- United States

- /

- Pharma

- /

- NYSE:ELAN

Elanco Animal Health (ELAN): Evaluating Valuation After Revised Earnings Outlook and Q3 Net Loss

Reviewed by Simply Wall St

Elanco Animal Health (ELAN) just released its third quarter results and updated financial guidance for 2025, giving investors a lot to digest. The company reported higher sales but a swing to a net loss, with projections for bigger losses in spite of increased revenue.

See our latest analysis for Elanco Animal Health.

Elanco Animal Health has certainly attracted attention lately, with its updated outlook and recent debt refinancing adding to the buzz. The momentum is hard to miss, as the stock’s 1-month share price return of nearly 16% and a stunning year-to-date gain of almost 90% suggest that investors are latching on to recovery hopes. Even as the 1-year total shareholder return of 62% and multi-year results remain mixed, the rally signals that sentiment around future prospects is building fast. This is occurring in spite of the lingering risks highlighted by the new forecasts.

If you’re curious about other companies showing strong performance and potential, now’s the perfect moment to broaden your radar and discover See the full list for free.

But with all this recent momentum and a share price near analyst targets, the big question is whether Elanco is still undervalued after its rally, or if markets have already priced in its recovery prospects.

Most Popular Narrative: 4% Overvalued

Elanco Animal Health closed at $22.86, which is about 4% above the most widely followed narrative fair value of $21.91. The market is pushing beyond what consensus valuations consider reasonable, setting the table for debate on how optimistic recovery expectations have become.

Margin expansion is viewed as a significant opportunity. Elanco's current margins trail those of sector leaders, presenting room for substantial improvement and EBITDA growth.

Want to know what is igniting talk of a higher valuation? One bold assumption in this narrative hinges on margins breaking out of their historical range and analysts seeing a profit leap rare for the sector. What else drove this striking fair value uptick? Dive deeper and find out which expectations have really caught Wall Street’s attention.

Result: Fair Value of $21.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent foreign exchange headwinds and rising operating expenses could quickly derail Elanco’s margin and profitability improvement narrative if conditions worsen.

Find out about the key risks to this Elanco Animal Health narrative.

Another View: Discounted Cash Flow Signals Undervaluation

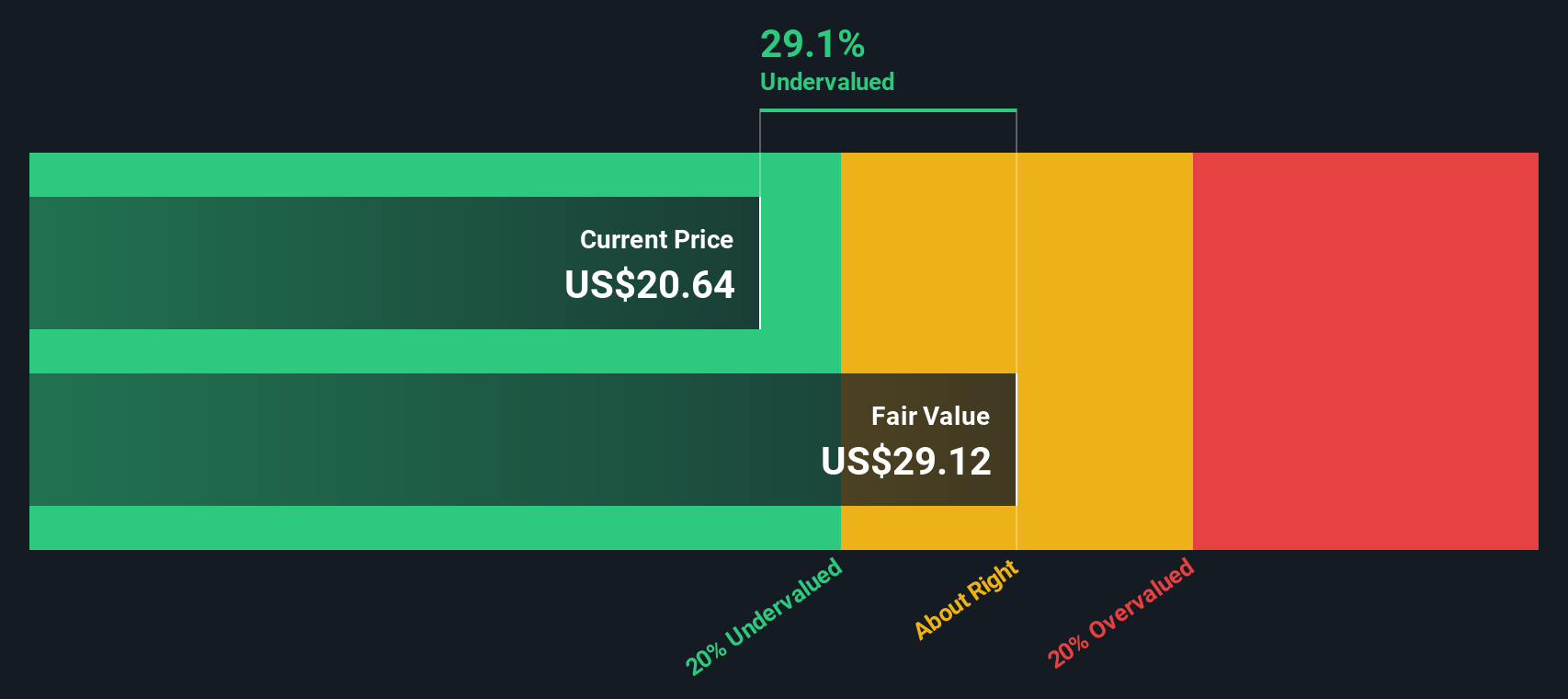

While the market consensus points to Elanco being slightly overvalued based on share price and analyst targets, our SWS DCF model tells a different story. According to this cash flow-based approach, Elanco trades almost 30% below its estimated fair value. Does this indicate a real bargain that other investors are missing, or is the gap a sign of risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Elanco Animal Health Narrative

If you want to dig deeper or see the story from your own angle, you can quickly build your perspective in just a few minutes. Do it your way

A great starting point for your Elanco Animal Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't watch from the sidelines while unique opportunities appear every day. Use the Simply Wall Street Screener now to hunt out powerful trends before others catch on. Your next smart move could be just a click away.

- Capitalize on the artificial intelligence surge by checking out these 25 AI penny stocks which are reshaping everything from healthcare to automation with rapid growth potential.

- Secure your income stream by tapping into these 15 dividend stocks with yields > 3% delivering superior yields and steady returns in today's market environment.

- Lead the charge in market innovation as you browse these 82 cryptocurrency and blockchain stocks which are pioneering advancements in blockchain, fintech, and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives