- United States

- /

- Pharma

- /

- NYSE:NUVB

Nuvation Bio (NUVB): Assessing Valuation After Key Phase 3 TRUST-IV Trial Milestone

Reviewed by Kshitija Bhandaru

Nuvation Bio has just kicked off a major milestone by enrolling the first patient in its Phase 3 TRUST-IV trial for taletrectinib as an adjuvant therapy in early-stage ROS1-positive non-small cell lung cancer. With FDA alignment on the study design, this development could reshape the company’s late-stage clinical outlook.

See our latest analysis for Nuvation Bio.

The past year has seen Nuvation Bio’s 1-year total shareholder return climb to 60%, a sign that optimism around its late-stage clinical advances is rippling through the stock. After a robust run-up, spurred on by recent clinical milestones, momentum is clearly building, despite the typical volatility in biotech names.

If breakthrough trials in biotech are catching your attention, you’ll want to check out See the full list for free. for other companies shaping the healthcare landscape.

But with shares already rising on clinical headlines and longer-term returns appearing robust, investors now face a familiar question: is Nuvation Bio still undervalued at these levels, or has the market already priced in future success?

Price-to-Book of 3.4x: Is it justified?

At a price-to-book (P/B) ratio of 3.4x, Nuvation Bio appears attractively valued compared to its direct peers, especially given the last close of $3.68 per share.

The price-to-book ratio compares a company's current market price to its net assets, providing a snapshot of how the market values the company's tangible equity. In biotech, where many firms lack steady profits but hold valuable intellectual property and cash, P/B is one way to gauge relative value.

Compared to the peer group average of 10.5x, Nuvation Bio's multiple is substantially lower. This discount positions it as a potentially overlooked candidate in the space, with valuation levels that could shift as milestones are achieved. If the market re-rates the company closer to the sector average price-to-book, there could be significant upside.

Explore the SWS fair ratio for Nuvation Bio

Result: Price-to-Book of 3.4x (UNDERVALUED)

However, setbacks in clinical development or failure to meet revenue growth expectations could quickly reverse the current momentum and affect investor sentiment.

Find out about the key risks to this Nuvation Bio narrative.

Another View: Discounted Cash Flow Tells a Deeper Story

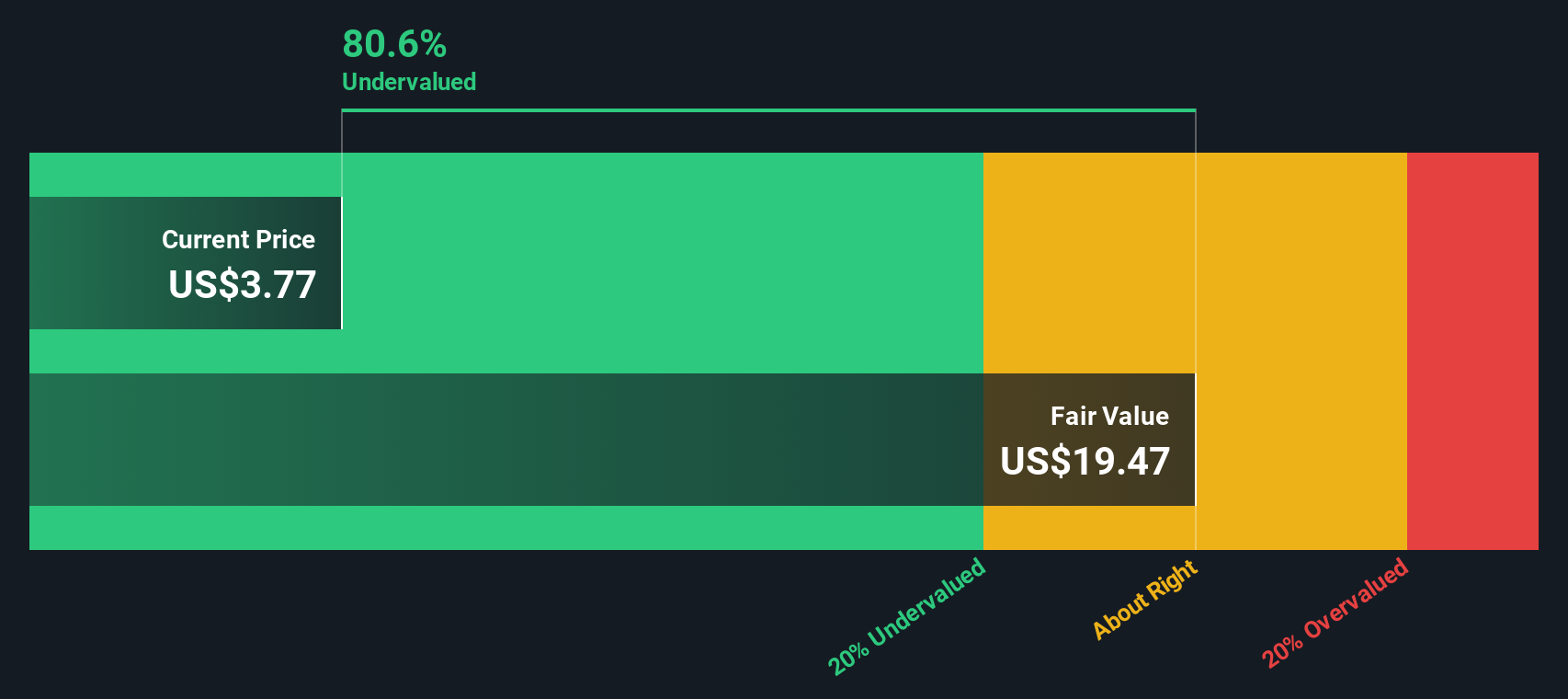

While the price-to-book ratio suggests Nuvation Bio is undervalued compared to peers, our DCF model paints an even more dramatic picture. The shares are trading at over 80% below our estimate of fair value, signaling a substantial margin of safety—or perhaps indicating that the market perceives risks not yet reflected in the numbers. Is this the kind of disconnect that creates opportunity, or is the market seeing something others are not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nuvation Bio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nuvation Bio Narrative

If you have your own perspective or want to dig deeper into the data, you can craft a personal narrative in just minutes. Do it your way.

A great starting point for your Nuvation Bio research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take charge of your investing journey and seize opportunities others might overlook. Our screeners connect you to compelling stocks and innovative sectors ready to grow.

- Supercharge your search for future blue chips by checking out these 3573 penny stocks with strong financials, making waves with impressive financial strength and market potential.

- Tap into the ROI power of stable yields by seeing these 18 dividend stocks with yields > 3%, offering more than 3% returns for consistent income in your portfolio.

- Catalyze your portfolio’s growth by targeting undervalued gems through these 881 undervalued stocks based on cash flows, that show the greatest upside based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives