- United States

- /

- Biotech

- /

- NYSE:MYOV

Earnings Update: Myovant Sciences Ltd. (NYSE:MYOV) Just Reported And Analysts Are Boosting Their Estimates

It's been a sad week for Myovant Sciences Ltd. (NYSE:MYOV), who've watched their investment drop 11% to US$21.38 in the week since the company reported its quarterly result. Revenues fell -36% short of what the analysts had expected, coming in at US$1.4m. Statutory losses were somewhat milder than expected, coming in with a loss of US$0.82 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Check out our latest analysis for Myovant Sciences

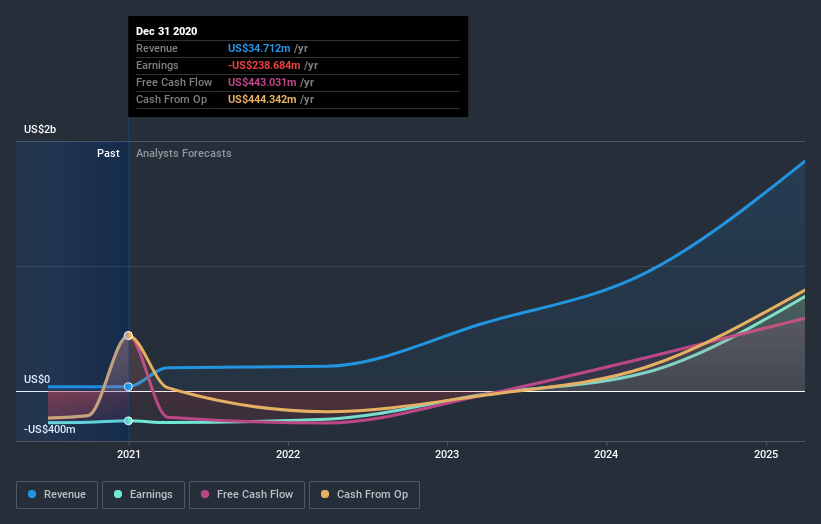

Following the latest results, Myovant Sciences' seven analysts are now forecasting revenues of US$197.5m in 2022. This would be a huge 469% improvement in sales compared to the last 12 months. Losses are expected to be contained, narrowing 16% from last year to US$2.23. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$160.7m and losses of US$2.19 per share in 2022. So there's definitely been a change in sentiment in this update, with the analysts upgrading next year's revenue estimates, while at the same time holding losses per share steady.

There were no major changes to the US$35.86consensus price target despite the higher revenue estimates, with the analysts seeming to believe that ongoing losses have a larger impact on the valuation than growing sales. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Myovant Sciences, with the most bullish analyst valuing it at US$55.00 and the most bearish at US$28.00 per share. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Myovant Sciences. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Myovant Sciences analysts - going out to 2025, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Myovant Sciences (1 is potentially serious!) that you need to be mindful of.

If you decide to trade Myovant Sciences, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:MYOV

Myovant Sciences

Myovant Sciences Ltd., a biopharmaceutical company, develops redefine care for women and for men.

High growth potential and overvalued.

Market Insights

Community Narratives