- United States

- /

- Pharma

- /

- NYSE:NUVB

Nuvation Bio (NUVB) Losses Widen 45%—Profit Hopes Challenged Despite Strong Revenue Growth Forecast

Reviewed by Simply Wall St

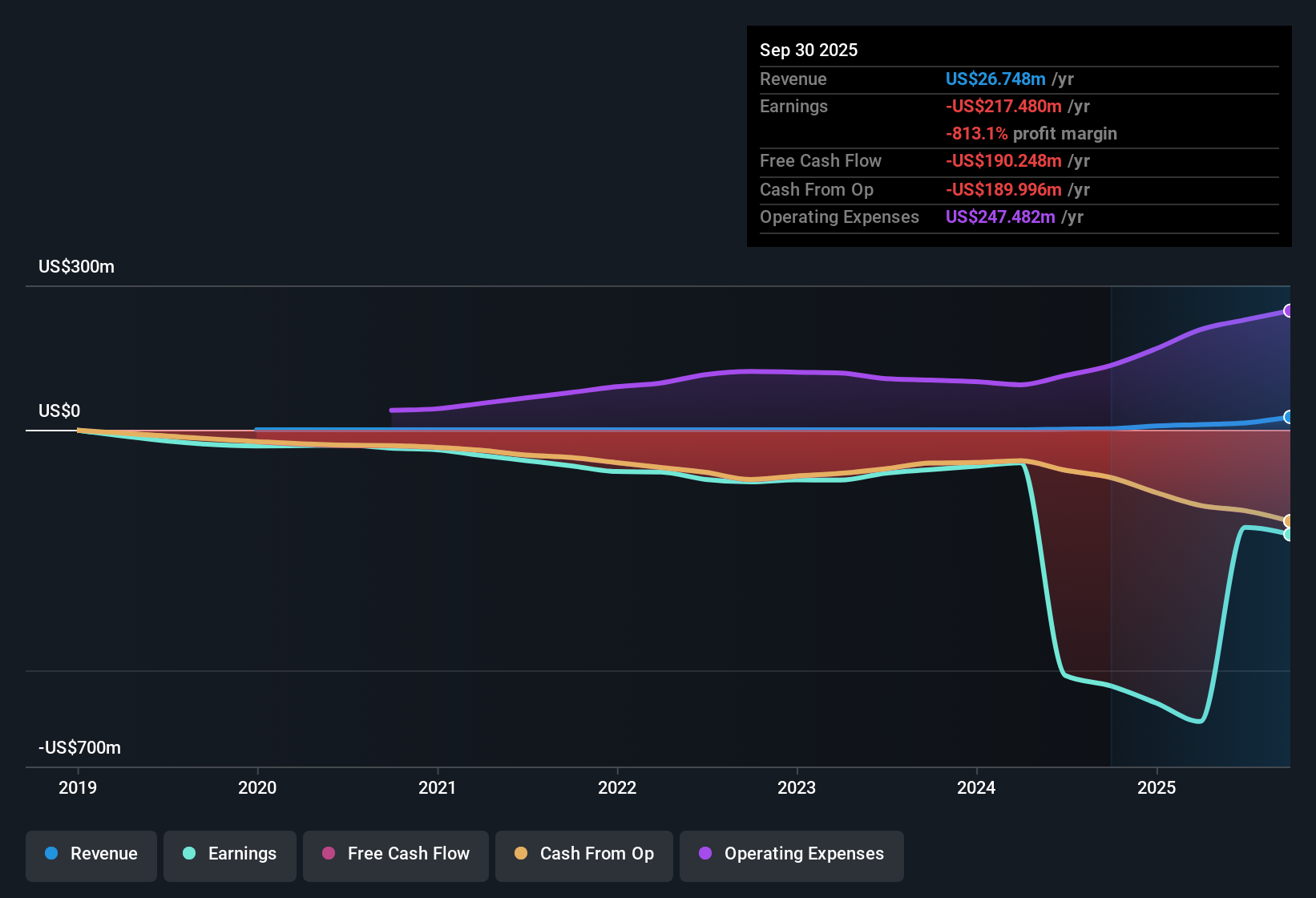

Nuvation Bio (NUVB) posted another year of widening losses, with its net income declining at an average annual rate of 45.2% over the past five years. Still, analysts expect revenue to surge by 51.23% per year, outpacing the broader US market’s average growth of 10.5%. Despite the robust outlook, shares currently trade at $4.83, well below the company’s estimated fair value of $19.43 based on a discounted cash flow model. Profitability remains elusive and margins show no signs of meaningful improvement.

See our full analysis for Nuvation Bio.Now, let’s see how these headline numbers measure up to the widely discussed narratives about Nuvation Bio. Where do the facts match expectations, and where do they shake things up?

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Book Sits Above Industry Average

- Nuvation Bio’s price-to-book ratio is 5.1x, which is more than double the US pharmaceuticals industry average of 2.4x and sits below direct peer valuations with an average of 11.6x.

- Recent analysis indicates that while a higher price-to-book multiple supports market optimism about Nuvation Bio’s growth prospects, it also raises questions about whether the premium is justified given ongoing unprofitability.

- Despite robust revenue forecasts, critics would point to years of net losses and unchanged margins as signals that a premium valuation has yet to be earned by improving earnings.

- What is notable is that compared to peers, the company looks attractively valued on this metric, but relative to the broader industry, it already commands a significant premium that could limit further upside until sustained profitability is achieved.

Share Price Volatility Persists

- The share price, now at $4.83, has not shown stability over the past three months, reflecting ongoing market caution around the stock.

- Prevailing perspectives note that share price swings are typical for biotech firms with anticipated breakthroughs. In Nuvation Bio’s case, volatility stands out because even with a strong revenue trajectory, investors remain unconvinced by profit momentum.

- Bulls highlight the sector’s history of rapid rebounds following clinical or business catalysts, but with Nuvation Bio still far from profitability, the unstable share price underscores persistent doubts about execution.

- Conversely, some see the price as already factoring in both risk and reward, leaving limited margin for error given the lack of recent margin improvement or profit milestones.

DCF Suggests Significant Upside to Fair Value

- The current share price of $4.83 trades well below Nuvation Bio’s DCF fair value of $19.43, implying a steep discount relative to its long-term potential based on discounted cash flow analysis.

- There is a widespread view that the gap to DCF fair value heavily supports an upside case if Nuvation Bio can deliver on its rapid revenue growth targets in the years ahead, even as the path to profitability remains uncertain.

- Persistent losses of 45.2% per year challenge the notion that the stock deserves a sharp rerating, so closing the valuation gap will likely require visible improvements in either margins or future earnings guidance.

- Still, sector watchers note that DCF-based upside may help buffer the stock against broader sector downturns, as growth-oriented investors focus on the long-term prize despite short-term volatility.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nuvation Bio's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Nuvation Bio’s ongoing net losses and lack of margin improvement raise concerns about its ability to deliver consistent earnings and stable performance.

If you’re seeking stocks that have proven they can grow steadily and reliably, check out stable growth stocks screener (2077 results) to shift your focus toward companies with dependable growth and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives