- United States

- /

- Biotech

- /

- NYSE:BHVN

Will Biohaven's (BHVN) $175 Million Equity Raise Reshape Its Path to Financial Strength?

Reviewed by Sasha Jovanovic

- Biohaven Ltd. has completed a follow-on equity offering of 23,333,334 common shares at US$7.50 per share, raising approximately US$175 million, with Leerink Partners LLC and TD Securities (USA) LLC added as co-lead underwriters for the transaction.

- This capital raise follows recent financial results showing reduced net loss per share compared to the previous year, highlighting Biohaven's efforts to bolster its financial position.

- We'll explore how this infusion of capital and expanded underwriting team shape Biohaven's investment narrative and future trajectory.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Biohaven's Investment Narrative?

To be a Biohaven shareholder at this moment, you have to see a future where the company’s research pipeline and partnerships eventually translate into meaningful revenue, given that it continues to operate without product sales and remains unprofitable. The recent US$175 million equity raise, backed by new underwriting support from Leerink Partners LLC and TD Securities (USA) LLC, shores up the company’s cash position just as its net loss per share narrows slightly. This influx of cash could help Biohaven pursue important clinical milestones and regulatory progress, particularly after setbacks like the FDA’s recent response to VYGLXIA. However, it also adds to shareholder dilution, adding pressure to deliver results from next-generation therapy development. All eyes will now be on the company’s ability to turn ambitious trial plans into approvals as legal overhangs and volatility continue to weigh on the story.

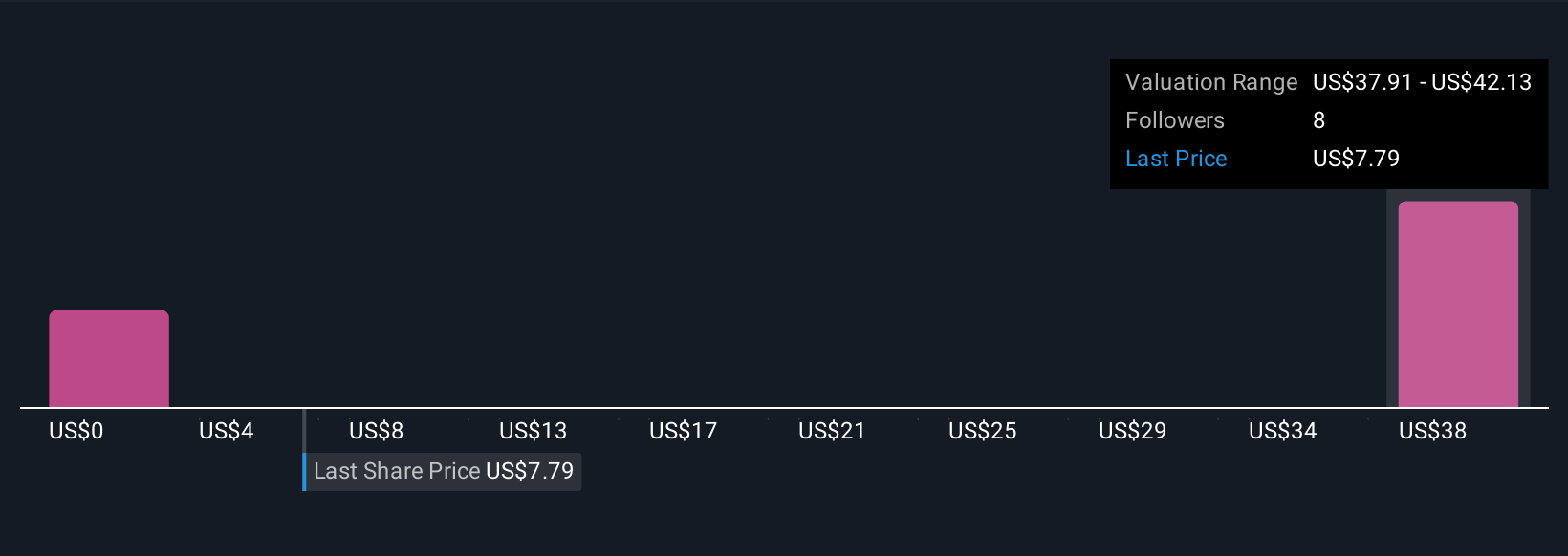

But with share lock-up expiries ahead, new dilution and legal risks could impact share price further. According our valuation report, there's an indication that Biohaven's share price might be on the expensive side.Exploring Other Perspectives

Explore 5 other fair value estimates on Biohaven - why the stock might be worth over 2x more than the current price!

Build Your Own Biohaven Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Biohaven research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Biohaven research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Biohaven's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biohaven might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHVN

Biohaven

Biohaven Ltd. discovers, develops, and commercializes therapies for immunology, neuroscience, and oncology worldwide.

Moderate risk with limited growth.

Market Insights

Community Narratives