- United States

- /

- Life Sciences

- /

- NYSE:DHR

Assessing Danaher (DHR) Valuation After Recent 7.9% Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for Danaher.

Danaher’s share price is showing renewed energy after a solid 7.9% gain in the past month, adding to the momentum that has started to build in recent weeks. Even though the one-year total shareholder return remains slightly negative, the latest gains have investors watching closely for shifts in sentiment and a potential turnaround.

If you’re looking for more stocks that have shown resilient growth and fresh momentum lately, it might be the ideal time to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading below the average analyst price target and recent performance picking up, is Danaher an undervalued opportunity for investors? Or have recent gains already captured the company’s future growth prospects?

Most Popular Narrative: 11.4% Undervalued

According to the most widely followed narrative, Danaher's estimated fair value sits well above its last close price. This sets the stage for debate about whether the rally has further room to run or if the premium is already factored in.

Innovation in precision medicine and disciplined operational execution position the company for high-margin growth and expanding global market opportunities. The company's disciplined execution of the Danaher Business System, emphasizing cost productivity, structural cost reductions, and the integration of innovative new products, continues to drive operational efficiency and margin resilience. This supports improved net earnings and cash flow generation.

Want to discover the numbers putting Danaher’s value so far ahead of the stock price? The financial bets behind this narrative hint at bold jumps in future profit and margin expansion, plus a growth trajectory that could leave many surprised. Ready to see why analysts are pricing in this premium? Dive into the full narrative and get the inside track.

Result: Fair Value of $254.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions and ongoing weakness in biotech funding could quickly undermine these upbeat projections. This makes the recovery story far from certain.

Find out about the key risks to this Danaher narrative.

Another View: Traditional Multiples Raise Caution

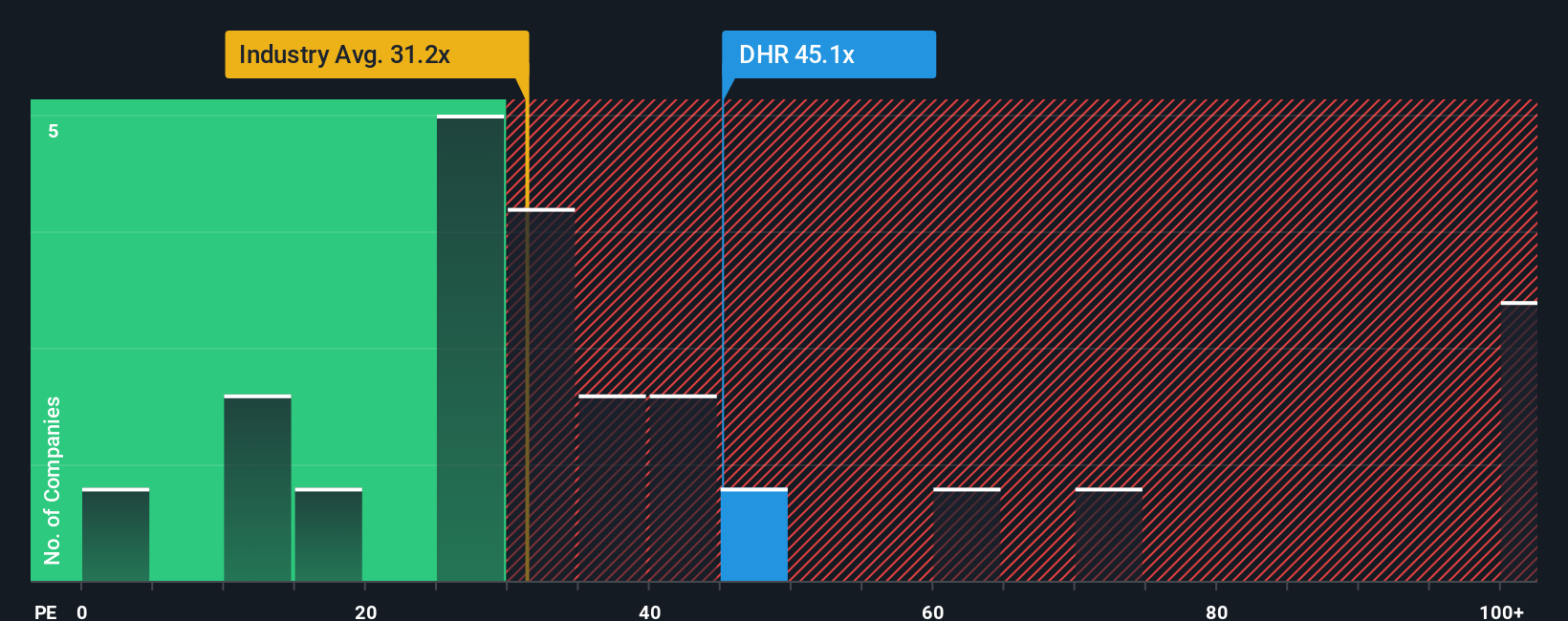

While analysts see Danaher as undervalued versus its fair value estimate, a look at its price-to-earnings ratio tells a different story. At 45.5 times earnings, the stock is significantly pricier than both the industry average of 34.9 and peer average of 32.3. This also exceeds its fair ratio of 31.2. Such a premium signals elevated expectations, but also higher risk if growth disappoints. Can the company continue to justify this lofty valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

If you like challenging the status quo or prefer to chart your own path through the numbers, it takes less than three minutes to build a custom story and Do it your way

A great starting point for your Danaher research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip by. Broaden your horizon with fresh investment themes where smarter strategies and strong returns may be within reach.

- Uncover income potential by evaluating these 18 dividend stocks with yields > 3%, which offers impressive yields and reliable payout histories.

- Capture the upside from cutting-edge innovation by tracking these 27 AI penny stocks as they transform industries with real-world artificial intelligence breakthroughs.

- Tap into long-term value by investigating these 904 undervalued stocks based on cash flows, which may signal robust upside based on genuine cash flows and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives