- United States

- /

- Pharma

- /

- NYSE:NUVB

Nuvation Bio (NUVB) Is Up After Strong IBTROZI Launch and Q3 Revenue Beat – Has Sentiment Shifted?

Reviewed by Sasha Jovanovic

- Nuvation Bio Inc. recently reported third-quarter 2025 earnings, highlighting US$13.12 million in revenue and continued market momentum following the commercial launch of IBTROZI for ROS1-positive non-small cell lung cancer.

- Strong early uptake of IBTROZI, supported by broad payer coverage and new patient starts, has become a key driver of confidence in the company’s outlook.

- We’ll explore how IBTROZI’s successful launch and rapid sales growth are reshaping Nuvation Bio’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Nuvation Bio's Investment Narrative?

Owning shares in Nuvation Bio means believing in the company’s ability to turn IBTROZI’s FDA approval and commercial launch into sustainable, long-term revenue growth, even as profitability remains distant. The recent third-quarter results, with revenue jumping to US$13.12 million, clearly spotlight IBTROZI’s strong start and its pivotal role as both a near-term catalyst and a signal of traction with payers and patients. These numbers surpassed expectations and appear to bolster analyst sentiment, supporting upward price target revisions and renewed optimism about the company’s lead asset. However, the company continues to report net losses and negative cash flows, and future operating performance will hinge on IBTROZI’s ability to maintain fast uptake, expand globally, and deliver on regulatory milestones. While financial risk remains significant, especially with ongoing R&D investments and reliance on external capital, the earnings beat ties directly into the company’s most important catalyst: real-world commercial execution of its flagship therapy.

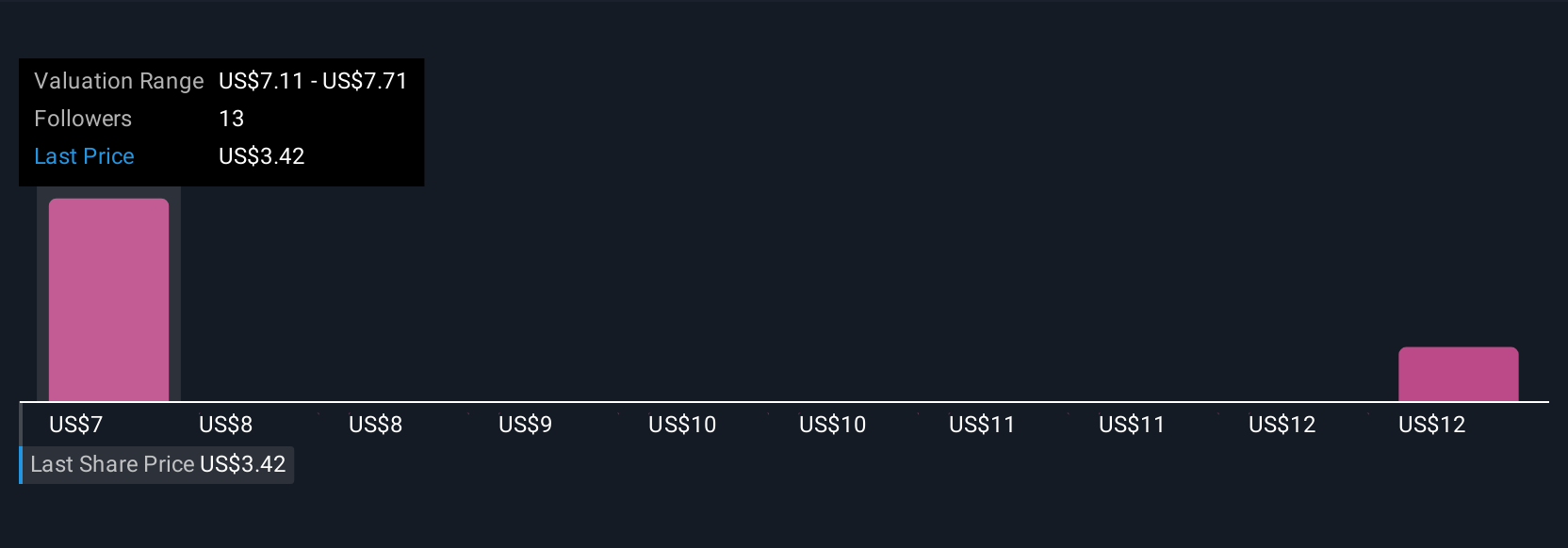

But investors should keep a close eye on Nuvation Bio’s persistent net losses and cash burn. Despite retreating, Nuvation Bio's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 5 other fair value estimates on Nuvation Bio - why the stock might be worth over 3x more than the current price!

Build Your Own Nuvation Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nuvation Bio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nuvation Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nuvation Bio's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives