Approach 2: Novo Nordisk Price vs Earnings

The price-to-earnings (PE) ratio is widely recognized as a reliable valuation tool, especially for profitable companies like Novo Nordisk. It shows how much investors are willing to pay per dollar of earnings, offering a straightforward way to compare market expectations for a business’s future profitability.

Growth expectations and risk play a big role in determining what a “normal” or “fair” PE ratio should be. Companies with higher expected growth and stable earnings typically trade at higher multiples, while more risk-sensitive or lower-growth companies warrant a discount.

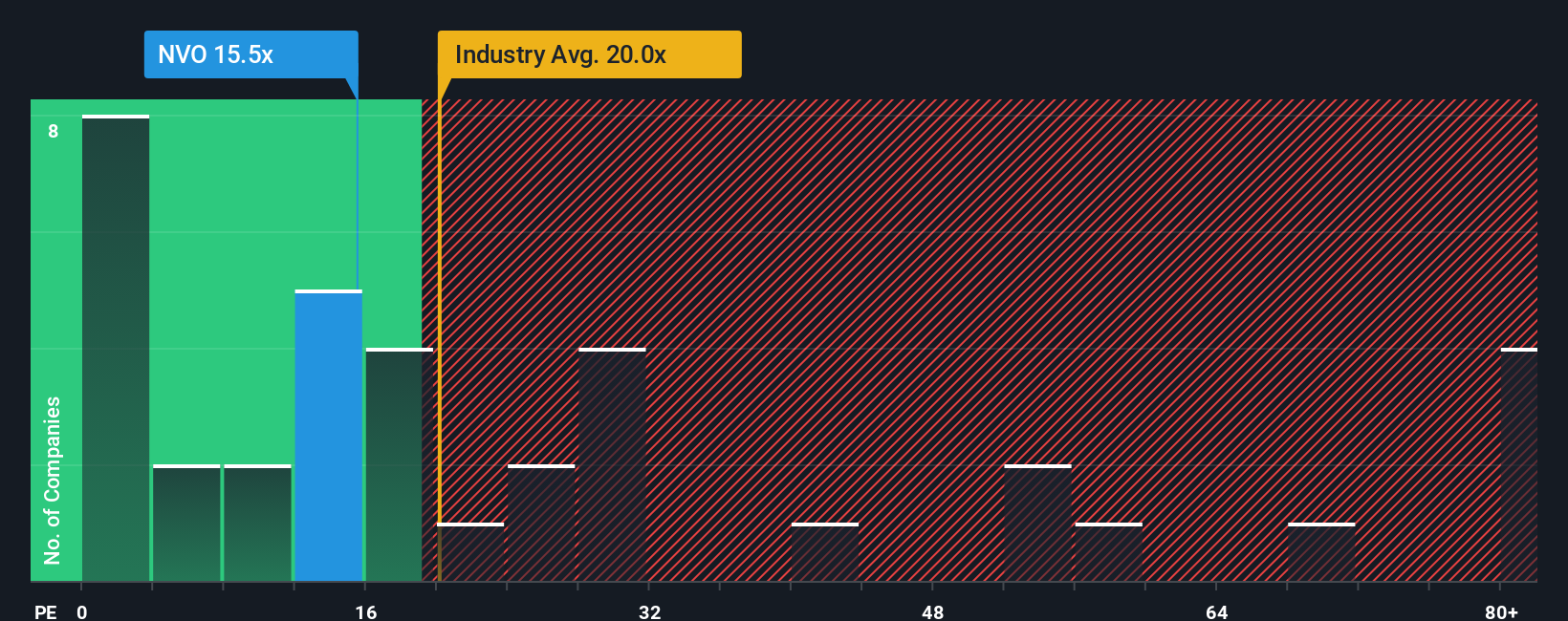

Currently, Novo Nordisk trades at a PE ratio of 12.04x. This is well below the industry average of 17.84x and also significantly lower than the average of its direct peers, which sits at 22.40x. At first glance, this suggests the market is undervaluing Novo Nordisk compared to other pharmaceutical companies.

Simply Wall St’s proprietary “Fair Ratio” provides a more nuanced assessment by considering not only Novo Nordisk’s growth outlook and profitability, but also risks, margins, its position in the industry, and market capitalization. This approach improves on basic benchmarks because it tailors the fair multiple to the company’s unique profile rather than relying on broad-brush industry averages.

Novo Nordisk’s Fair Ratio is calculated at 33.46x, which is substantially higher than its current PE ratio and all other benchmarks. This sizeable gap indicates the company’s shares are undervalued on an earnings multiple basis, given its growth, risk, and profitability characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novo Nordisk Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a powerful yet approachable tool that brings your unique perspective to stock analysis. A Narrative is your story behind the numbers; it lets you specify what you believe about a company’s future growth, margins, and fair value, effectively bridging the gap between financial data and your own interpretation of a company’s outlook.

With Narratives, you can link your view of Novo Nordisk’s business trends to actual forecasts and then directly see how these assumptions lead to a fair value estimate. Narratives are easy to use and available on the Simply Wall St Community page, already utilized by millions of investors, so you can create your own scenarios or explore those of others.

This feature helps you decide exactly when to buy or sell, as you can instantly compare your Narrative’s fair value to the current stock price. Importantly, Narratives update dynamically whenever fresh news or earnings are released, meaning your analysis stays relevant and timely.

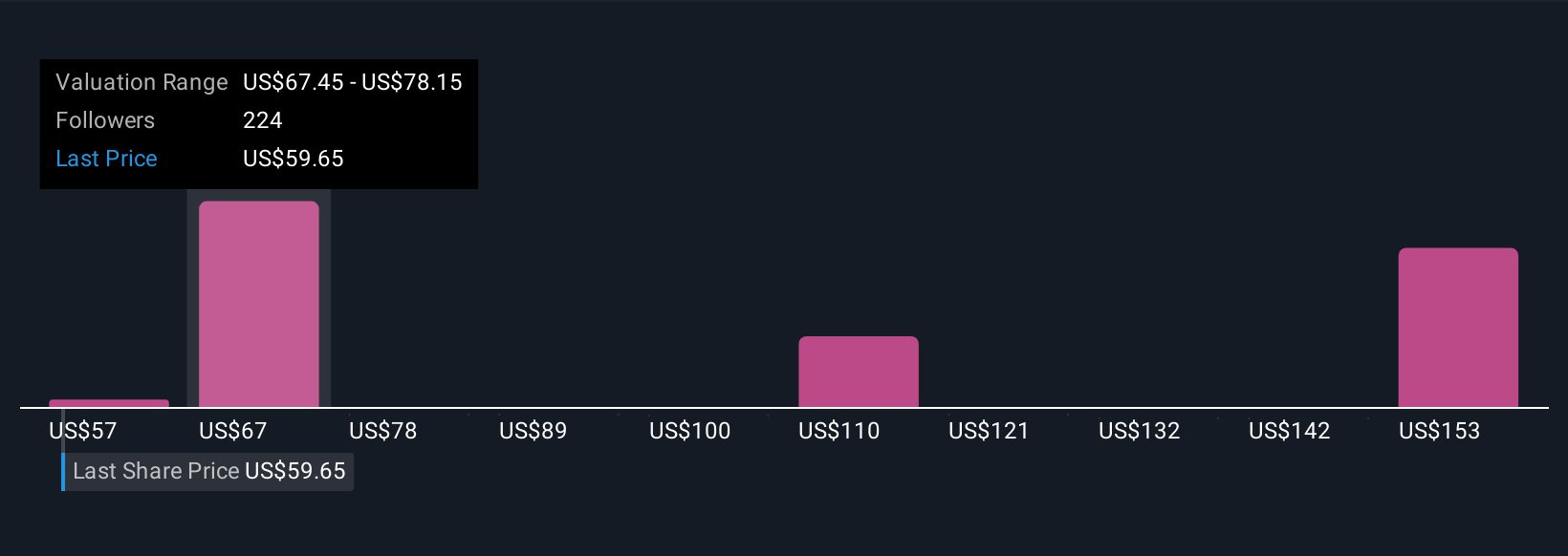

For Novo Nordisk, some investors set the fair value above $145, assuming pipeline successes, while others see it near $70 if risks materialize. This demonstrates how powerful and personal Narratives can be in guiding your investment decisions.

Do you think there's more to the story for Novo Nordisk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVO

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives