- United States

- /

- Pharma

- /

- NYSE:JNJ

Is Johnson & Johnson’s Recent Stock Jump a Sign of Hidden Value in 2025?

Reviewed by Bailey Pemberton

- Wondering if Johnson & Johnson’s stock could actually be worth more than what the market is pricing in? You’re not alone. Today we’ll take a friendly but forensic look at how much value is hiding under the surface.

- The share price has climbed an impressive 4.0% in just the past week and 5.8% over the last month. This hints at renewed optimism in the company’s growth story or perhaps a shift in how investors see its risk profile.

- Recent headlines have focused on Johnson & Johnson’s strategic push into new pharmaceutical innovations and its ongoing efforts to streamline its consumer health segment. These moves have caught Wall Street’s attention and could be major drivers behind the recent momentum in the stock price.

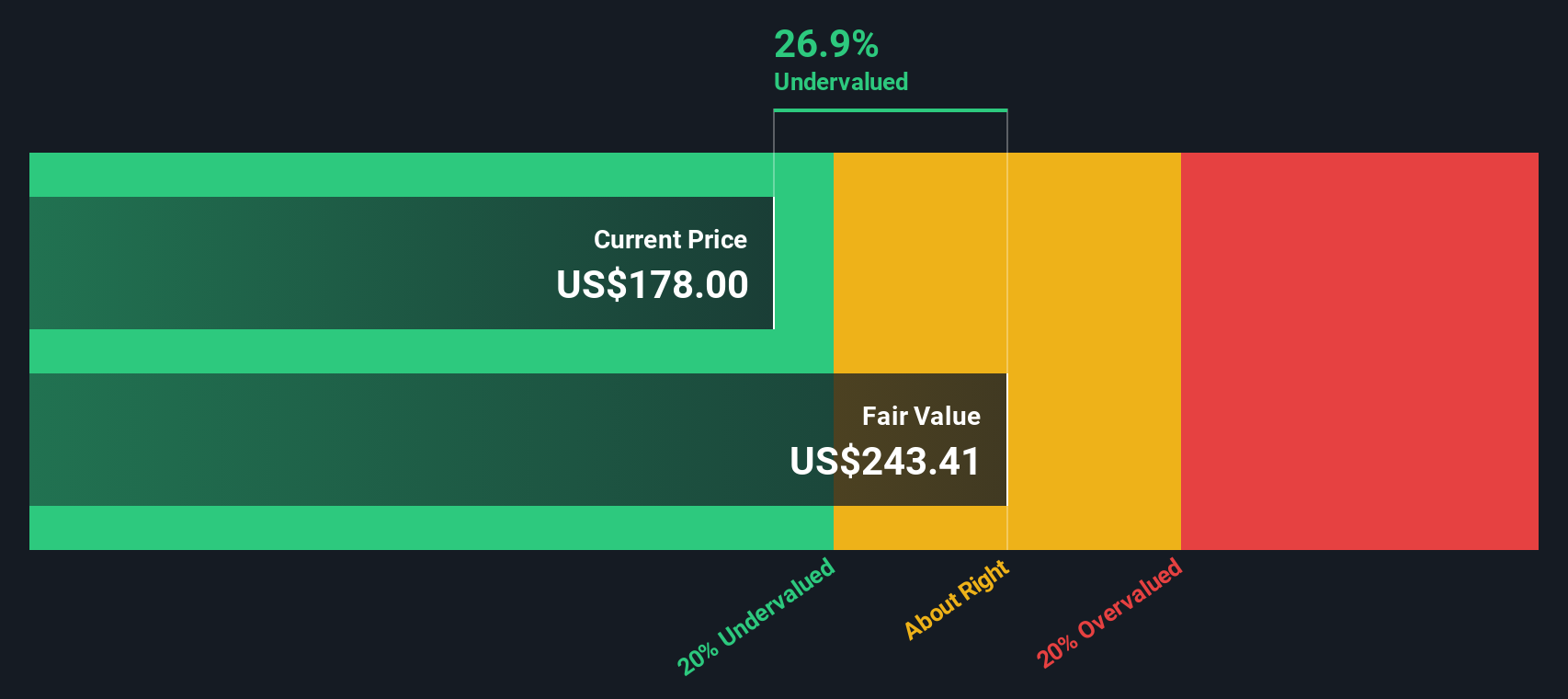

- On our valuation checks, Johnson & Johnson earns a 4 out of 6. This suggests it is undervalued by most metrics but not all. The real intrigue comes from how we approach that valuation, and we’ll dig into those methods next, with a new perspective waiting for you at the end.

Approach 1: Johnson & Johnson Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today. This approach gives investors a sense of what the business is worth right now based on those future cash streams.

For Johnson & Johnson, analysts see current Free Cash Flow (FCF) at $19.5 Billion, with projections suggesting ongoing growth. Over the next ten years, FCF is expected to climb steadily, reaching as high as $48.0 Billion by 2035, according to analyst estimates and the model's own extrapolations. By 2029, the company’s FCF is predicted at $33.0 Billion. These projections, all in USD, are crucial inputs for determining how much value the company is set to generate going forward.

After crunching the numbers using these forecasts, the DCF model pegs Johnson & Johnson’s estimated fair value at $384.12 per share. This represents a sizable premium relative to the current market price and implies the stock may be trading at a 47.1% discount to its true worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Johnson & Johnson is undervalued by 47.1%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Johnson & Johnson Price vs Earnings

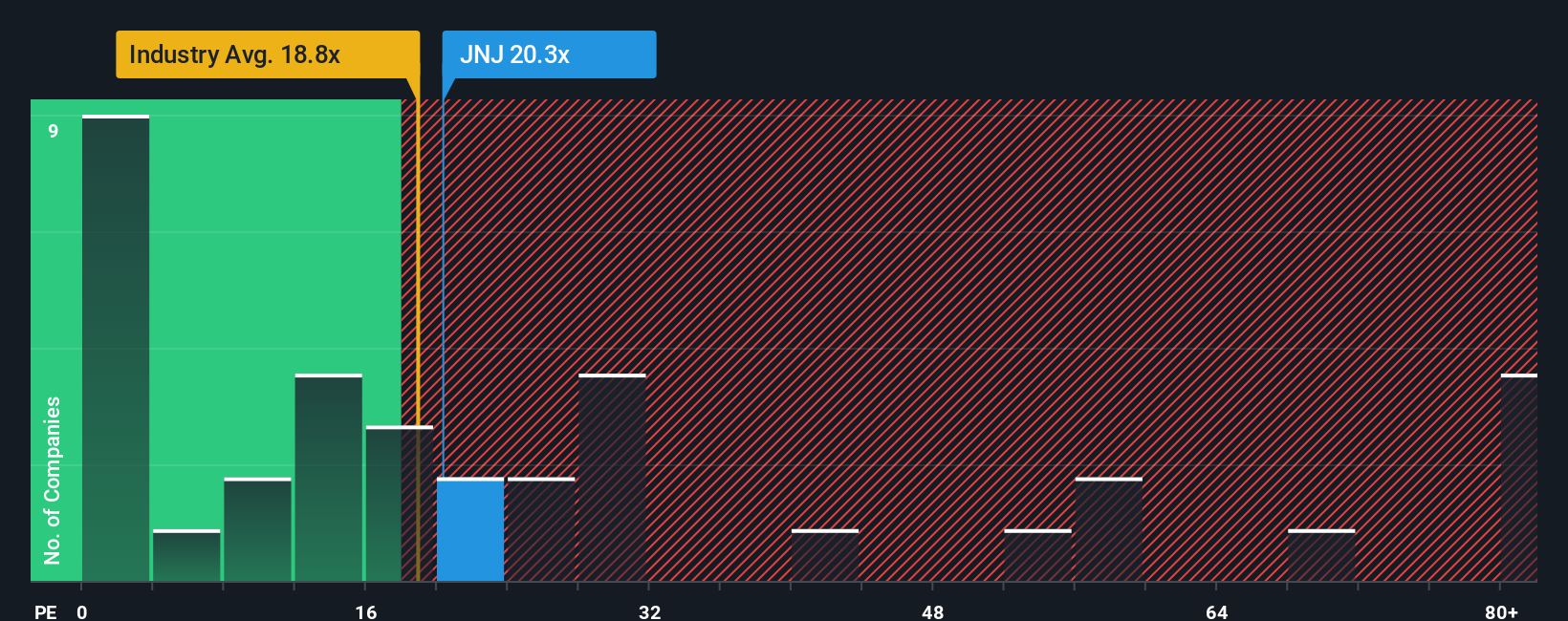

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like Johnson & Johnson because it directly relates a company's market price to its earnings. Investors use the PE ratio as a shorthand for how much they are paying for each dollar of current earnings, making it a clear way to assess value relative to profit generation.

The "right" or fair PE ratio depends on several factors, most notably growth expectations and risk. Companies with more stable or faster-growing earnings often merit a higher PE, while those with more risks or lower growth receive a lower one. This means it is not just about how much profit a business makes today, but also how confident investors are in the company’s future earnings potential.

Johnson & Johnson is currently trading at a 19.5x PE, which is nearly identical to the broader Pharmaceuticals industry average of 19.4x, but below the peer group average of 23.2x. While these benchmarks offer context, Simply Wall St’s “Fair Ratio” goes a step further. The Fair Ratio for Johnson & Johnson sits at 26.4x, calculated by factoring in unique elements like the company’s earnings growth, market cap, risk profile, industry placement, and profit margins, rather than relying solely on averages.

The Fair Ratio offers a more tailored perspective because it reflects the company’s individual strengths and circumstances, not just how peers are being valued at the moment. By comparing the current PE ratio to this Fair Ratio, we see that Johnson & Johnson’s shares appear undervalued, with a difference of nearly 7x between its market valuation and what would be justified by its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Johnson & Johnson Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. This is a smarter, more dynamic approach for investment decisions built right into Simply Wall St’s Community page.

A Narrative is your opportunity to create a story behind your numbers, combining your personal perspective on the company with your estimates for future revenue, earnings, and margins. This bridges the gap between what you believe about Johnson & Johnson’s business direction and what the financial models project, connecting a company’s story directly to a forecast and a fair value calculation.

Narratives are easy to use and accessible to all investors, whether you are new to stocks or have years of experience, and they are used by millions of people on Simply Wall St. By setting your assumptions and outlook, Narratives let you see how your story stacks up. For example, you can identify if Johnson & Johnson is a buy because you expect steady innovation and resilience, or a hold if you have concerns about litigation risks or slowing growth.

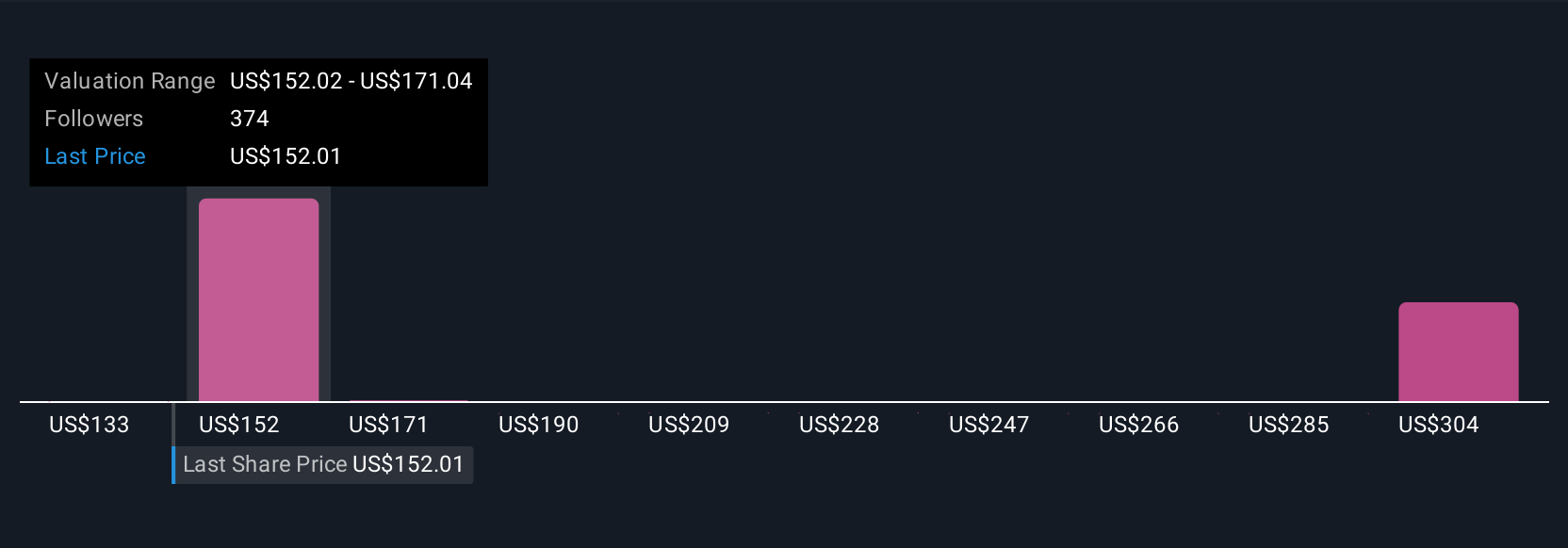

The best part is that Narratives update automatically whenever new information or earnings are released, so your insights and fair value always stay in sync with the latest data. For example, recent Narratives for Johnson & Johnson show that some investors expect the company’s fair value to be as high as $200 per share on strong MedTech expansion, while the most cautious see it as low as $155 due to ongoing legal uncertainties and margin pressures.

In just a few minutes, you can build your Narrative, compare your fair value against the current share price, and decide with confidence whether Johnson & Johnson truly fits your portfolio’s story and goals.

Do you think there's more to the story for Johnson & Johnson? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives