- United States

- /

- Biotech

- /

- NYSE:EBS

Emergent BioSolutions (EBS): One-Off $42.1M Loss Clouds Return to Profit, Tests Bullish Narratives

Reviewed by Simply Wall St

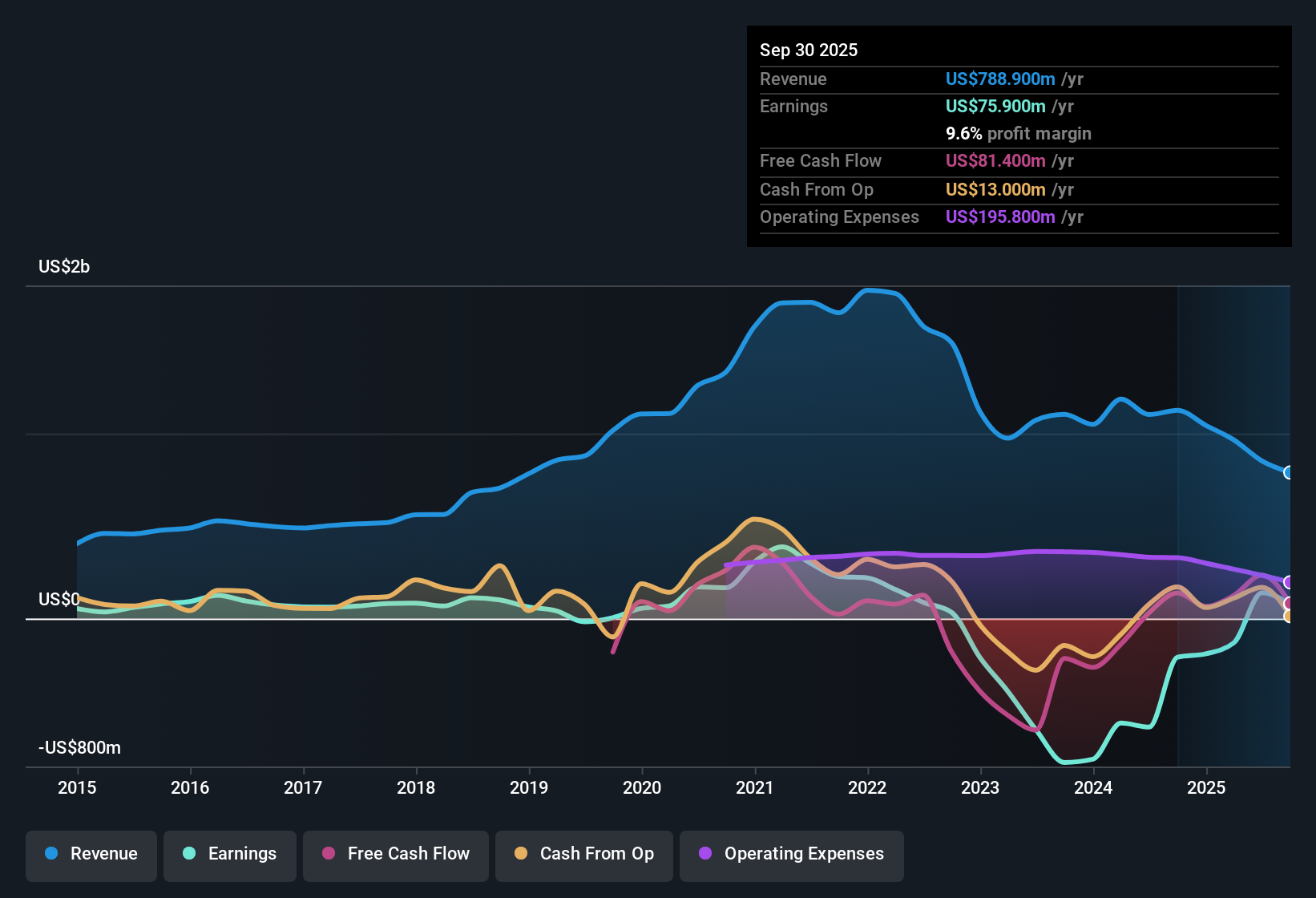

Emergent BioSolutions (EBS) recently turned profitable, reversing a multi-year trend of losses. However, headline numbers were clouded by a hefty one-off charge of $42.1 million that weighed on reported earnings for the last twelve months. Long-term comparisons remain tough, as the company’s average annual earnings have declined by 40.2% over five years. Current forecasts point to a 53.8% annual drop in EPS and a 1.2% annual revenue dip over the next three years. Despite a price-to-earnings ratio of 9x that stands out as a value signal versus peers, investors face a mixed outlook. Renewed profitability is offset by sharp anticipated declines in both revenue and profit growth.

See our full analysis for Emergent BioSolutions.Next, we will examine how these numbers stack up against the most widely held investor narratives for EBS, highlighting where the latest results confirm or challenge existing stories.

See what the community is saying about Emergent BioSolutions

Margin Gains Outpace Revenue Shrinkage

- Net profit margins have improved to 16.4%, a marked turnaround from consistent losses even though revenues are forecast to shrink by 4.4% annually over the next three years.

- Analysts' consensus view suggests margin stability is being maintained through efficient cost management and a favorable product mix. This could support earnings even as top-line sales contract.

- Sustained government demand and diversification into international markets, now making up as much as 48% of medical countermeasure sales, are helping to balance margin preservation against revenue headwinds.

- However, consensus highlights that ongoing restructuring and reliance on cost containment, rather than organic revenue growth, pose a risk to long-term earnings durability if demand or pricing falters.

Consensus sees the margin story as a double-edged sword. While improved efficiency helps absorb revenue drops, true momentum will eventually require new growth drivers.

📊 Read the full Emergent BioSolutions Consensus Narrative.

One-Off Charges Cloud Profit Rebound

- The $42.1 million one-time charge reported in the past twelve months has distorted headline profit figures, making it harder to assess whether improved profitability will persist into future periods.

- According to the analysts' consensus view, this kind of non-recurring item calls into question the underlying health of recent results, as heavy dependence on government contracts and limited pipeline innovation mean sustained profits may only materialize with new multi-year agreements or breakthrough products.

- The consensus points out that while management emphasizes expanded international sales and recurring government orders, the true test is whether such large losses reappear or are fully behind the company.

- Critics highlight that restructuring and cost-cutting, rather than organic business expansion, have played oversized roles in driving this temporary profit boost.

Valuation Gap vs. Peers Remains Stark

- The current price-to-earnings ratio for EBS sits at 9x, which is considerably below the US Biotechs industry average of 15.5x. The current share price of $12.84 trades at a 42% discount to the $13.5 analyst price target.

- The analysts' consensus narrative warns that analysts are pricing in ongoing declines but still believe the underlying business is more valuable than what the market reflects. This suggests that valuation alone cannot offset persistent risks around earnings and revenue contraction.

- Achieving consensus price targets would require stabilization of revenues around $744.5 million and PE multiples improving to 7.3x on projected earnings. This scenario assumes no further major setbacks from restructuring, patent expiries, or lost contracts.

- The deep discount may tempt value investors, but the consensus stresses that long-term returns will depend on real progress against operational headwinds, not just the valuation gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Emergent BioSolutions on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Tell your side of the story and shape your own investment perspective in just a few minutes. Do it your way

A great starting point for your Emergent BioSolutions research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

See What Else Is Out There

Emergent BioSolutions faces declining revenues, significant reliance on cost-cutting, and uncertain long-term earnings due to inconsistent growth drivers and restructuring risks.

If the patchy growth outlook has you concerned, focus on stable growth stocks screener (2112 results) to discover companies delivering consistent expansion and more reliable performance across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emergent BioSolutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EBS

Emergent BioSolutions

A life sciences company, provides preparedness and response solutions for accidental, deliberate, and naturally occurring public health threats in the United States.

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives