- United States

- /

- Life Sciences

- /

- NYSE:IQV

IQVIA (IQV): Assessing Valuation After Nobel Laureate Dr. Kaelin Joins Board

Reviewed by Simply Wall St

IQVIA Holdings has announced that Dr. William G. Kaelin Jr., Nobel Prize-winning physician-scientist, is joining its board of directors. Investors may view this move as a way to strengthen the company’s scientific leadership and strategic direction.

See our latest analysis for IQVIA Holdings.

IQVIA Holdings' 14.9% share price gain over the past three months hints at growing investor enthusiasm, likely sparked by fresh scientific leadership and a renewed sense of direction. However, the 1-year total shareholder return stands at just 2.3%, highlighting that long-term momentum has yet to fully develop.

If this fresh leadership move has you interested in what else is turning the heads of insiders and investors, now is a great time to discover fast growing stocks with high insider ownership

With shares trading at a modest discount to analyst targets and growth metrics pointing up, investors may wonder if IQVIA remains undervalued relative to its future prospects or if the recent gains already reflect what is ahead.

Most Popular Narrative: 11.5% Undervalued

With a fair value estimate of $246.84 versus the latest close at $218.53, the most followed narrative suggests the stock has more room to run. According to the analysts' pricing model, investors may be underappreciating its future prospects and operational strengths.

Accelerated AI adoption and proprietary platforms, alongside strategic partnerships, strengthen IQVIA's operational efficiency and market differentiation, and create significant competitive barriers. Sustained growth in real-world evidence and clinical research demand boosts project backlog and revenue visibility, supporting long-term expansion and earnings resilience.

Curious how rising margins and bullish growth assumptions are fueling this target? Discover which revenue drivers and profit levers the narrative says could reshape the valuation equation. The most revealing projections are still under the surface.

Result: Fair Value of $246.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as persistent pricing pressures and rising competition across the contract research sector could quickly challenge these optimistic estimates.

Find out about the key risks to this IQVIA Holdings narrative.

Another View: Multiples Tell a Different Story

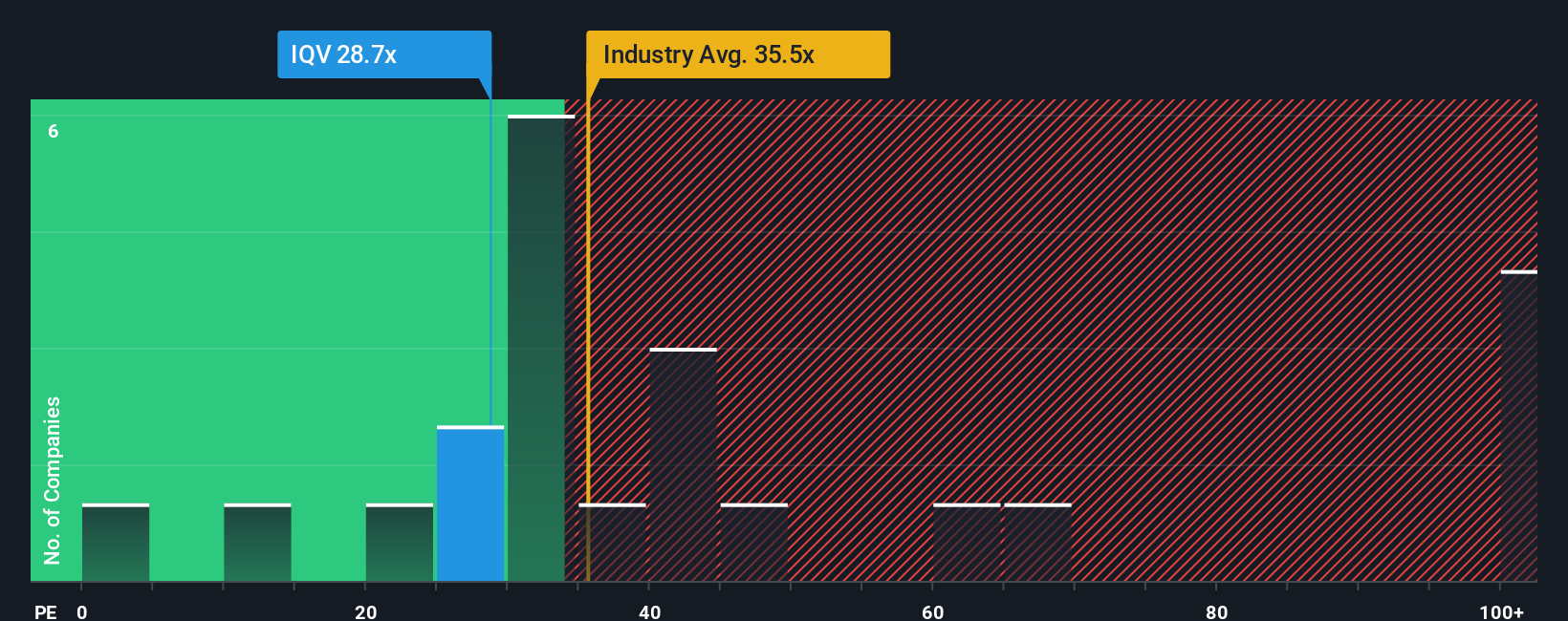

While the valuation narrative points to IQVIA Holdings being undervalued, a look through the lens of its price-to-earnings ratio offers a more mixed perspective. IQVIA trades at 29x earnings, higher than its fair ratio of 26x. However, it is still less expensive than both the industry average of 36.8x and the peer average of 36.5x. This gap means investors are paying a premium versus the fair ratio, but are getting a deal compared to most alternatives. Is this a risk worth taking or a tempting opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IQVIA Holdings Narrative

If you see the numbers in a different light or want your own take, the tools are available for you to craft a unique perspective in just a few minutes, so why not Do it your way

A great starting point for your IQVIA Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors look beyond a single opportunity. Give yourself an edge and uncover unique stocks that could strengthen your portfolio using these proven approaches:

- Capitalize on resilient income streams by targeting these 15 dividend stocks with yields > 3% offering market-beating yields above 3% and steady long-term returns.

- Get ahead of the next tech breakthrough by checking out these 27 quantum computing stocks making waves in quantum computing and transforming entire industries.

- Supercharge your returns by pinpointing these 856 undervalued stocks based on cash flows packed with strong fundamentals and trading below their intrinsic value, before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IQV

IQVIA Holdings

Provides clinical research services, commercial insights, and healthcare intelligence to the life sciences and healthcare industries in the Americas, Europe, Africa, and the Asia-Pacific.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives