- United States

- /

- Pharma

- /

- NYSE:BHC

What Recent Debt Reduction Efforts Mean for Bausch Health Companies’ Share Price in 2025

Reviewed by Bailey Pemberton

- Ever wondered if Bausch Health Companies is actually a bargain or if its low share price is just a mirage? You are not alone. There has been ongoing discussion about value opportunities in the healthcare sector.

- Bausch’s share price has seen some movement, climbing 3.6% over the past week and 2.5% in the last month. Despite these gains, it is still down nearly 17% year-to-date and about 28% over the past year.

- Recent headlines have focused on the company’s continued efforts to reduce its debt load and navigate ongoing litigation issues. Both of these factors have influenced investor sentiment lately. Growing interest from institutional investors and strategic moves within its product pipeline have also helped fuel speculation about potential turnaround prospects.

- Currently, Bausch Health Companies has a valuation score of 5 out of 6, which suggests it may be undervalued based on most metrics. We will explore what this score really means, compare several valuation approaches, and highlight an even more insightful way to think about value by the end of this analysis.

Find out why Bausch Health Companies's -28.2% return over the last year is lagging behind its peers.

Approach 1: Bausch Health Companies Discounted Cash Flow (DCF) Analysis

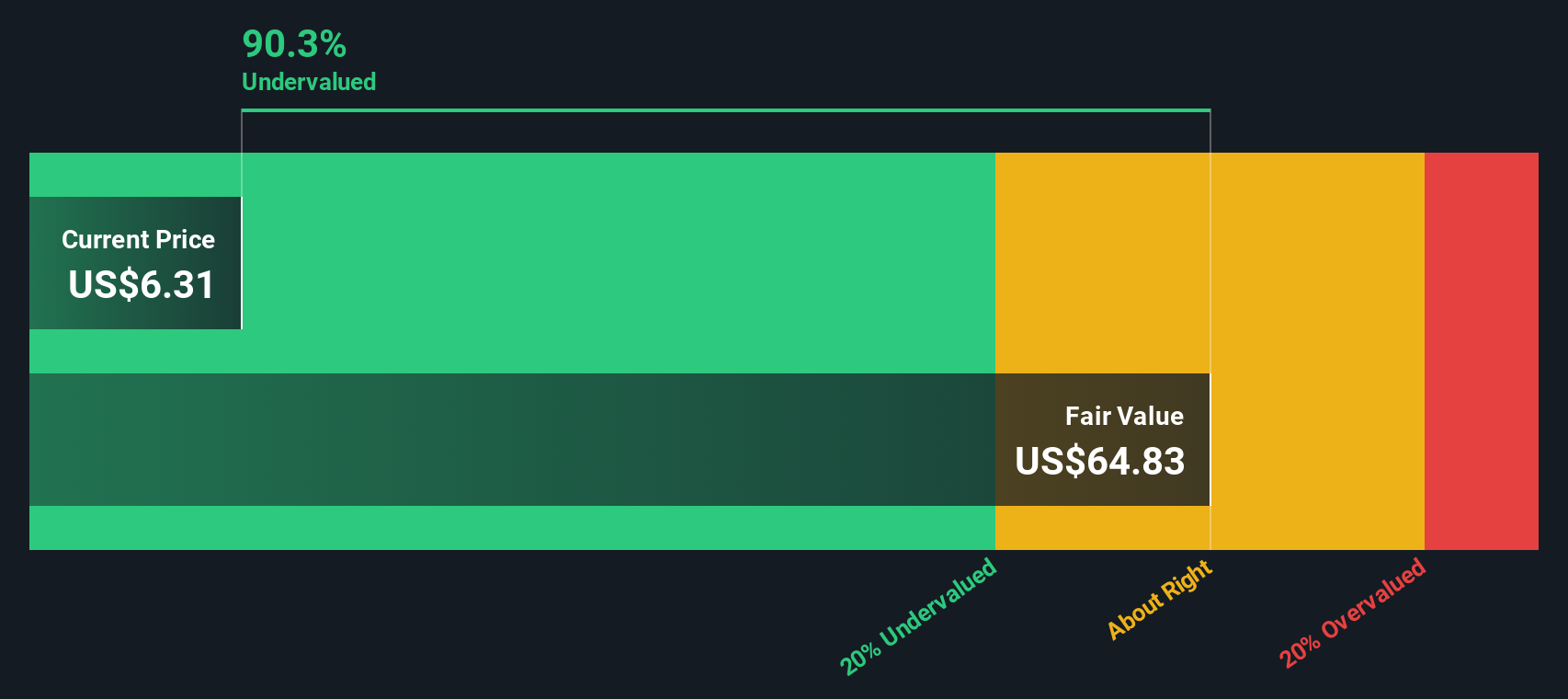

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future cash flows and discounting them back to today’s value. This approach seeks to determine what Bausch Health Companies is really worth, based on the amount of cash it is expected to generate in years ahead.

Currently, Bausch Health Companies produces Free Cash Flow (FCF) of $1.16 Billion. Analysts provide detailed forecasts for only the next five years. After 2029, future projections, including a forecasted FCF of $2.27 Billion in 2029 and $2.52 Billion by 2035, are extended using conservative growth rates. These estimates, expressed in Billions, are all in US dollars.

After discounting future cash flows using a standard rate, the model calculates an intrinsic value of $64.82 per share. This estimate suggests Bausch Health Companies is trading at an 89.8% discount to its fair value, indicating the stock may be very undervalued at current levels. The share price sits well below what long-term cash generation would support.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bausch Health Companies is undervalued by 89.8%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Bausch Health Companies Price vs Earnings

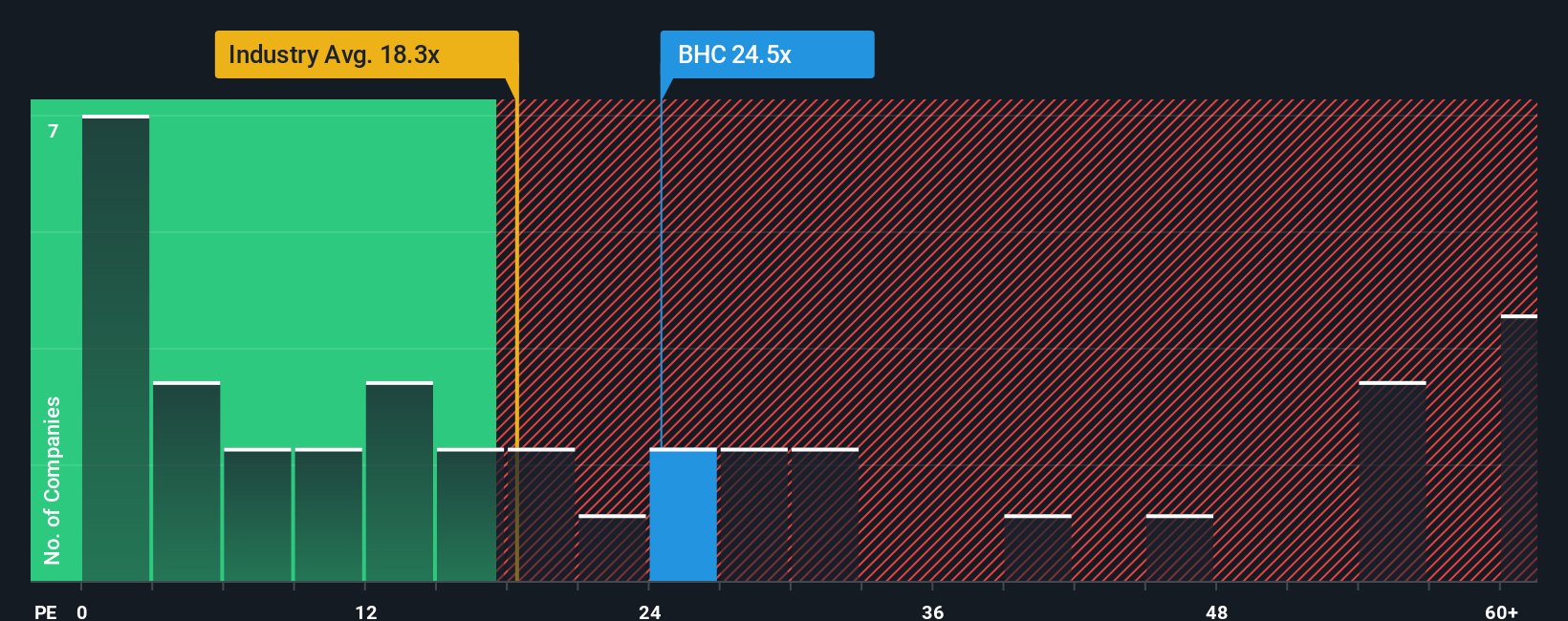

The Price-to-Earnings (PE) ratio is a standard benchmark for valuing profitable companies because it compares a company's share price to its earnings. This ratio reflects how much investors are willing to pay for each dollar of profit. For companies like Bausch Health Companies, which are generating steady earnings, PE provides a direct way to assess whether the stock is attractively priced relative to its bottom line.

A "normal" or fair PE ratio is influenced by growth and risk. Rapidly growing businesses or those with less risk tend to command higher PE ratios, as investors are willing to pay more today for future profits. Conversely, a slower growth rate or higher risk profile usually means a lower PE is considered fair.

Bausch Health Companies currently trades at a PE ratio of 6.75x. This stands in stark contrast to the Pharmaceuticals industry average of 18.13x and its peers’ average of 38.82x. This suggests the stock is much cheaper than both its sector and direct competitors on an earnings basis.

However, Simply Wall St's proprietary “Fair Ratio” refines this assessment further. The Fair Ratio for Bausch Health Companies is 17.04x, calculated by taking into account the company’s unique blend of earnings growth, profit margins, size, sector, and specific risk profile. Unlike basic industry or peer averages, the Fair Ratio offers a far more individualized perspective on what multiple Bausch truly deserves.

With an actual PE ratio of 6.75x compared to its Fair Ratio of 17.04x, Bausch Health Companies appears meaningfully undervalued based on what the business fundamentals suggest is fair.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bausch Health Companies Narrative

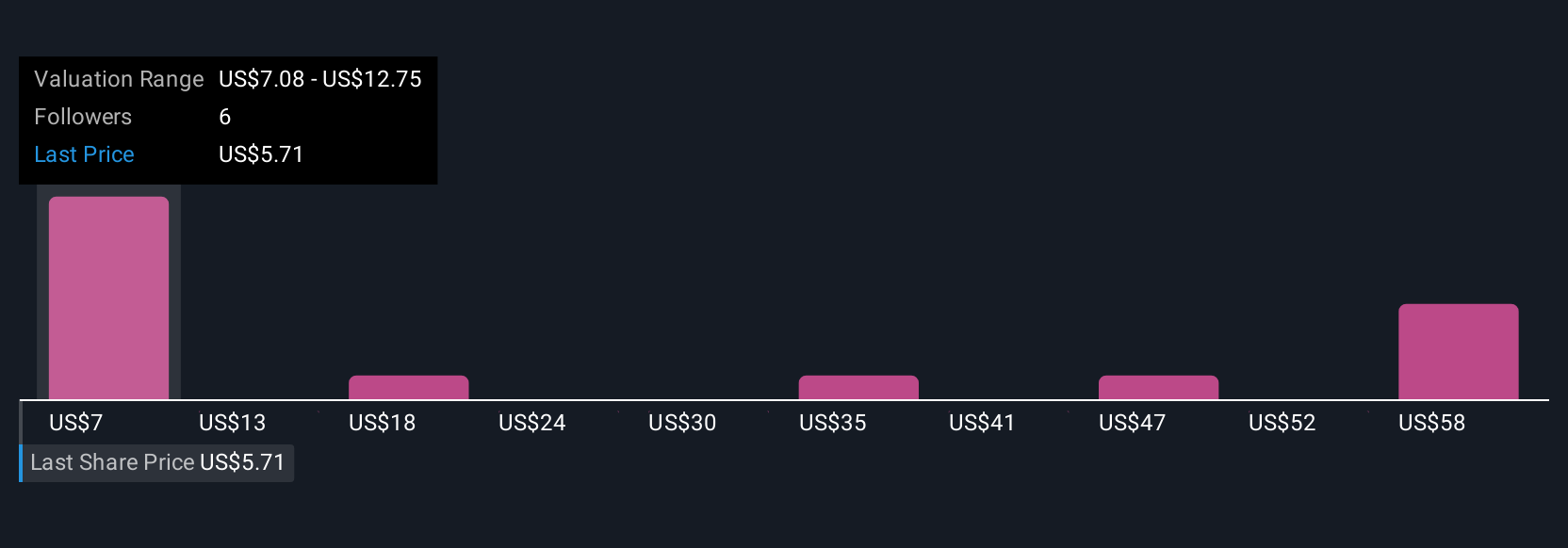

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your unique story about a company, blending your own view of its future (such as fair value estimates, expected revenues, earnings, and profit margins) with a reasoned financial forecast. It connects what you believe about Bausch Health Companies’ prospects directly to what you think its shares are worth.

On Simply Wall St’s Community page, millions of investors use Narratives to create and refine forecasts for companies, making it easy and accessible to express your perspective. You can quickly see how that outlook compares to others. With Narratives, you can instantly assess whether Bausch Health Companies is worth buying, selling, or watching by comparing your fair value figure to the real-time share price.

Narratives also update automatically when news or new financial results emerge, keeping your outlook relevant as conditions change. For example, the highest current Narrative expects Bausch to reach $10.00 per share on strong performance in global markets, while the lowest sees a risk-limited upside at just $5.00. This demonstrates how different forecasts reflect real-world uncertainty and opportunity.

Do you think there's more to the story for Bausch Health Companies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with questionable track record.

Similar Companies

Market Insights

Community Narratives