- United States

- /

- Life Sciences

- /

- NYSE:DHR

Is Danaher Back on Track After 13.8% Surge and Positive Sector News?

Reviewed by Bailey Pemberton

If you have been trying to figure out what to do with Danaher stock lately, you are far from alone. Over the past week, Danaher surprised the market with a 13.8% jump in share price, recapturing some attention after an otherwise sluggish year. In fact, if you widened your lens, Danaher is still down 20.8% over the past twelve months and remains negative for the year, trailing at -7.9%. Even over the last three years, returns have been slightly under water at -7.3%. That sets up some natural questions around whether the recent improvement marks a turning point or just a temporary rebound.

There are a few notable market developments making investors perk up. Shifts in the broader healthcare and life sciences sectors, sparked by announcements of government research funding and renewed demand for diagnostic testing tools, have given companies like Danaher a renewed sense of growth potential. But there is also a noticeable change in how the market assigns risk to these players, driving both cautious optimism and caution depending on where you stand.

Looking just at the numbers, Danaher’s current valuation score is just 1 out of 6, meaning it only clears one check for being undervalued by traditional methods. For anyone weighing their investment options, that might sound discouraging, but the full story is more nuanced. Before making a call, let’s break down the different valuation approaches and see where Danaher stands on each one. And if you are after a more practical way to judge value, stick with me for a method many analysts overlook until the end.

Danaher scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Danaher Discounted Cash Flow (DCF) Analysis

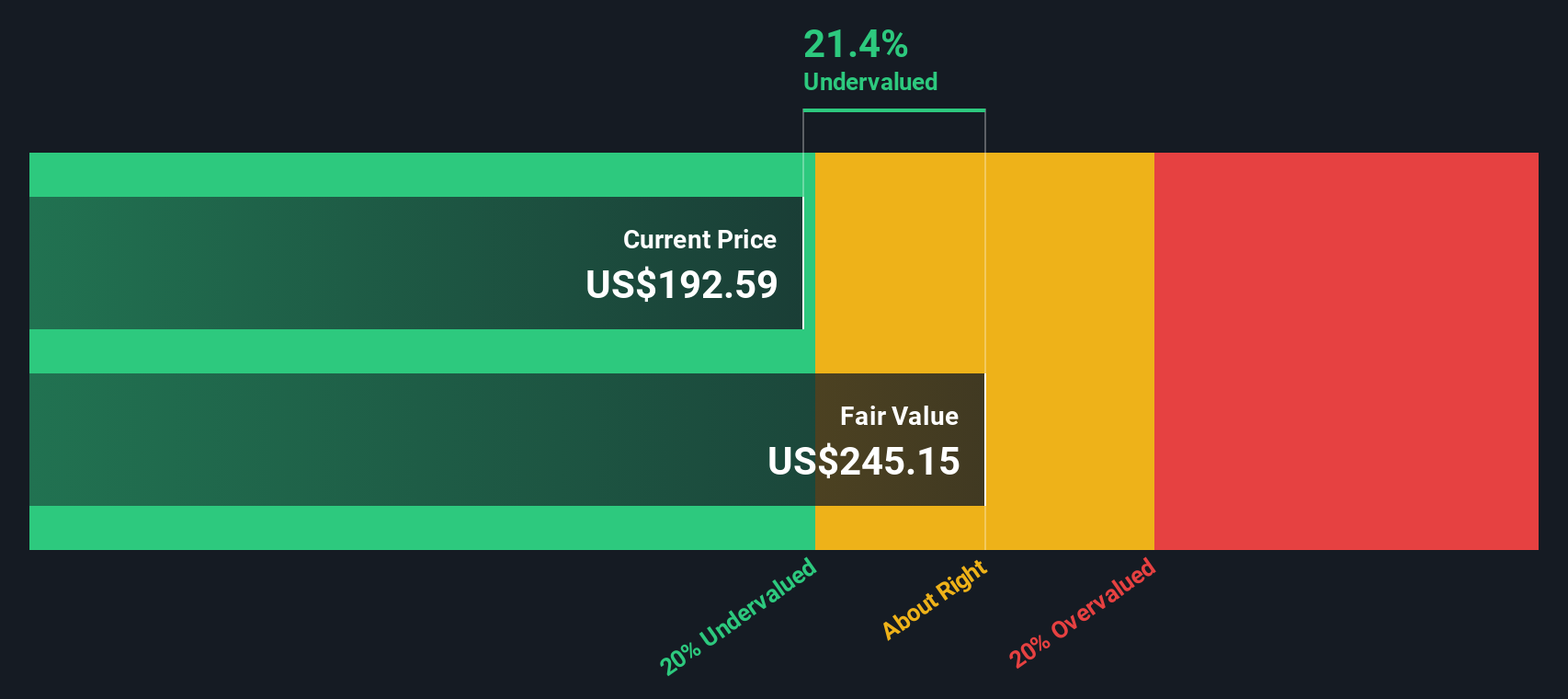

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's dollars. For Danaher, this method looks at the cash the company generates and anticipates how that will evolve over time, giving investors an idea of the stock's underlying worth.

Danaher's most recent reported Free Cash Flow (FCF) stands at $4.87 billion. Analyst estimates suggest this figure will continue to grow over the coming years, reaching approximately $7.19 billion by 2028. While detailed analyst projections only extend about five years out, further FCF projections extending to 2035 are extrapolated based on reasonable industry growth assumptions.

When these future cash flows are discounted back to the present, the DCF model produces an estimated intrinsic value of $234.23 per share. Compared to the current share price, this points to a 9.6% discount and suggests Danaher stock is priced just below its calculated fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Danaher's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

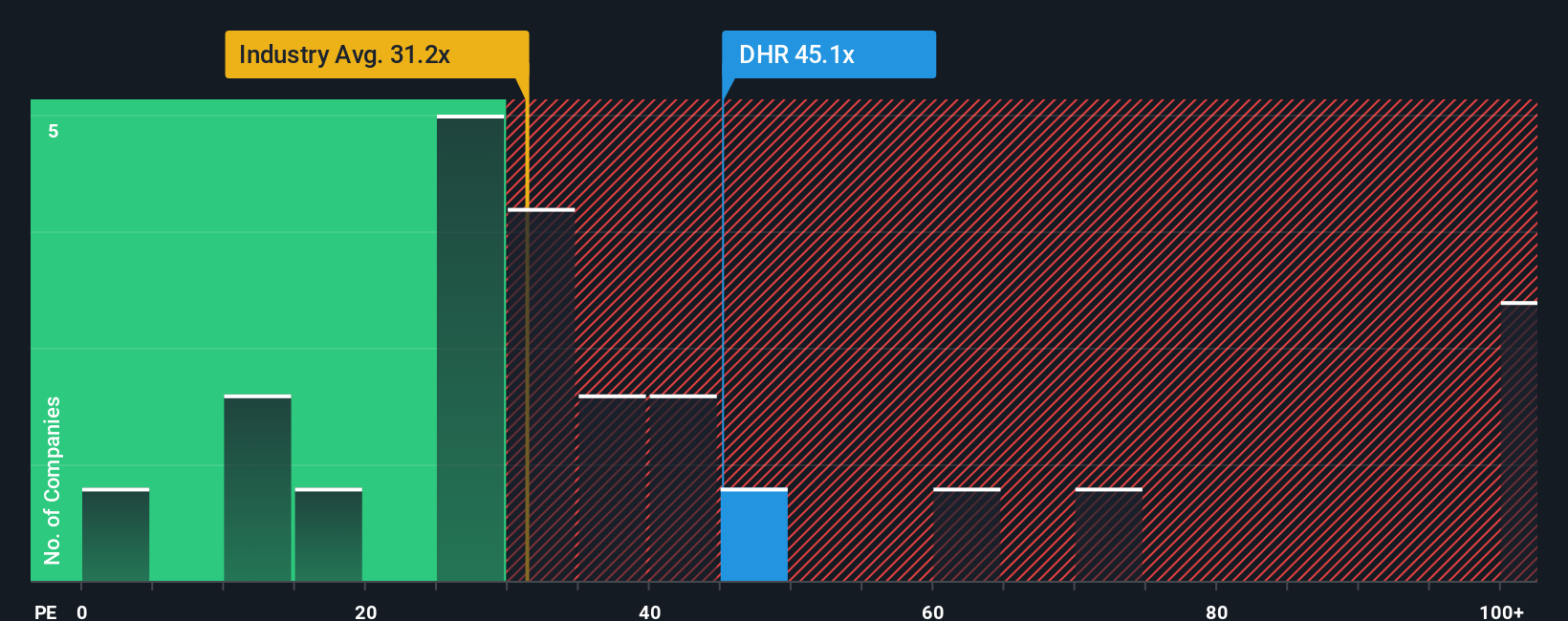

Approach 2: Danaher Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Danaher. It relates a company’s share price to its earnings per share, making it especially useful for mature businesses with consistent profits. Investors often turn to this metric to gauge whether a stock is expensive or a bargain compared to its earnings power.

However, a “normal” or “fair” PE ratio depends on various factors such as growth prospects and perceived risks. Higher growth usually justifies a higher PE, while more uncertainty or slowdowns might lead investors to expect a lower one. For this reason, comparing Danaher’s PE ratio in isolation isn’t enough.

Currently, Danaher trades at a PE ratio of 44.4x, which is significantly above the average for its industry (Life Sciences) of 32.7x and the peer average of 31.4x. Simply Wall St’s proprietary “Fair Ratio,” which incorporates Danaher’s growth profile, profit margin, market cap, and risk factors, comes in at 28.2x. Unlike a basic industry or peer comparison, the Fair Ratio provides a more tailored perspective, reflecting how Danaher’s unique business mix and financial health compare to what investors should rationally pay.

With Danaher’s current PE well above its Fair Ratio and other benchmarks, shares appear stretched in the context of its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Danaher Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story, connecting your view of where Danaher is headed to your assumptions about future revenue, earnings, and margins, and then translating those into a fair value estimate. Rather than relying strictly on ratios or analyst consensus, Narratives help you document and quantify why you believe Danaher is worth more or less than today’s price. This makes your investment decision both structured and practical.

Simply Wall St’s Community page makes creating a Narrative simple and accessible, even if you’re new to investing. Millions of users already leverage this tool to map out what they think will drive Danaher’s results, whether it’s recurring revenues from diagnostics, the impact of new technologies, or shifting global healthcare demand. Narratives also make it easier to decide when to buy or sell by clearly showing if your calculated Fair Value is above or below the current Price.

Your Narrative updates dynamically as news or earnings emerge, so you always have a living forecast tied to real events. For example, one investor might see Danaher leading the future of precision medicine and set a fair value as high as $310, while another concerned about sector volatility could justify a fair value closer to $205. Narratives help you act confidently, based on your own logic and evidence, regardless of market noise.

Do you think there's more to the story for Danaher? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives