- United States

- /

- Life Sciences

- /

- NYSE:IQV

How Investors Are Reacting To IQVIA Holdings (IQV) Q3 Earnings and Nobel Laureate Board Appointment

Reviewed by Sasha Jovanovic

- IQVIA Holdings announced third-quarter 2025 results, reporting revenue of US$4.10 billion and net income of US$331 million, alongside reaffirmed full-year guidance and the appointment of Nobel laureate Dr. William G. Kaelin Jr. to its board of directors.

- The addition of Dr. Kaelin, an influential physician-scientist recognized for his achievements in cancer research and ongoing board leadership at Eli Lilly, reflects IQVIA's focus on scientific leadership and industry expertise at the board level.

- Let's explore how strong quarterly earnings and reinforced executive leadership may impact IQVIA's investment outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

IQVIA Holdings Investment Narrative Recap

To own IQVIA Holdings, you need to believe that global demand for outsourced clinical research, advanced analytics, and health technology will continue to power revenue growth, even as the CRO market faces pricing pressures and regulatory uncertainty. The appointment of a renowned Nobel laureate to the board underscores IQVIA’s investment in scientific leadership, but the effect on immediate catalysts, such as margin expansion or contract momentum, appears modest at this stage, while competitive and pricing risks continue to loom large.

Of the recent company updates, the reaffirmation of full-year 2025 guidance is particularly relevant. This steady outlook signals management’s confidence in IQVIA’s near-term revenue visibility and pipeline strength, despite persistent pressure on margins and the evolving mix of service lines that could influence profitability going forward.

Yet, amid these signs of stability, investors should not overlook the persistent risk from heightened pricing competition and its impact on long-term margin potential...

Read the full narrative on IQVIA Holdings (it's free!)

IQVIA Holdings' narrative projects $18.4 billion in revenue and $1.8 billion in earnings by 2028. This requires 5.4% yearly revenue growth and a $0.6 billion earnings increase from the current $1.2 billion.

Uncover how IQVIA Holdings' forecasts yield a $246.84 fair value, a 16% upside to its current price.

Exploring Other Perspectives

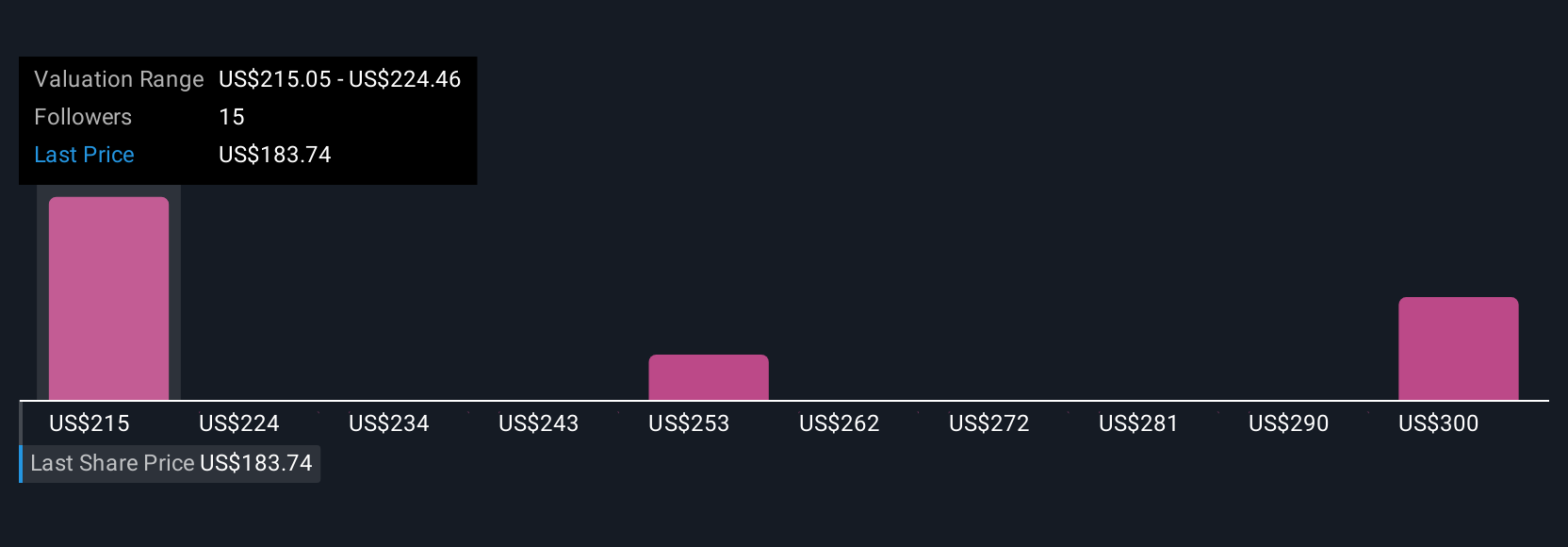

Four different fair value estimates from the Simply Wall St Community for IQVIA range between US$246.84 and US$305.86. Despite this diversity, the risk of sustained pricing pressure remains an important consideration for those evaluating the stock’s future performance.

Explore 4 other fair value estimates on IQVIA Holdings - why the stock might be worth as much as 44% more than the current price!

Build Your Own IQVIA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IQVIA Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IQVIA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IQVIA Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IQV

IQVIA Holdings

Provides clinical research services, commercial insights, and healthcare intelligence to the life sciences and healthcare industries in the Americas, Europe, Africa, and the Asia-Pacific.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives