- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (NYSE:JNJ) Sees Robust Q2 Sales Growth and Strategic FDA Approvals, But Faces MedTech Challenges

Reviewed by Simply Wall St

Delve into the full analysis report here for a deeper understanding of Johnson & Johnson.

Strengths: Core Advantages Driving Sustained Success For Johnson & Johnson

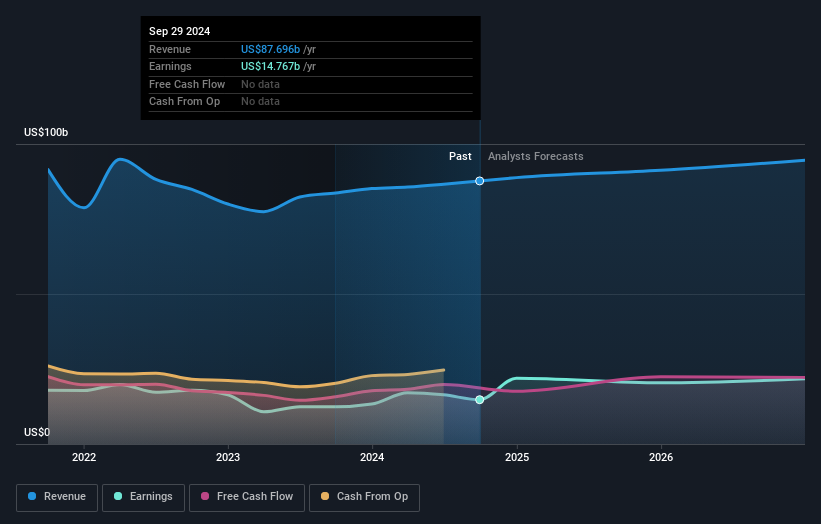

Johnson & Johnson's financial health is robust, evidenced by its worldwide sales of $22.4 billion for the second quarter of 2024, marking a 6.6% increase. Notably, Innovative Medicine sales surged by 7.8%, with U.S. growth at 8.9%. The company also reported adjusted net earnings of $6.8 billion and an adjusted diluted EPS of $2.82, reflecting increases of 1.6% and 10.2%, respectively. Johnson & Johnson continues to invest strategically in R&D, allocating $3.4 billion or 15.3% of sales this quarter. This commitment to innovation is further demonstrated by significant clinical and regulatory milestones. Furthermore, JNJ is currently trading at $164.82, which is below the estimated fair value of $266.99, indicating that the stock is undervalued based on discounted cash flow analysis.

Weaknesses: Critical Issues Affecting Johnson & Johnson's Performance and Areas For Growth

Despite its strengths, Johnson & Johnson faces some challenges. The diluted EPS was $1.93, down from $2.05 a year ago. The MedTech segment underperformed, not meeting growth expectations. Additionally, the cost of products sold margin deleveraged by 60 basis points due to product mix and macroeconomic factors. The effective tax rate also increased to 18.5% from 14.7% last year. Moreover, while JNJ is good value based on its P/E ratio of 24.2x compared to the peer average of 47.5x, it is expensive relative to the U.S. Pharmaceuticals industry average of 19x.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Johnson & Johnson has multiple growth opportunities. The company received FDA approval for CARVYKTI in earlier therapy lines and reported positive overall survival results from the CARTITUDE-4 study. Anticipated product launches, such as RYBREVANT plus lazertinib in frontline EGFR-positive lung cancer, and TREMFYA in IBD, are expected to drive future growth. Market expansion in the Cardiovascular sector through strategic acquisitions is another key opportunity. Additionally, Johnson & Johnson has invested approximately $17 billion in strategic value-creating inorganic growth opportunities in the first half of 2024, enhancing its market position.

Threats: Key Risks and Challenges That Could Impact Johnson & Johnson's Success

Johnson & Johnson faces several external threats. Competitive pressures are evident, with total Innovative Medicine sales growth partially offset by declines in other neuroscience areas and unfavorable patient mix in XARELTO. Economic factors pose another risk, particularly in securing premium pricing for differentiated innovations. Regulatory risks are also significant, with the company not aligning with IRA and the price-setting process, impacting its guidance. Additionally, market volatility in China presents a short-term challenge, as noted by Tim Schmid, MedTech Leader, who mentioned that the situation is starting to normalize but remains a pain point.

Conclusion

Johnson & Johnson's strong financial health, marked by significant sales growth and strategic R&D investments, positions the company well for sustained success. However, challenges such as declining diluted EPS and underperformance in the MedTech segment highlight areas needing improvement. The company's proactive approach to growth through FDA approvals and strategic acquisitions offers promising future prospects. Despite facing competitive and regulatory risks, the current trading price of $164.82, significantly below the estimated fair value of $266.99, suggests a potential for substantial stock appreciation, reflecting a positive outlook for long-term investors.

Next Steps

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:JNJ

Johnson & Johnson

Researches, develops, manufactures, and sells various products in the healthcare field worldwide.

Excellent balance sheet established dividend payer.