- United States

- /

- Life Sciences

- /

- NYSE:IQV

With EPS Growth And More, IQVIA Holdings (NYSE:IQV) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in IQVIA Holdings (NYSE:IQV). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide IQVIA Holdings with the means to add long-term value to shareholders.

See our latest analysis for IQVIA Holdings

IQVIA Holdings' Improving Profits

Over the last three years, IQVIA Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, IQVIA Holdings' EPS shot from US$3.17 to US$6.22, over the last year. It's not often a company can achieve year-on-year growth of 96%.

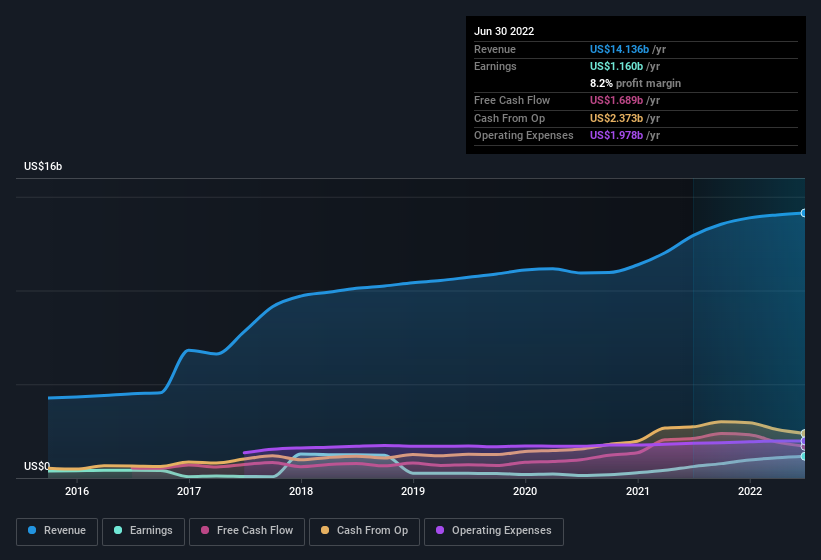

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. IQVIA Holdings shareholders can take confidence from the fact that EBIT margins are up from 9.0% to 12%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of IQVIA Holdings' forecast profits?

Are IQVIA Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The US$1.0k worth of shares that insiders sold during the last 12 months pales in comparison to the US$2.7m they spent on acquiring shares in the company. We find this encouraging because it suggests they are optimistic about IQVIA Holdings'future. Zooming in, we can see that the biggest insider purchase was by Independent Director John Danhakl for US$2.7m worth of shares, at about US$273 per share.

On top of the insider buying, it's good to see that IQVIA Holdings insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$337m. While that is a lot of skin in the game, we note this holding only totals to 0.8% of the business, which is a result of the company being so large. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Is IQVIA Holdings Worth Keeping An Eye On?

IQVIA Holdings' earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest IQVIA Holdings belongs near the top of your watchlist. Still, you should learn about the 1 warning sign we've spotted with IQVIA Holdings.

The good news is that IQVIA Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IQV

IQVIA Holdings

Engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific.

Very undervalued with proven track record.