- United States

- /

- Pharma

- /

- NYSE:ELAN

How Investors May Respond To Elanco Animal Health (ELAN) Lowering 2025 Earnings Guidance Despite Higher Sales

Reviewed by Sasha Jovanovic

- Elanco Animal Health recently reported its third quarter 2025 results, showing higher sales of US$1.14 billion compared to US$1.03 billion a year ago, but posted a net loss of US$34 million versus net income of US$364 million last year and issued lowered full-year earnings guidance, expecting a net loss of US$41 million to US$56 million for 2025.

- This combination of improved sales and reduced earnings outlook suggests operational challenges are impacting profitability, even as the company continues to expand its top line.

- We’ll look at how Elanco’s lowered full-year earnings guidance affects the company’s outlook for margin recovery and long-term growth potential.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Elanco Animal Health Investment Narrative Recap

To be a shareholder in Elanco Animal Health, you need confidence in the company's ability to drive sustained innovation and organic revenue growth, despite recent profitability setbacks and margin compression. The lowered full-year earnings guidance after Q3 results draws attention to near-term earnings risk; at present, it does not materially change the main catalyst, successful execution on new product launches and continued top-line expansion. The biggest risk remains Elanco's challenge in converting higher revenues into meaningful profit improvements while controlling costs.

One of the most relevant recent announcements is Elanco’s amendment to its credit agreement to refinance and extend portions of its debt. This refinancing provides financial flexibility, which could help Elanco support the launches of new products, a key short-term catalyst for potential margin recovery and growth ambitions. However, managing leverage and associated interest expenses will remain important for…

Read the full narrative on Elanco Animal Health (it's free!)

Elanco Animal Health's outlook anticipates $5.1 billion in revenue and $186.7 million in earnings by 2028. This projection relies on a 4.5% annual revenue growth rate and a decline in earnings of $247.3 million from the current $434.0 million.

Uncover how Elanco Animal Health's forecasts yield a $21.91 fair value, in line with its current price.

Exploring Other Perspectives

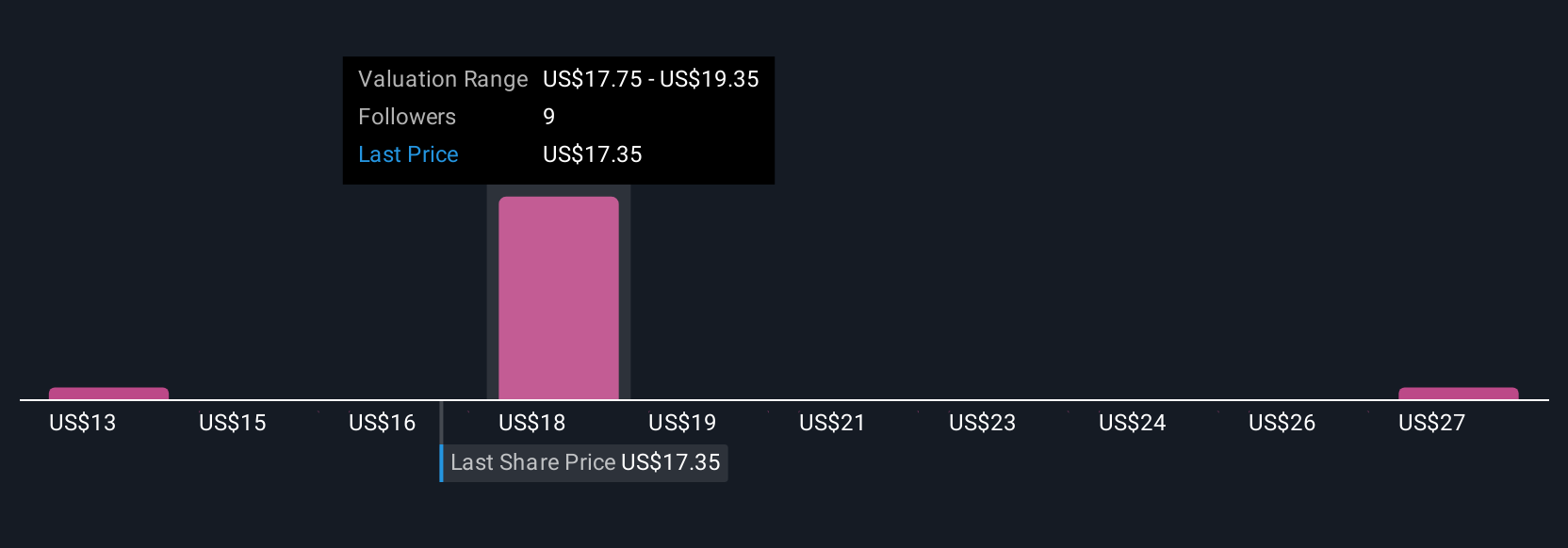

Simply Wall St Community members estimate Elanco’s fair value from US$12.93 to US$32.30, across three individual perspectives. Amid these differing views, the risk of weaker net margin improvement may affect the company’s ability to capitalize on future revenue growth, highlighting the importance of reviewing multiple opinions.

Explore 3 other fair value estimates on Elanco Animal Health - why the stock might be worth 42% less than the current price!

Build Your Own Elanco Animal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elanco Animal Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Elanco Animal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elanco Animal Health's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives