- United States

- /

- Pharma

- /

- NYSE:CTLT

Catalent (NYSE:CTLT) shareholders have earned a 26% CAGR over the last five years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term Catalent, Inc. (NYSE:CTLT) shareholders would be well aware of this, since the stock is up 218% in five years. Also pleasing for shareholders was the 13% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 7.9% in 90 days).

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Catalent

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

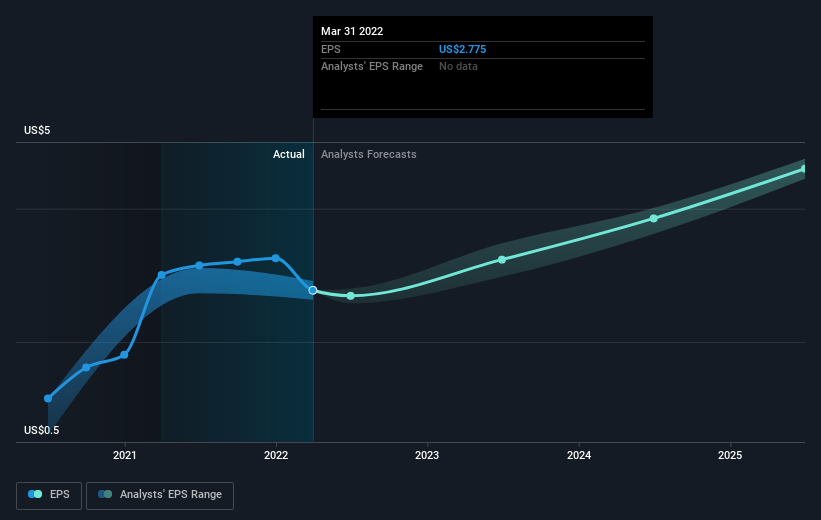

During five years of share price growth, Catalent achieved compound earnings per share (EPS) growth of 26% per year. That makes the EPS growth particularly close to the yearly share price growth of 26%. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Catalent's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Catalent shareholders are down 8.8% over twelve months, which isn't far from the market return of -8.9%. The silver lining is that longer term investors would have made a total return of 26% per year over half a decade. If the stock price has been impacted by changing sentiment, rather than deteriorating business conditions, it could spell opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Catalent has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CTLT

Catalent

Develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies, and consumer health products worldwide.

Moderate growth potential and slightly overvalued.