- United States

- /

- Pharma

- /

- NYSE:BMY

Assessing Bristol-Myers Squibb After a 19% Drop and Recent Drug Approval News

Reviewed by Bailey Pemberton

- Curious if Bristol-Myers Squibb is finally a bargain, or whether there is still further to fall? Let’s dig into its value to see if now is the time to pay attention.

- The stock has moved a bit lately, rising 3.1% over the past month even after a 5.5% dip this week. It still sits 19.1% lower year-to-date.

- There has been a steady stream of headlines, including updates on major drug approvals and recent pharmaceutical partnership announcements, which are keeping market sentiment in flux. These developments help explain the recent uptick in volatility and why investors are checking in on the company’s longer-term outlook.

- On the numbers side, Bristol-Myers Squibb scores a 5 out of 6 on our valuation checks, suggesting it is undervalued by most metrics. We will break down the main valuation methods next, but stick around to see a smarter way to understand what Bristol-Myers Squibb is really worth.

Find out why Bristol-Myers Squibb's -17.2% return over the last year is lagging behind its peers.

Approach 1: Bristol-Myers Squibb Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to a present value. For Bristol-Myers Squibb, this approach uses estimated cash flows over the next decade to gauge the company's intrinsic value.

Currently, Bristol-Myers Squibb generates approximately $15.3 billion in free cash flow. Analyst forecasts expect this figure to remain strong, with projections such as $13.6 billion in 2026 and $11.2 billion by 2029. While direct analyst estimates are limited to five years, the model extrapolates further out, indicating FCF will steadily hover above $10 billion annually for the next decade. All cash flow data is reported in US dollars.

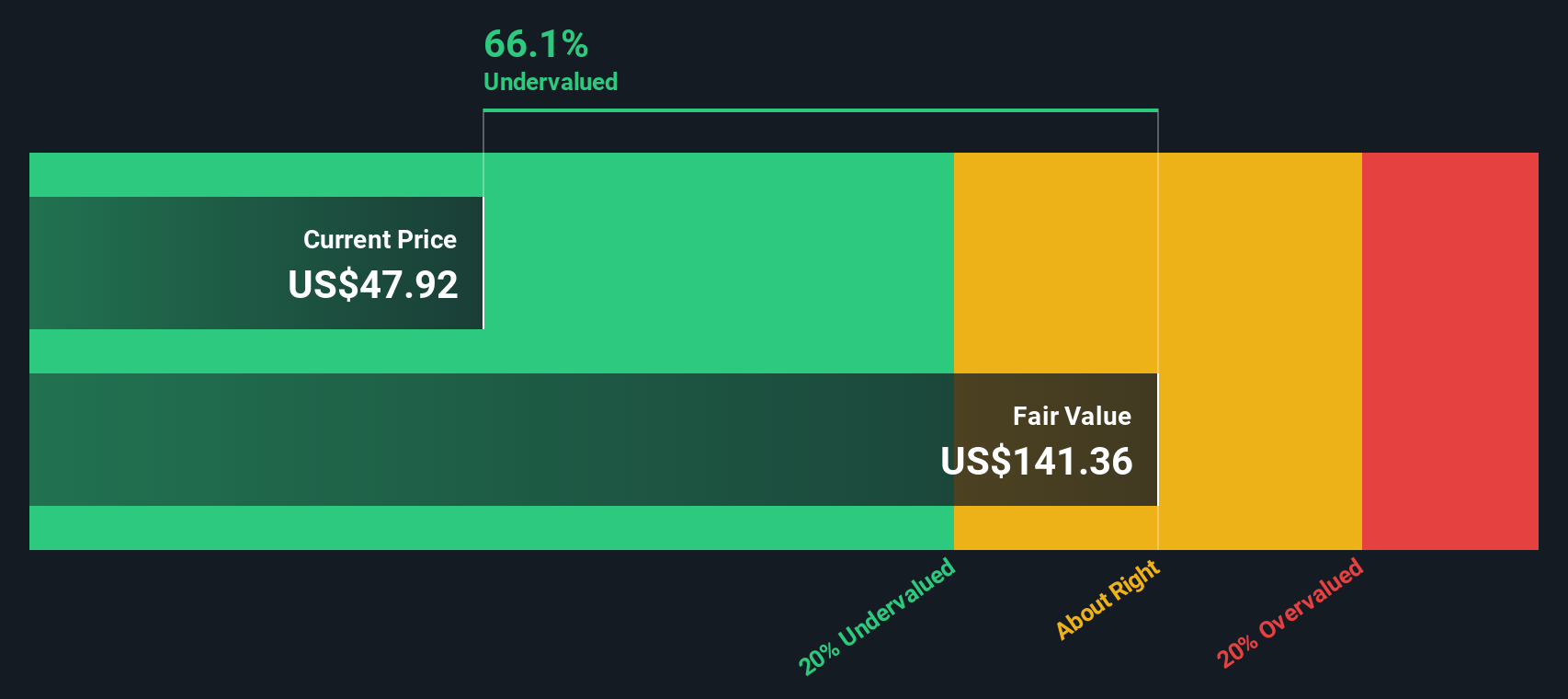

The DCF analysis estimates Bristol-Myers Squibb’s intrinsic value to be $118.93 per share. This value is significantly above the current price, signaling the stock is trading at a 61.4% discount. This suggests the market is pricing in more pessimism than the model’s assumptions indicate and points to considerable potential upside.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bristol-Myers Squibb is undervalued by 61.4%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: Bristol-Myers Squibb Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation tool, especially for profitable companies like Bristol-Myers Squibb. This metric reflects how much investors are willing to pay for each dollar of earnings. It is a quick way to compare valuation across companies with positive net incomes.

Growth expectations and company risk play a significant role in what investors perceive as a "normal" or "fair" PE. Companies with strong growth prospects or lower risk can typically justify higher PE ratios, while slower-growing or riskier companies tend to trade at lower multiples.

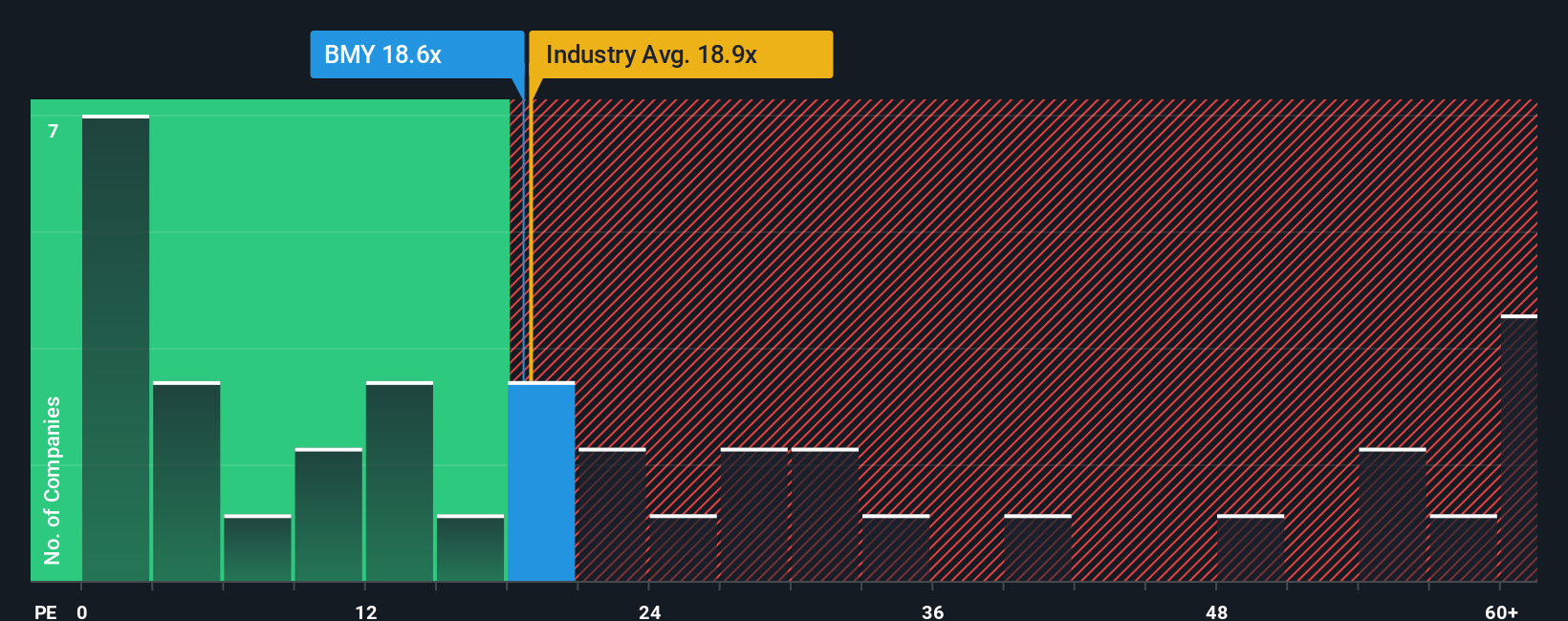

Bristol-Myers Squibb currently trades at a PE ratio of 15.5x. This is notably below the Pharmaceuticals industry average of 19.4x and the peer average of 21.2x. On the surface, this suggests the stock may be undervalued compared to its sector.

However, Simply Wall St's proprietary "Fair Ratio" goes a step further by incorporating the company's growth profile, risks, profit margins, industry setting, and market cap. This approach produces a Fair Ratio of 24.1x for Bristol-Myers Squibb and reflects a more holistic view of what constitutes fair value for the stock beyond blunt peer or sector averages.

Comparing the current PE of 15.5x to the Fair Ratio of 24.1x reinforces that Bristol-Myers Squibb is undervalued on an earnings basis, with its multiple falling substantially below what would be expected given its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bristol-Myers Squibb Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your investment story—a clear, personal perspective that connects what you believe about Bristol-Myers Squibb’s prospects to the actual numbers behind the business, including estimates of future revenue, earnings, and margins.

Narratives act as a bridge, linking the unique story of a company with a financial forecast and, ultimately, a fair value calculation. With Simply Wall St’s platform, Narratives are accessible on the Community page, allowing you to easily create, follow, or update investment theses used by millions of investors worldwide.

They let you track when the gap between fair value and share price signals a buying or selling opportunity, and unlike static valuations, Narratives dynamically update as new information such as regulatory approvals, earnings, or pipeline news hits the market.

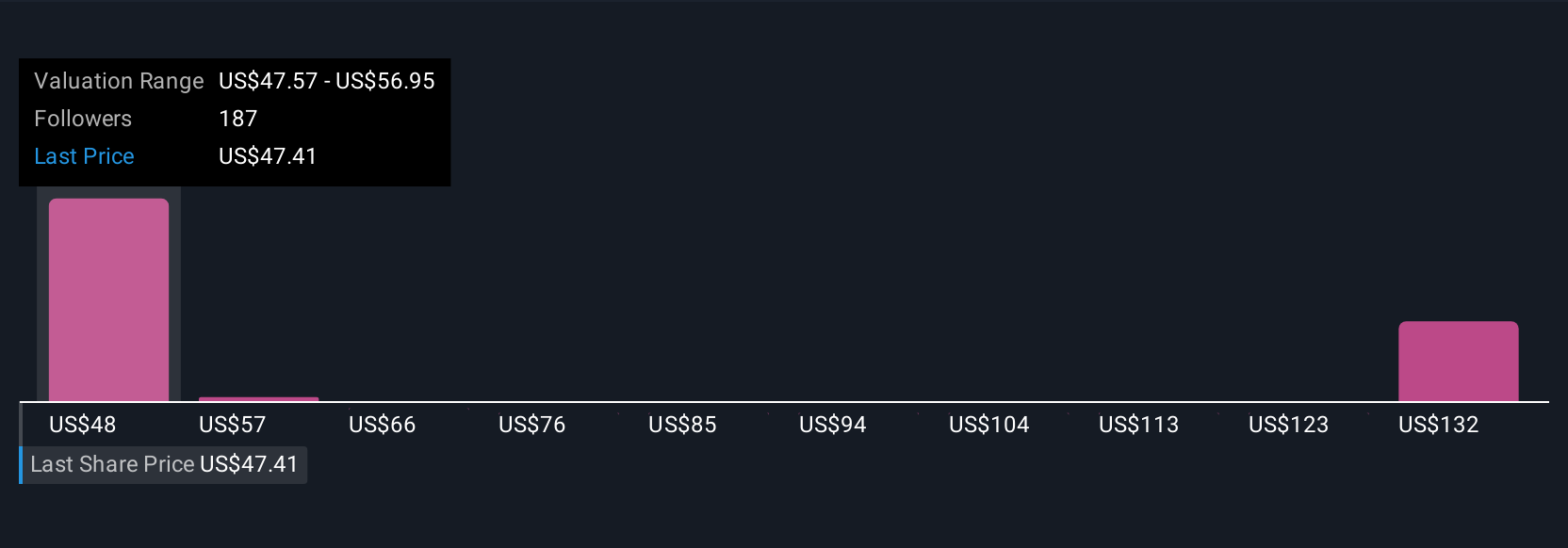

For example, some investors forecast Bristol-Myers Squibb achieving a fair value as high as $65 per share, emphasizing future cost savings and pipeline wins. Others remain cautious, citing patent risks and assign a much lower target of $34 per share. Narratives ensure your investment decisions reflect your own research and beliefs, helping you act confidently as the story evolves.

Do you think there's more to the story for Bristol-Myers Squibb? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives