- United States

- /

- Life Sciences

- /

- NYSE:DHR

A Fresh Look at Danaher (DHR) Valuation Following Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Danaher (DHR) shares have delivered returns of 8% over the past month and 10% in the past 3 months. This has drawn renewed interest from investors and traders tracking performance in the life sciences sector.

See our latest analysis for Danaher.

Danaher’s recent momentum stands out against a tougher long-term backdrop. The 1-month share price return of 8% reflects a strong rebound in sentiment, but the 1-year total shareholder return remains down over 23%, reminding investors that recovery is ongoing even as short-term optimism builds.

Given this renewed momentum in life sciences, it could be the perfect moment to discover other innovative companies. See what’s trending on our healthcare stocks screener: See the full list for free.

With shares regaining ground but long-term returns still lagging, the question now is whether Danaher’s current valuation offers investors a chance to capitalize on an undervalued stock, or if the market has already priced in future growth.

Most Popular Narrative: 14.5% Undervalued

Danaher's most-followed narrative sees the stock trading well below its calculated fair value. With the last close at $209.06, observers are watching the gap between market price and consensus assumptions closely.

"Increasing global healthcare investment, particularly from emerging markets and stimulus-driven spending in regions like China, is expanding Danaher's addressable market and creating new revenue opportunities. This is reflected in recent improvements in order activity and incremental funding flows in Bioprocessing and Life Science Tools. The sustained advancement of precision medicine and personalized therapies, including new AI-assisted diagnostic solutions and groundbreaking launches in genomics (such as support for in vivo CRISPR therapies), positions Danaher's technology portfolio to capture higher-margin growth and drive long-term EBITDA expansion."

Eager to discover the financial engine powering that bullish target? One key detail: the narrative's valuation banks on ambitious revenue and profit growth, along with premium margin expansion. Wondering which forecasted milestones justify confidence in Danaher's future price? Unlock the breakdown and dig into the projections behind those double-digit expectations.

Result: Fair Value of $244.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing global trade tensions and policy changes in China could weigh on revenue growth and serve as catalysts that may challenge the bullish outlook.

Find out about the key risks to this Danaher narrative.

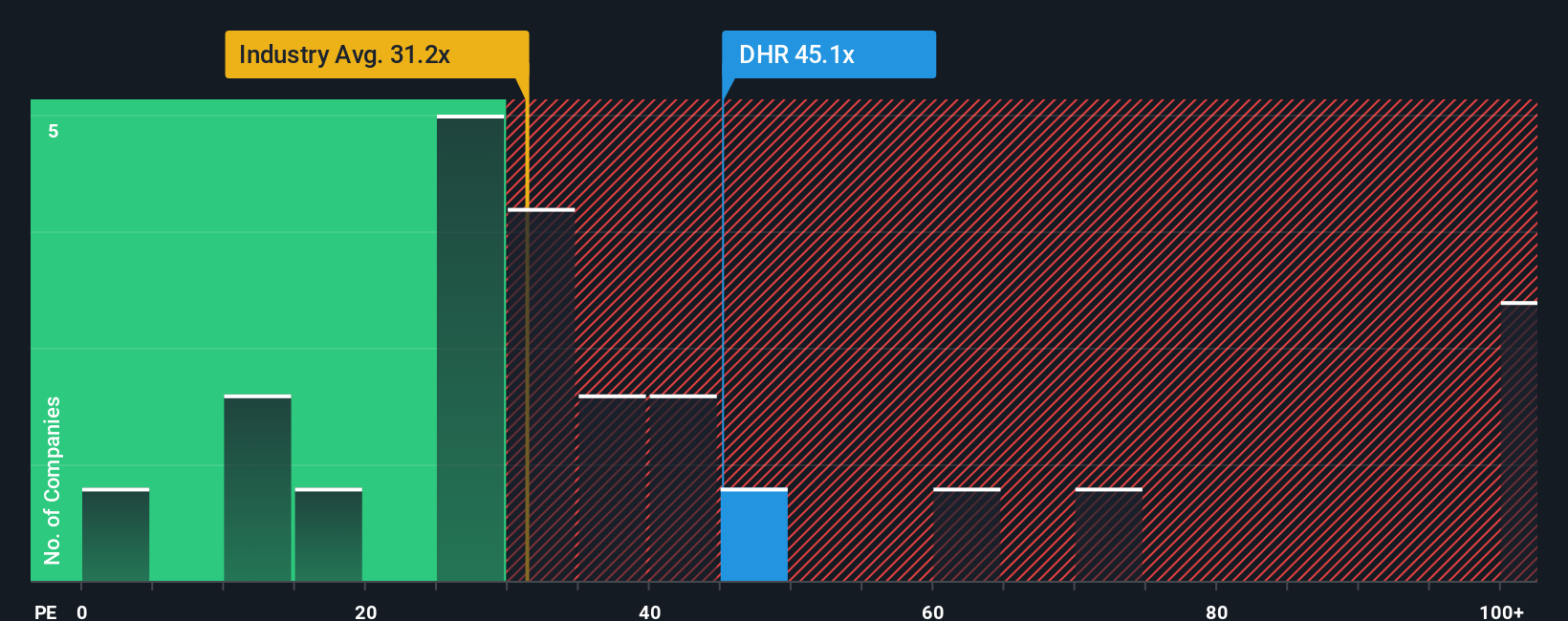

Another View: Market Ratios Paint a Different Picture

Looking at Danaher’s valuation through the lens of price-to-earnings, the stock trades at 43.9x earnings, noticeably above both its peer average of 31.4x and the US Life Sciences industry average of 33x. The fair ratio sits even lower at 28.6x, underlining a substantial premium investors are currently paying.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

If you want to interpret the numbers differently or form your own conclusions, our tools let you craft a personalized thesis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Danaher.

Looking for more investment ideas?

Don’t settle for just one opportunity when an entire world of potential is waiting. Use the Simply Wall Street Screener to spot your next smart move.

- Unlock stable income streams by checking out these 18 dividend stocks with yields > 3% with strong yields and consistent payouts.

- Accelerate your portfolio’s growth by targeting high-potential winners with these 24 AI penny stocks that are shaping tomorrow’s innovations.

- Fuel your search for value by zeroing in on these 878 undervalued stocks based on cash flows that may be flying under the radar right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives