- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (LLY): Assessing Valuation After Recent Share Price Surge and Strong Growth

Reviewed by Simply Wall St

See our latest analysis for Eli Lilly.

Eli Lilly’s recent momentum is hard to ignore, with a 9.3% share price return over the last month and a remarkable 47.8% in the past quarter, hinting at growing optimism for its pipeline and future earnings. For long-term investors, the three-year total shareholder return of 169% and five-year total return of 583% speak to sustained outperformance. This shows that confidence in the company’s innovation story has not faded.

Curious which other healthcare stocks are catching investors’ attention this year? It is a great time to compare by checking out See the full list for free.

But with shares hovering near all-time highs, investors might wonder whether Eli Lilly is undervalued given its strong fundamentals, or if the stock is already reflecting all future growth expectations and potential rewards.

Most Popular Narrative: 22.3% Undervalued

According to eat_dis_watermelon, the narrative’s fair value of $1,189 is well above Eli Lilly’s last close price of $924, implying that the market may not fully reflect the company’s future profit potential. Let’s look at a defining argument driving this narrative.

Market penetration for all GLP-1 drugs is only at 4% of the target audience of 100 to 120 million people in the USA alone. There is still a lot of room to grow for more than one GLP-1 drug.

What hidden projections fuel this high valuation? The answer lies in the narrative’s bold expectations for market reach, future revenue growth, and profit margins. Want to know if these assumptions really stack up? Dive in to find the surprising drivers behind the numbers.

Result: Fair Value of $1,189 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain delays or a rise in side effect concerns could quickly dampen Eli Lilly’s growth outlook and shift investor sentiment.

Find out about the key risks to this Eli Lilly narrative.

Another View: Valuation by Multiples Raises Caution

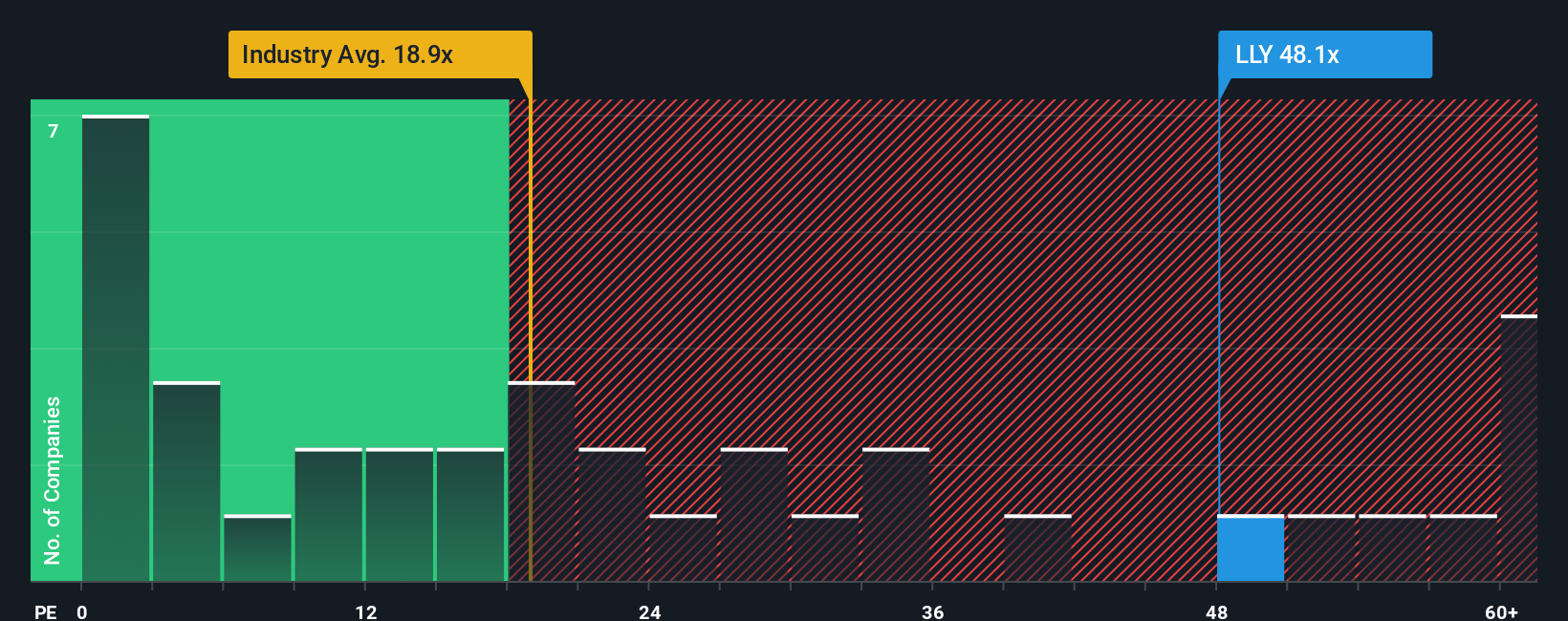

While the narrative and fair value estimates suggest Eli Lilly is undervalued, the current share price tells a different story. The company trades at a price-to-earnings ratio of 45x, far above the industry average of 17.4x and the peer average of 14.8x. Even the fair ratio sits at 42.6x, indicating the stock is priced for exceptional growth and little room for error. Could the premium be justified, or are expectations running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eli Lilly Narrative

If you have a different perspective or want to dig into the numbers yourself, crafting your own narrative is quick and simple. Do it your way with Do it your way.

A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investing Ideas?

Broaden your opportunities and ensure you catch tomorrow’s winners by using the Simply Wall Street Screener to find stocks in exciting, high-potential areas right now.

- Tap into reliable income streams by reviewing these 16 dividend stocks with yields > 3% yielding over 3% and positioning your portfolio for resilient returns.

- Spot powerful technology trends when you analyze these 24 AI penny stocks that are reshaping industries with innovation and rapid growth potential.

- Unlock opportunities the market may be missing by sizing up these 876 undervalued stocks based on cash flows based on their strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives