- United States

- /

- Pharma

- /

- NYSE:BHC

Will BHC’s Shareholder Rights Plan Shape Its Long-Term Corporate Control Strategy?

Reviewed by Sasha Jovanovic

- Bausch Health Companies Inc. announced that shareholders have approved the adoption of its Amended and Restated Shareholder Rights Plan Agreement at a special meeting held on October 7, 2025, with final results to be reported to regulators and the public.

- The approval of the shareholder rights plan, typically designed to guard against unsolicited takeover attempts, reflects shareholder alignment with management’s vision and approach to corporate control.

- We’ll assess how the adoption of the updated shareholder rights plan may influence Bausch Health Companies’ broader investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bausch Health Companies Investment Narrative Recap

To be a shareholder in Bausch Health Companies, you need to have conviction in the company’s ability to expand its gastroenterology and specialty pharma franchises, overcome regulatory price pressures, and reduce a still-significant debt load. The recent approval of the amended Shareholder Rights Plan is not expected to materially impact the most significant near-term catalyst, progress on key drug launches and pipeline development, nor does it meaningfully reduce immediate risks such as exposure to U.S. drug price negotiations and debt-related financial constraints.

Among recent updates, the most relevant is Bausch Health’s strengthened focus on deleveraging, highlighted by several debt financing and redemption actions in 2025 that align with the company’s need to improve financial resilience in the face of concentrated product risk and regulatory challenges. This backdrop underscores why the approval of the Shareholder Rights Plan serves more as a safeguard for corporate control rather than a direct driver of short-term financial or operational performance.

However, with these protections in place, investors should be aware that the company's heavy reliance on its lead product, Xifaxan, exposes Bausch Health to...

Read the full narrative on Bausch Health Companies (it's free!)

Bausch Health Companies is projected to reach $10.1 billion in revenue and $264.4 million in earnings by 2028. This forecast assumes a 0.9% annual decline in revenue and a $166.4 million earnings increase from the current earnings of $98.0 million.

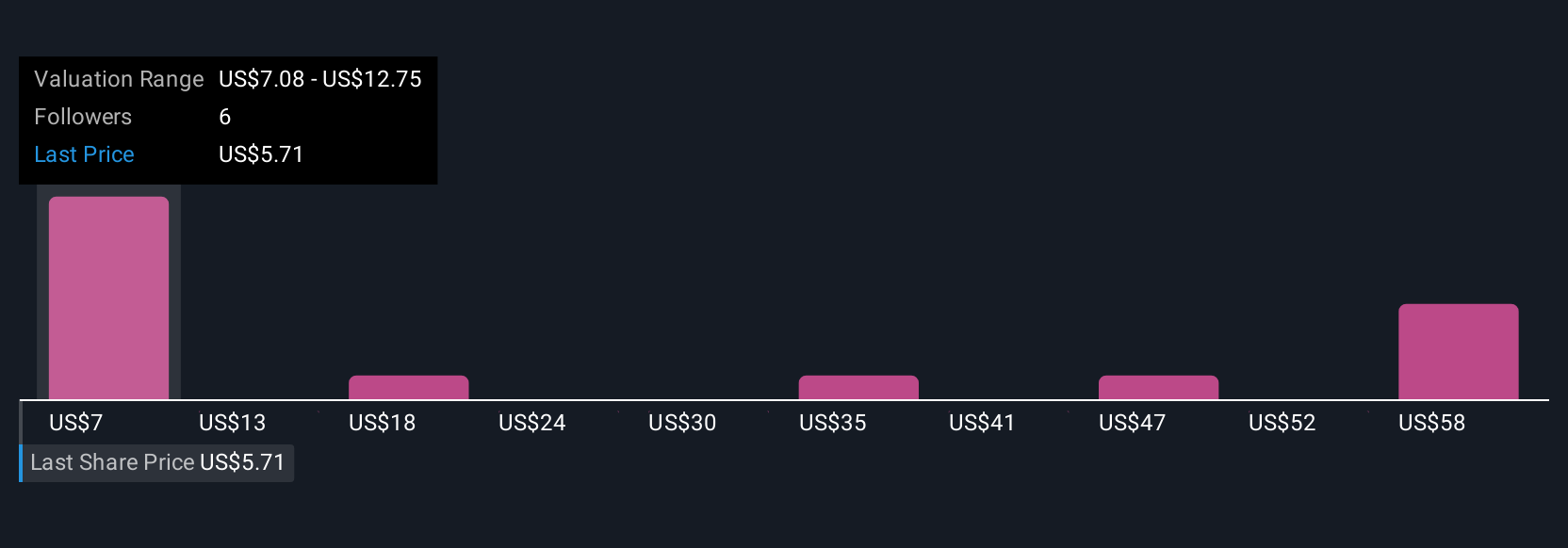

Uncover how Bausch Health Companies' forecasts yield a $7.08 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Five individual fair value estimates from the Simply Wall St Community span a wide range, from US$7.08 to US$64.83 per share. While you consider this spread of opinion, remember that regulatory risk and concentration in key products remain critical factors shaping Bausch Health’s path forward.

Explore 5 other fair value estimates on Bausch Health Companies - why the stock might be worth over 10x more than the current price!

Build Your Own Bausch Health Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch Health Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bausch Health Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch Health Companies' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives