- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (MRK) Valuation in Focus After FDA Breakthrough Therapy Designation for Lung Cancer Drug

Reviewed by Simply Wall St

Most Popular Narrative: 13% Undervalued

According to community narrative, Merck is currently seen as undervalued relative to its fundamental prospects. The consensus analyst view suggests that the stock’s true value is higher than where it trades today.

With its acquisition and licensing strategy, Merck has nearly tripled its late-phase pipeline since 2021. This pipeline is expected to present a potential commercial opportunity of over $50 billion by the mid-2030s, which could drive earnings growth.

What exactly is pushing this undervalued narrative? A key part of the calculation lies in the company’s future revenue and margin growth expectations, along with significant assumptions on profit multiples. Want to discover which financial factors analysts are focusing on, and what market shifts could justify such a gap to fair value? Explore the numbers behind this projection; the details may surprise you.

Result: Fair Value of $100.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, GARDASIL sales pressures in China or any surprise impact from new tariffs could influence Merck’s earnings outlook and challenge this current undervalued narrative.

Find out about the key risks to this Merck narrative.Another View: What Does the SWS DCF Model Say?

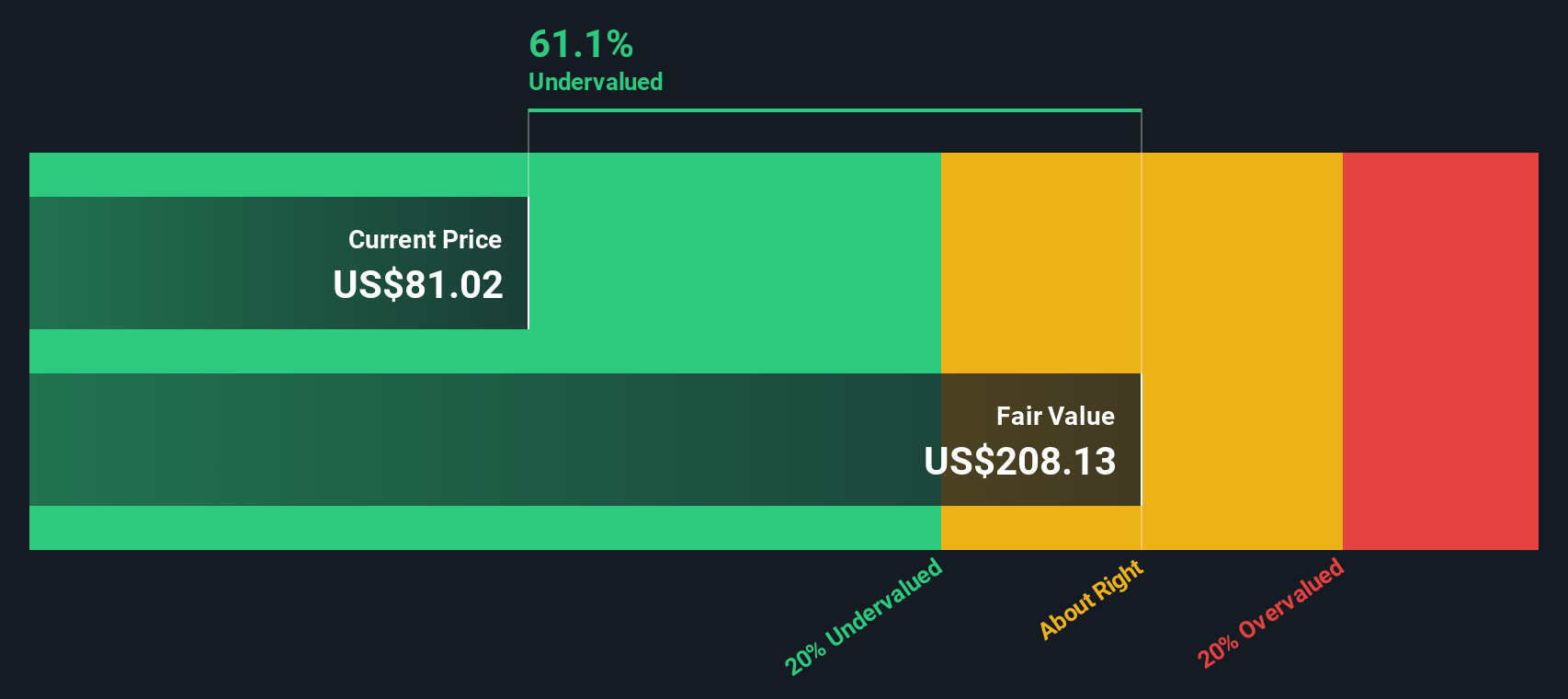

Looking at Merck through our DCF model offers a different angle. This method suggests the stock could be trading far below its actual worth. Is the real opportunity hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Merck Narrative

If you see things differently or want to dig into the numbers on your own terms, you can easily assemble your own view in just minutes. So why not do it your way?

A great starting point for your Merck research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to a single opportunity when so many smart investing angles are right at your fingertips. Make sure you catch these trends before others do. Here are three standout stock themes worth your attention:

- Boost your portfolio’s income stream by targeting dividend stocks with yields > 3% and enjoy yields above 3%. This approach is ideal for building steady returns without sacrificing quality.

- Get ahead of tomorrow’s healthcare breakthroughs by following healthcare AI stocks, where advanced AI is accelerating medical innovation and reshaping patient care.

- Position yourself in technology’s next wave with quantum computing stocks to gain exposure to visionary companies advancing the real-world impact of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success