- United States

- /

- Life Sciences

- /

- NYSE:MTD

Are Margin Pressures at Mettler-Toledo (MTD) Hinting at Deeper Profitability Challenges?

Reviewed by Sasha Jovanovic

- Mettler-Toledo International recently reported solid quarterly results, but ongoing challenges in organic revenue growth and declining adjusted operating margins have raised new questions about its ability to sustain long-term profitability.

- Despite this strong performance, analyst consensus indicates caution given the company’s limited revenue growth projections and continuing margin pressures over the next year.

- To assess the impact of these developments, we'll explore how the decline in operating margin could affect Mettler-Toledo's investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Mettler-Toledo International Investment Narrative Recap

To be a shareholder in Mettler-Toledo International, you typically need to believe in the company’s potential to benefit from growing demand in highly regulated industries like pharmaceuticals and food production, which support stable long-term growth for its measurement and laboratory technologies. The recent strong quarterly results helped drive the share price higher, but continuing sluggish organic revenue growth and narrowing operating margins have cast doubt on whether improved profitability can be sustained; for now, the ongoing margin pressure remains the key risk to the current investment narrative, more so than short-term sales momentum.

Among recent announcements, management reaffirmed its expectation for full-year 2025 sales growth of just 1% to 2%, highlighting the impact of persistent market headwinds and organic growth challenges. This guidance echoes analysts’ concerns that ongoing softness in key geographies, combined with margin deterioration, could limit meaningful upside in the near term even as sector tailwinds remain intact for the longer run.

Yet, in contrast to the enthusiasm sparked by recent results, investors should also keep in mind the ongoing risk from...

Read the full narrative on Mettler-Toledo International (it's free!)

Mettler-Toledo International's narrative projects $4.4 billion revenue and $1.0 billion earnings by 2028. This requires 4.5% yearly revenue growth and a $170 million earnings increase from $829.8 million.

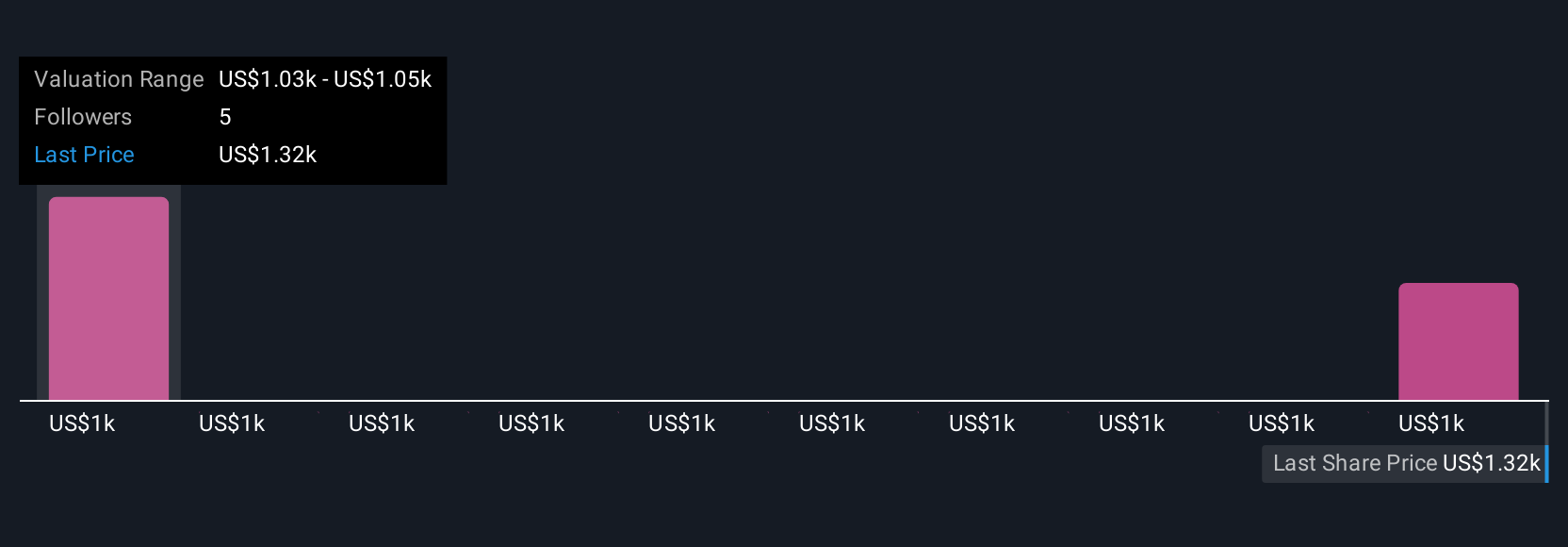

Uncover how Mettler-Toledo International's forecasts yield a $1328 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced two fair value estimates for Mettler-Toledo, from US$1,005 to US$1,328. With margin pressure persisting, your view may depend on how you see long-term profitability trends evolving, consider where you stand among these diverse outlooks.

Explore 2 other fair value estimates on Mettler-Toledo International - why the stock might be worth as much as $1328!

Build Your Own Mettler-Toledo International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mettler-Toledo International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mettler-Toledo International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mettler-Toledo International's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTD

Mettler-Toledo International

Manufactures and supplies precision instruments and services in the Americas, Europe, Asia, and internationally.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives