- United States

- /

- Life Sciences

- /

- NYSE:BIO

Can Bio-Rad (BIO) Sustain Innovation Momentum After Leadership Loss and Diagnostics Expansion?

Reviewed by Sasha Jovanovic

- Bio-Rad Laboratories announced that its co-founder and Director Emeritus, Alice N. Schwartz, passed away on September 25, 2025, at the age of 99, highlighting her critical contributions to the company and scientific community since its founding in 1952.

- Alongside this loss, Bio-Rad has recently expanded its molecular diagnostics reach through launching new ddPCR platforms, acquiring Stilla Technologies, and entering a comprehensive European distribution partnership with Gencurix for oncology testing kits.

- We'll explore how Bio-Rad's broadened molecular diagnostics footprint could influence its growth and risk narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bio-Rad Laboratories Investment Narrative Recap

To be a Bio-Rad Laboratories shareholder, you need to believe the company can translate its leadership in life sciences and clinical diagnostics into renewed revenue and earnings growth, despite periods of volatility and margin pressure. The recent passing of co-founder Alice N. Schwartz is a significant moment for company culture and legacy, but has no material impact on immediate catalysts or current business risks, which remain centered on market demand and competitive pressures.

Among recent announcements, Bio-Rad’s exclusive European distribution deal with Gencurix for oncology testing kits is especially relevant as it expands the company’s molecular diagnostics reach. This partnership aligns with efforts to address the biggest short-term catalyst, driving adoption of advanced diagnostics, while also enhancing its competitive stance as instrument demand softness lingers.

In contrast, investors should be aware that persistent weakness in instrument demand could mean that even with expanded diagnostics capabilities, there is still...

Read the full narrative on Bio-Rad Laboratories (it's free!)

Bio-Rad Laboratories' outlook projects $2.7 billion in revenue and $232.0 million in earnings by 2028. This is based on an assumed 2.3% annual revenue growth rate and a $87.2 million decrease in earnings from the current level of $319.2 million.

Uncover how Bio-Rad Laboratories' forecasts yield a $310.00 fair value, in line with its current price.

Exploring Other Perspectives

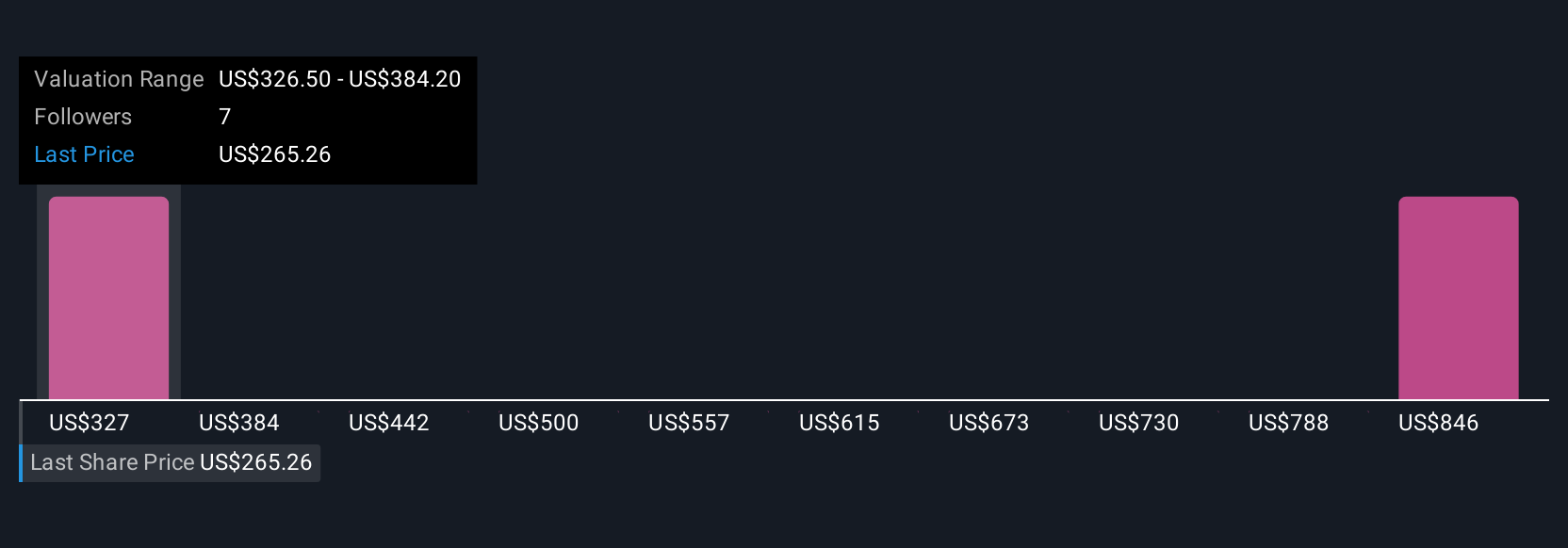

Simply Wall St Community fair value estimates for Bio-Rad Laboratories span from US$310 to US$878 based on two individual viewpoints. Persistent softness in instrument demand remains a pressing concern that many community members weigh differently, so examine several perspectives before forming an outlook.

Explore 2 other fair value estimates on Bio-Rad Laboratories - why the stock might be worth over 2x more than the current price!

Build Your Own Bio-Rad Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bio-Rad Laboratories research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bio-Rad Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bio-Rad Laboratories' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Rad Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIO

Bio-Rad Laboratories

Manufactures and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives