- United States

- /

- Life Sciences

- /

- NYSE:BIO

Is Bio-Rad (BIO) Sending a New Signal With Expanded Buybacks and Diagnostic Partnerships?

Reviewed by Sasha Jovanovic

- Bio-Rad Laboratories reported third-quarter 2025 earnings with sales rising to US$653 million and disclosed a net loss of US$341.9 million, while completing a significant share repurchase totaling over US$715 million under its ongoing buyback program.

- Biodesix, Inc. also recently announced an expanded partnership to leverage Bio-Rad’s Droplet Digital PCR technology for advanced cancer diagnostics, highlighting Bio-Rad’s continued focus on innovation and oncology applications.

- We’ll examine how Bio-Rad’s earnings report and major buyback completion affect its investment narrative, especially given new diagnostic partnerships.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Bio-Rad Laboratories Investment Narrative Recap

To be a shareholder in Bio-Rad Laboratories, you need to believe in the company’s ability to expand its digital PCR leadership and drive recurring revenue from diagnostics despite current pressures in academic and biotech funding. The latest earnings report, with sales largely flat and a sizeable net loss, reinforced that recovery in instrument demand remains the crucial short-term catalyst, while persistent weakness in funding and margin compression is the top risk; the recent news does not materially alter these themes.

Among recent developments, Bio-Rad’s expanded partnership with Biodesix to advance Droplet Digital PCR technology for oncology applications is particularly relevant. This collaboration directly supports the growth of higher-margin assays and aligns closely with the main catalyst, wider adoption of digital PCR, which is critical if Bio-Rad is to offset headwinds from slower instrument sales and challenging academic markets.

Yet, in contrast to these promising diagnostics advances, investors should be aware of ongoing risks tied to declining academic research funding and what this could mean for future revenue growth...

Read the full narrative on Bio-Rad Laboratories (it's free!)

Bio-Rad Laboratories' outlook projects $2.7 billion in revenue and $232.0 million in earnings by 2028. This assumes a 2.3% annual growth rate in revenue, but a decrease in earnings of $87.2 million from the current $319.2 million.

Uncover how Bio-Rad Laboratories' forecasts yield a $324.00 fair value, in line with its current price.

Exploring Other Perspectives

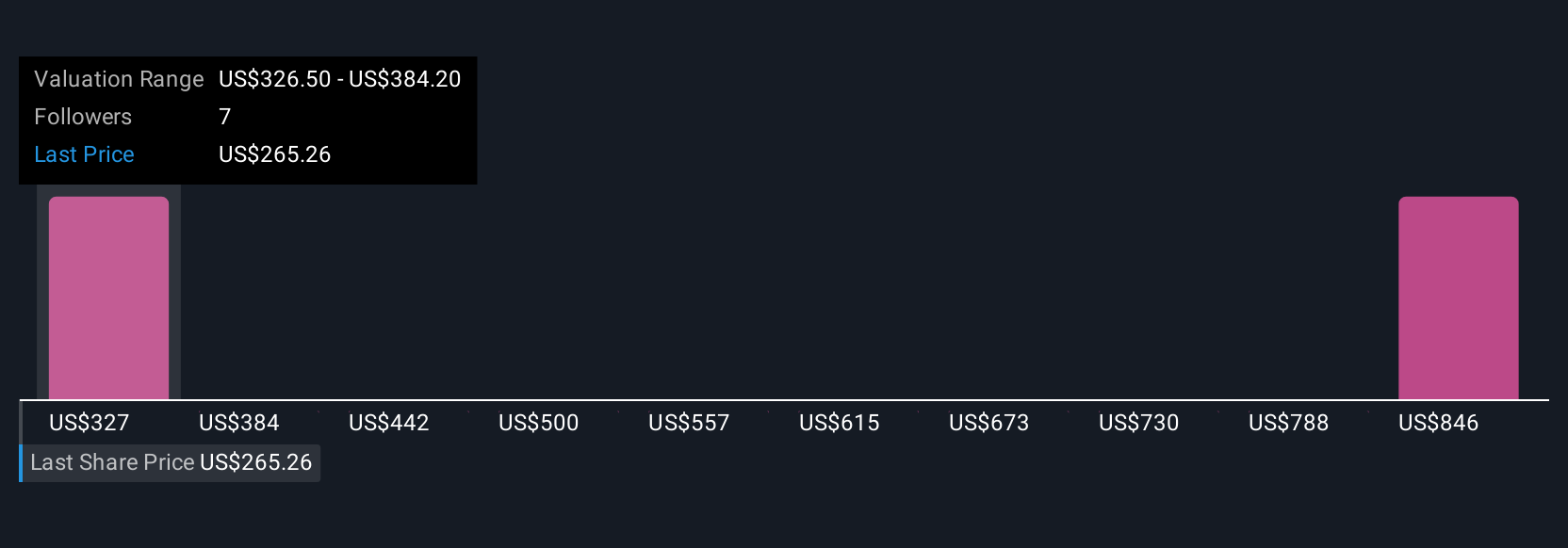

Simply Wall St Community members estimate Bio-Rad’s fair value between US$324 and US$423, based on two individual analyses. With funding challenges still constraining instrument demand, you will want to consider where your outlook for improvement fits within this wide range of opinions.

Explore 2 other fair value estimates on Bio-Rad Laboratories - why the stock might be worth just $324.00!

Build Your Own Bio-Rad Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bio-Rad Laboratories research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bio-Rad Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bio-Rad Laboratories' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Rad Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIO

Bio-Rad Laboratories

Manufactures and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives